If you thought betting against the stock market in a weak earnings season was a good idea, JPMorgan might convince you otherwise.

Bears have been making the case that the downbeat climate for corporate profits—alongside the shaky global growth outlook, ongoing trade tensions between the U.S. and China, and lingering concerns about the Fed’s next move—means now is the time to bet against the stock market.

So far this earnings season, around 80% of the companies in the S&P 500 have reported their Q4 results. According to FactSet, earnings have exceeded expectations by 3.5%, which is below the five-year average of 4.8%, and the growth rate for the S&P 500 has improve by just one percentage point since December 31—from 12.1% to 13.1%—which is also below the five-year average of a 3.8 percentage point improvement during earnings season.

But JPMorgan (NYSE: JPM) strategists say that a negative earnings outlook doesn’t necessarily mean that stock market losses will follow. And recent history suggests that equities actually perform pretty well in a season where companies and analysts alike are trying to temper expectations for the future.

“Many believe that one can’t buy stocks before earnings stop deteriorating,” wrote Mislav Matejka, head of global and European equity strategy at the firm, in a note to clients. “We continue to disagree with that view.”

Matejka and his team pointed to the last recession in 2015 – 2016 as an example for how the bull market can proceed this year after a tough 2018. Based on how the market has behaved in similar cycles, the team currently favors cyclical stocks and like energy and miner stocks rather than defensives.

In the 2015 – 2016 cycle, the market bottomed in February 2016, but the negative trend in earnings continued until December of that year. During that time, stocks rose 20% before the earnings outlook began to improve.

JPMorgan is anticipating the earnings outlook will begin to turn positive in the second half of this year, “If this comes to pass, it should drive the next leg of the current market rebound, as it will be seen as a fundamental confirmation of the upmove that many investors are still holding out for,” Matejka wrote in the note. In such a scenario, the market’s greatest headwinds could turn into tailwinds.

“We looked for supports from a dovish change in the Fed’s reaction function, peaking dollar, improvement in the Chinese growth backdrop and positive developments from the U.S.-China trade negotiations,” Matejka said.

JPMorgan has advised clients not to wait until earnings improve before jumping into stocks. They cited that over the past four negative earnings cycles, stocks have on average begun to rally seven months before a reversal, with an average gain of 30%.

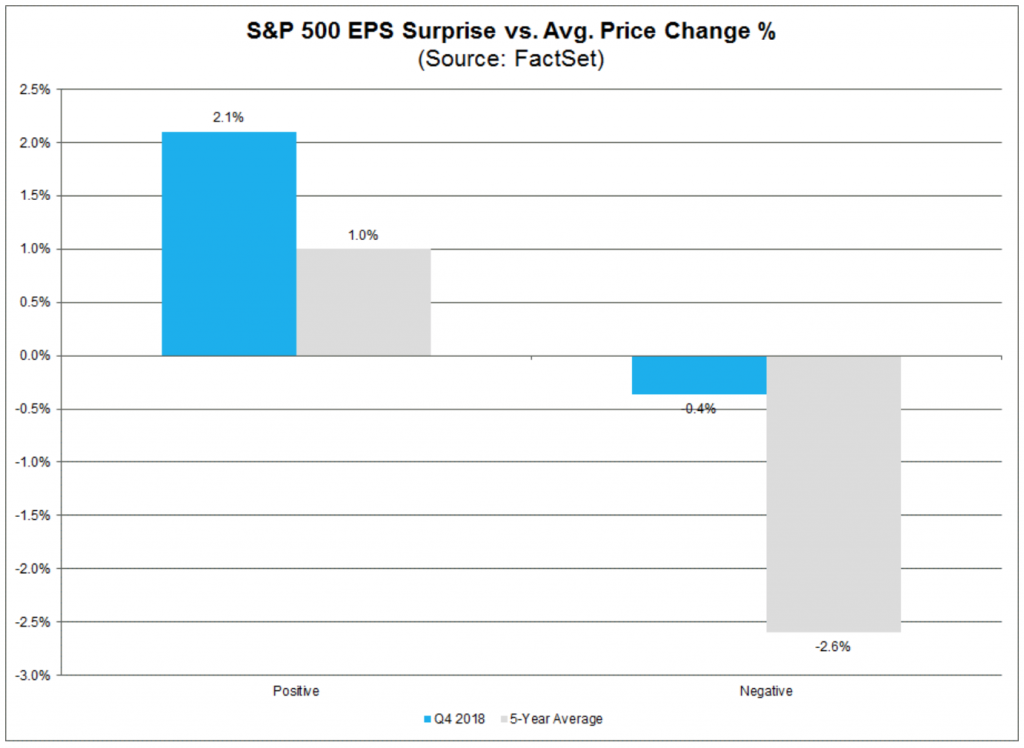

So far in the Q4 earnings reporting period, those companies that have missed on earnings estimates have seen much less of a market penalty than in previous years with such companies seeing a drop in share price of just 0.4% on average in the two days following reporting. According to FactSet, the typical decline is 2.6% and the penalty for misses right now is the lowest since the second quarter of 2009, when the market had bottomed.

JPMorgan cited several companies that have delivered gains so far this earnings season after having missed on expectations. General Electric (NYSE: GE) is one such company, and saw its stock soar 11.6% after reporting its Q4 financial results which saw the industrial giant earning $0.17 per share during the quarter, a 60% decline from last year and weaker than the $0.22 per share anticipated by analysts.

Goldman Sachs’ (NYSE: GS) David Kostin wrote in a note to clients that the weak earnings season on aggregate is also masking the potential for some good results.

“The gap between median and aggregate EPS growth underscores the opportunity for fundamental investors,” strategists led by Kostin wrote. “The wide distribution of earnings growth highlights the importance of fundamental stock-picking as a way of differentiating returns and reinforces our expectation for a shift from ‘beta’ to alpha.’”