The investment seeks the daily changes in percentage terms of its shares’ per share net asset value (“NAV”) to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the price of a specified short-term futures contract on light, sweet crude oil called the “Benchmark Oil Futures Contract,” less USO’s expenses. USO seeks to achieve its investment objective by investing primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels.

The United States Oil Fund® LP (USO) is an exchange-traded security designed to track the daily price movements of West Texas Intermediate (“WTI”) light, sweet crude oil. USO issues shares that may be purchased and sold on the NYSE Arca.

The investment objective of USO is for the daily changes in percentage terms of its shares’ NAV to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in price of USO’s Benchmark Oil Futures Contract, less USO’s expenses.

USO’s Benchmark is the near month crude oil futures contract traded on the NYMEX. If the near month futures contract is within two weeks of expiration, the Benchmark will be the next month contract to expire. The crude oil contract is WTI light, sweet crude oil delivered to Cushing, Oklahoma.

USO invests primarily in listed crude oil futures contracts and other oil-related futures contracts, and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of two years or less.

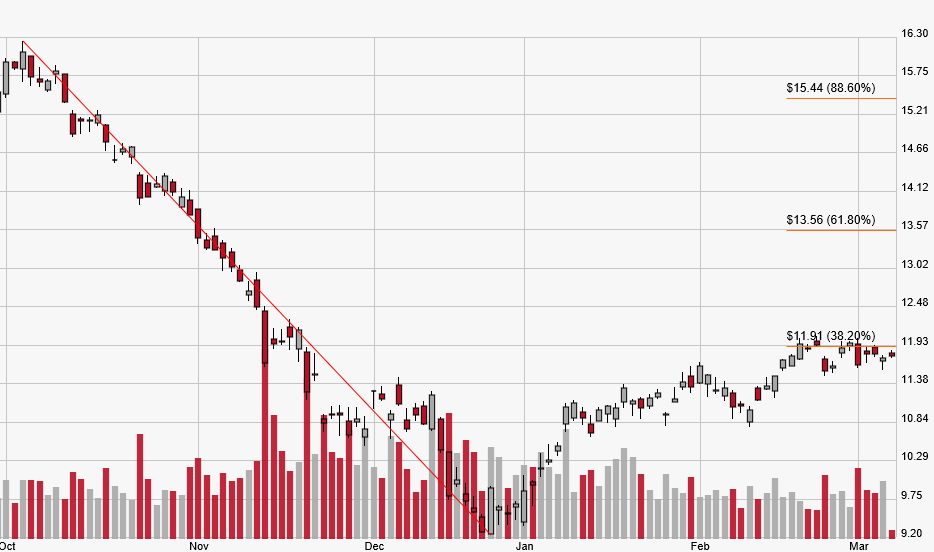

Trade Setup

| Buy Target $11.91 | Sell Target 1 $13.56 |

| Trailing Stop 20% | Sell Target 2 $15.44 |