Advanced Micro Devices Inc. (AMD) was the strongest performer for an otherwise lackluster S&P 500 Tuesday. Shares of the semiconductor company scored double-digit returns, while its parent index posted a negligible 0.01% loss.

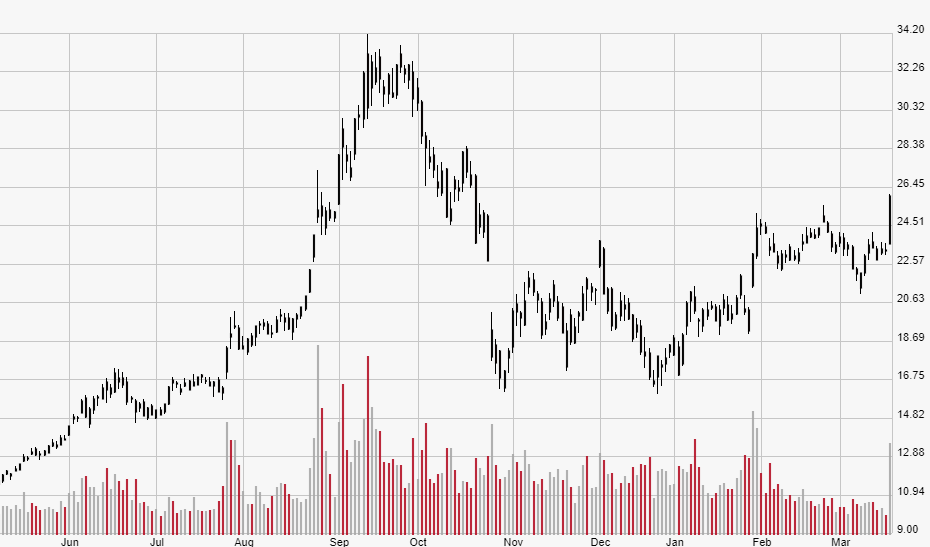

Before Tuesday’s incredible performance, AMD stock had suffered lackluster gains for investors. Shares of the firm are down 16.7% over the last six months while still experiencing pressure near the $32.72 resistance level investors saw a peak of back in October. After missing on revenue estimates in its Q4 earnings report, investors remain unsure of whether or not the once-hot semiconductor producer can keep up a winning streak, particularly in the wake of such nebulous gaming news that boosted shares.

Let’s take a closer look at Tuesday’s gains – and what they mean for investors moving forward…

The News

Advanced Micro Devices vaulted in the wake of Alphabet Inc.’s (GOOGL, GOOG) announcement that the semiconductor firm won the highly coveted deal to power Google’s new Stadia gaming platform. Stadia is Google’s largely surprising stretch into the gaming sector, and while details of the gaming platform remain unknown, it’s considered by The Verge to be “a bold but largely untested vision of the future of gaming that involves distributing and playing software in real-time over the internet.”

Stadia’s reveal at the Game Developers Conference (GDC) on Tuesday demonstrated not just that AMD would be the software’s key component, but also that it would be the massive data-storage partner the platform desperately needs to compete. AMD is expected to build chips that, Google claims, will deliver 10.7 teraflops of power. For comparison, Microsoft Corp.’s (MSFT) premier Xbox One requires six teraflops of power. Its primary competitor, the PS4 Pro, requires 4.2 teraflops.

The data-centric nature of Stadia is what’s driving appeal to Google’s newest foray into gaming. Google claims it will be able to support 4K games at a rate of 60 frames per second. However, the company hopes to support games with resolutions as high as 8K, all of which its new partnership with AMD will help support. These lofty ambitions can’t be ignored by any company, let alone one as influential as Google.

How Investors Reacted

Shares of AMD rocketed to more than five-month highs during Tuesday’s session, climbing 11.8% from $23.25 on Monday to an even $26. Not only did the stock experience an enormous single-day return, but it also surpassed the $24.52 one-year target price estimated by analysts surveyed by Yahoo! Finance.

The Bigger Picture

The semiconductor business has largely been on the rocks since the start of the U.S.-China trade war. The United States’ raising of trade tariffs centers on intellectual property, particularly in regard China’s Huawei and its semiconductor technology that President Trump concedes is spying on not just American citizens but also American technology.

While that’s been looming over the entire market since 2018, it’s even more important to consider Advanced Micro Devices from a closer perspective. The company reported mixed results for the October-December period. Though its earnings per share (EPS) of $0.08 met Wall Street’s estimates, the revenue missed by a $200,000 margin. Analysts pegged it at $1.44 billion, while the firm reported $1.42 billion in revenue.

Earnings notwithstanding, it’s difficult to configure AMD’s success into Stadia’s this early in the game. As tech companies are wont to do, Google touts Stadia as the absolute breakthrough in the gaming industry, but investors are currently left with little details about what exactly Stadia is. In its presentation Tuesday, Google didn’t elaborate on what games it hopes to release on the platform. Since Stadia will require games to be “ported” – or recoded to fit a new playing infrastructure – it’s difficult to say which popular games it can recode for the masses. With the rise of “Fortnite” and other zeitgeist-defining games on Xbox and other platforms, determining whether or not Google can compete – even with AMD at the helm – seems futile at this juncture.

The “porting” scenario may leave problems for AMD’s own chip development, considering the fact that Stadia will require more outside developers to configure their own games to the semiconductors as they see fit. Jade Raymond, who announced her lead in developing Stadia, said she plans to work with “external developers to bring all of the bleeding edge Google technology you have seen today available to partner studios big and small.”

Looking Ahead

Google’s inclination to partner with Advanced Micro Devices signals massive implications for the gaming industry. As one of the most powerful tech companies in the history of the world, Google holds all the power in the relationship. This may be both a great sign of strength and a bad one, since Google seems more than inclined to partner with other developers that may minimalize AMD’s software into some form of obsolescence down the road.

That being said, AMD remains a top-tier semiconductor stock in an otherwise troublesome space on the global stage. Investors should consider the long term; once Stadia hits the market, any market participant looking to get a piece of the action should make sure Google’s optimistic foray into gaming reflects AMD’s bottom line.