These 2 defense stocks could see big upside ahead this year.

Aerospace and defense stocks have had a good week.

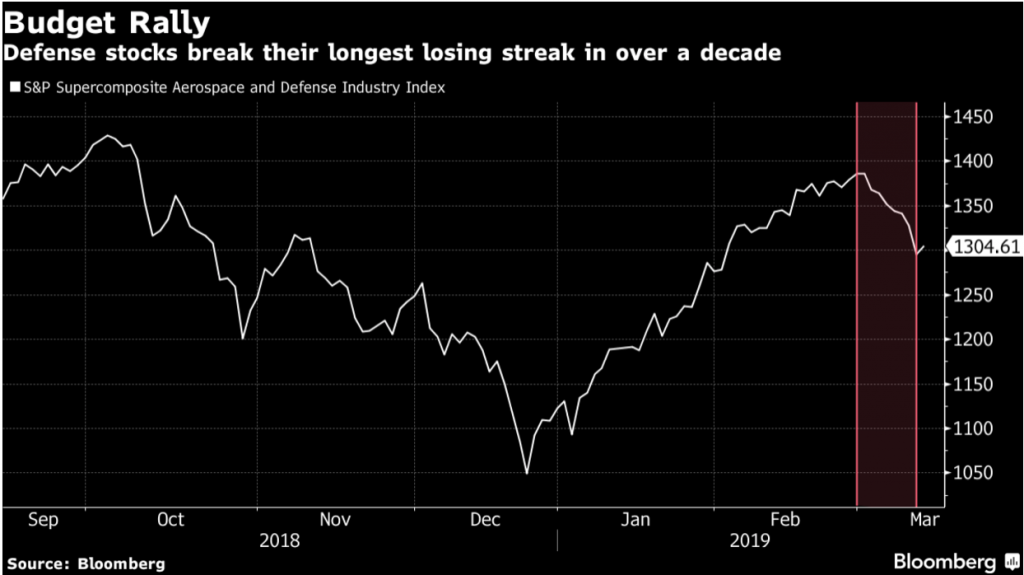

Bloomberg reported Wednesday that the sector had ended its longest losing streak in over a decade after the proposed federal fiscal 2020 budget was released.

The S&P Supercomposite Aerospace and Defense Industry Index gained as much as 1.2%, compared to the S&P 500 Index’s gain of 1%. Among the top gainers in the sector were Arconic (NYSE: ARNC), General Dynamics (NYSE: GD), Huntington Ingalls (NYSE: HII), Northrop Grumman (NYSE: NOC), Raytheon (NYSE: RTN), and United Technologies (NYSE: UTX).

President Trump’s proposed $750 billion defense budget got mixed reviews, as analysts noted that the proposed plan prioritized funding for R&D over actual procurement. However, analysts also said that the proposed budget is sure to be revised before an agreement is reached.

Defense stocks were under pressure in the last few months of last year as there were concerns about reaching a peak in defense spending. Valuations in the sector have recovered since the lows reached in late December.

Morgan Stanley analyst Rajeev Lalwani wrote in a note to clients that “The $750 billion headline defense budget was at the upper end of expectations, but light on investment funding. The mix of funds indicates a prioritization of research and development while trimming procurement, netting about 2 percent growth, shy of mid-single-digit expectations.”

While Morgan Stanley said the proposed budget was “lackluster” and unlikely to make it through Congress in its current form, there are defense stocks to consider now.

The Navy is asking for 12 more ships in fiscal year 2020, including 3 attack submarines. These submarines are built by General Dynamics’ subsidiary Electric Boat. The companies have been the beneficiaries of lucrative Navy contracts recently as submarines have made a resurgence in U.S. military strategy.

General Dynamics’ business unit, Land Systems, also just landed a $1.4 billion contract by the U.S. Army Contracting Command. Per the terms of the contract, the company will provide retrofit, damage repair, and reset-refurbishment services to the Stryker Family of Vehicles, with the work expected to be completed by February 2024.

The company’s board also just approved a 9.7% increase in its quarterly common stock dividend, to $1.02 per share. This marks the 22nd consecutive dividend hike.

Analysts are bullish on GD and their average price target for the stock is $207.88, suggesting possible upside of nearly 23% over the next twelve months. Just last month, Drexel Hamilton reiterated their Buy rating on the stock and set their price target at $230 – 35% above Thursday’s closing price.

Analysts are also bullish on Northrop Grumman, and have a consensus Buy rating for the stock. Their average price target for NOC is $335.47, indicating possible upside of 22% over the next twelve months.

Northrop made a bold acquisition in the space market last year with its $9.2 billion acquisition of Orbital-ATK, making it a key provider for International Space Station resupply missions, among other things. The company has been a long-standing player in the space market, having once built the moon lander used in the Apollo 11 mission, and continues to be a key contractor with the U.S. government across space and military operations.

The company is also the leader in the drone market, and it just landed an $89 million contract for sustainment and engineering support for the MQ-4C Triton unmanned aircraft surveillance system. It may also soon be testing drones as part of its Remedy project with the U.S. Navy.

Northrop delivered an earnings beat in January and CEO Kathy J. Warden said that they expected “double-digit sales growth in 2019 to approximately $34 billion … reflecting mid single-digit organic growth. Assuming continued strong support for national security spending and the capabilities outlined in the national defense strategy, we currently expect mid-single digit sales growth to continue in 2020.”