Hedge funds bought the dip at the end of last year, loading up on these five big tech stocks.

Hedge funds took advantage of the turmoil in the market at the end of last year, loading up on large tech stocks as they hit their bottom.

And their timing couldn’t have been better as some of these stocks have since seen double-digit rebounds so far this year.

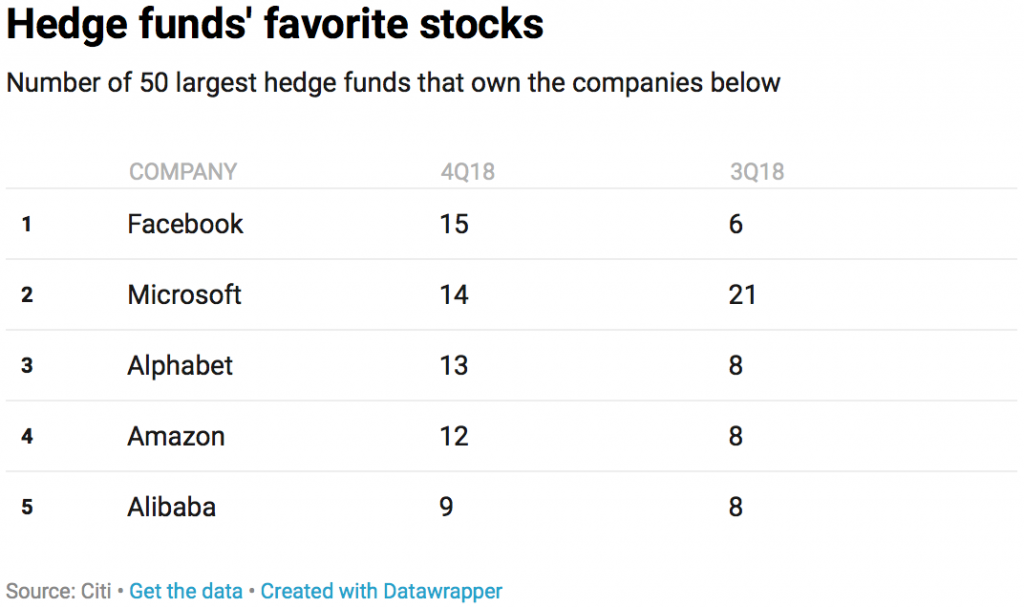

Citigroup (NYSE: C) reviewed the 13F regulatory filings from the 50 largest hedge funds and looked at their top 10 holdings as of the end of December.

The bank found that Facebook (NASDAQ: FB) was the most-owned stock by the largest hedge funds, followed by Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOGL, GOOG), Amazon (NASDAQ: AMZN), and Alibaba (NYSE: BABA).

Of these, Facebook and Alibaba have gained the most year-to-date, with Facebook up 23.8% and Alibaba up 24.16% so far this year.

At the end of Q4, Facebook was in the top 10 holdings of 15 out of the 50 largest hedge funds, more than double the number of hedge funds holding the stock in Q3, according to Citi’s data.

Citi’s analysts said that information technology stocks took up about 19% of hedge funds’ top holdings last quarter, with consumer discretionary stocks second at 14%.

In addition to betting on tech stocks, hedge funds also sold more defensive sectors including utilities, real estate, and consumer staples.

Buying the dip at the end of last year proved to be a smart strategy. Hedge funds posted their strongest monthly gain since September 2010 with a return of 3.5% for January, according to Hedge Fund Research.

Bill Ackman’s Pershing Square added more than 10 million shares of both Starbucks (NASDAQ: SBUX) and Hilton (NYSE: HLT), while Barry Rosenstein’s Jana Partners picked up $16 million worth of Salesforce (NYSE: CRM), and David Einhorn’s Greenlight Capital bought Dillard’s (NYSE: DDS), Shutterfly (NASDAQ: SFLY), and boosted their stake in Adient (NYSE: ADNT) and Altice (NYSE: ATUS).