These 4 stocks have been surging so far this year and are likely to continue to head higher.

Just two weeks ago, industrials were the best performing stocks on the market in 2019. But we’re now half way through the month and the sector is the only one in the red for March, with Boeing (NYSE: BA) weighing the entire sector down after the world-wide grounding of its Max 737 aircraft.

And now tech stocks are heating up, and one group of tech stocks in particular are outperforming the broader market.

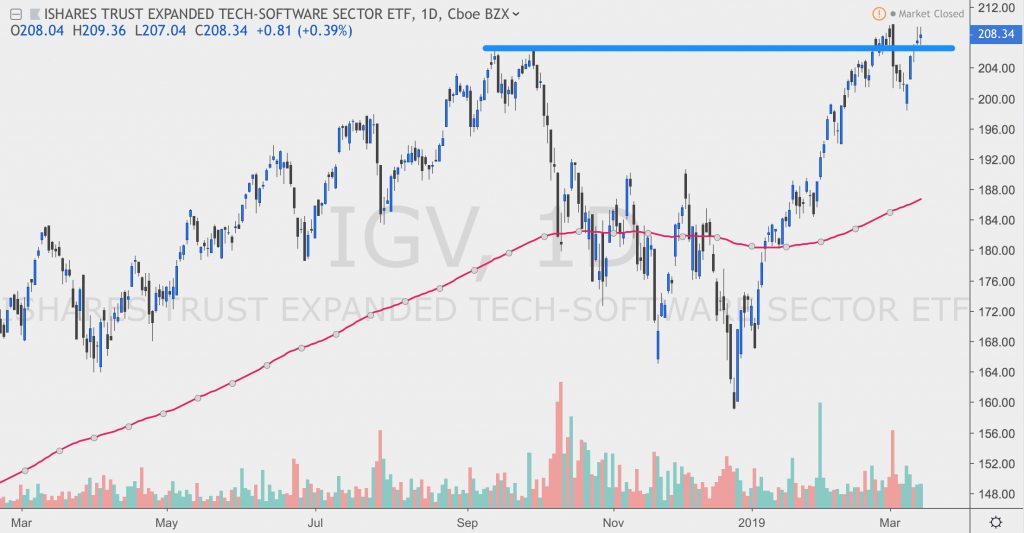

Oppenheimer’s Ari Wald, head of technical analysis, says that the software group of stocks are a “must-own industry.” Pointing to the IGV North American Tech-Software iShares ETF, Wald says this group of stocks is about to break out even more.

The IGV ETF, which holds big enterprise software names like Salesforce.com (NYSE: CRM) and Oracle (NYSE: ORCL), is up 20% year-to-date compared to 16.7% for the info-tech sector XLK ETF.

“The ETF has pushed right up into its 2018 highs at around $206. That’s resistance,” Wald told CNBC on Monday. “Aside from what could be a pause here, we think investors want to own this ETF ahead of what we think is going to be a breakout above this resistance level.”

The IGV ETF closed above $206 on Tuesday and is now at $208.

“You have a bullish trend going into it. You can see that rising 200-day moving average,” Wald said. “The ETF also scores well in our momentum ranks. That speaks to the relative leadership.”

So far this year, both Salesforce.com and Oracle have been surging, with the stocks up 17% and 17.5% respectively. Salesforce.com is the top holding in the IGV ETF, followed by Adobe (NASDAQ: ADBE)—which is up 18% year-to-date—and Oracle. Other names in the ETF’s portfolio include Intuit (NASDAQ: INTU), ServiceNow (NYSE: NOW), and Autodesk (NASDAQ: ADSK).

Wald says the ETF’s fourth-top holding, Microsoft (NASDAQ: MSFT), is an example of the type of software company that is likely to lead the whole group higher.

He says that Microsoft is “also reversing its near-term downtrend and we think [it is] positioned to see a resumption of its long-term uptrend, so overall we think these high-growth companies continue to lead the S&P’s secular advance in this low growth world.”

And according to Gina Sanchez, CEO of Chantico Global, the fundamentals of these software stocks should continue to work in their favor.

Referring to the software space, Sanchez said “One of the reasons it has done well is that it is a very profitable business. It has very high margins.”

In their most recently reported quarter, Microsoft boasted a profit margin of nearly 26%, Oracle reported a profit margin of 24.4%, Adobe posted a profit margin of 27.5%, and Salesforce.com reported a profit margin of 10%. As a whole, the IGV EFT has profit margins at 30% of total revenue.

“If you can get it right, it doesn’t take a lot of extra effort to continue to sell thousands or even millions of licenses on a piece of software,” Sanchez said. “It really just takes maintenance and continued maintenance. On the investor side, you’re starting to see some fatigue but we’re not seeing that in the pricing. The markets are still rewarding these companies.”