The last time it did this, it rallied 95%…

Competition is heating up in the video streaming space thanks to Apple (NASDAQ: AAPL) and Walt Disney (NYSE: DIS), among other new entrants.

Apple will reportedly unveil its new streaming platform next week, while Disney just closed its acquisition of 21st Century Fox – a deal that marks one of the biggest threats to streaming pioneer Netflix (NASDAQ: NFLX) in its 21-year history.

But on the day the massive Disney-Fox deal closed this week, shares of Netflix surged nearly 5% in a day. The stock is currently up 5.3% for the week and 41% so far this year, making Netflix the best performer among FANG stocks so far in 2019.

And equity strategist Matt Maley of Miller Tabak believes Netflix could still climb higher.

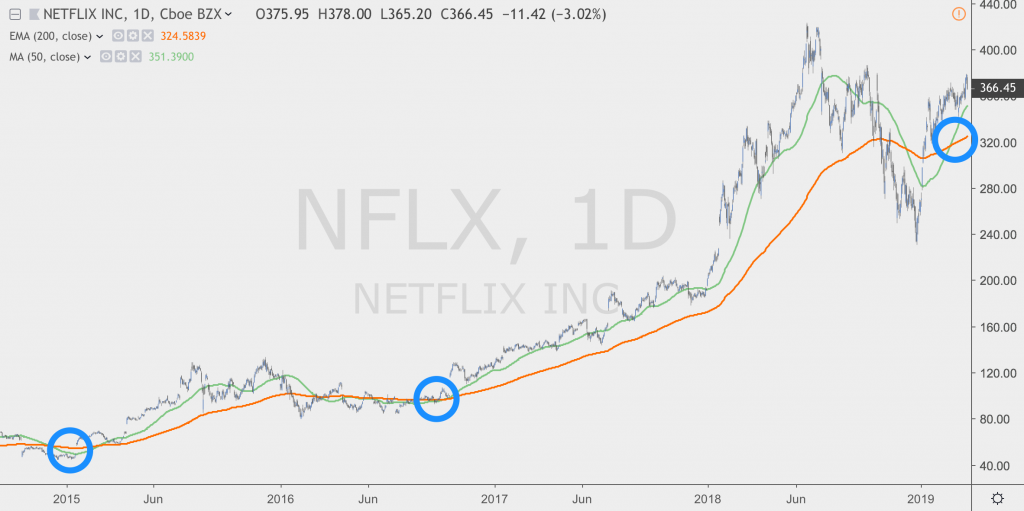

“This stock already took a little bit of a breather last month and now it’s starting to rally again,” Maley told CNBC on Tuesday. “The key that’s really going on right now is the stock is seeing a golden cross with its 50-day moving average moving above its 200-day moving average.”

A golden cross forms when a shorter-term moving average crosses above a longer-term one, and is considered the bullish reversal of a downtrend. According to Maley, such a golden cross developed on Netflix’s chart on March 11.

“The last two times in 2015 and 2016, it saw a rally of 120 and 95 percent after they saw the golden crosses,” said Maley. “I’m not calling for that kind of a huge rally but history says it’s been a positive sign.”

So why the renewed bullishness for Netflix when Apple and Disney are preparing to launch rival services due later this year? Wall Street believes that any threat from these new rivals has long been already priced into the stock, and Netflix has already been preparing for Disney to pull its content from Netflix’s library, having been stocking up on its own must-watch titles for years.

In fact, that message was no more clear than on Wednesday, when Netflix unveiled the new trailer for the third season of its smash hit Stranger Things just hours after the Disney-Fox merger was officially closed.

Two analysts have come out this week with bullish notes on Netflix, citing the company’s original content and the groundwork the company has laid in international markets in the last few years.

Imperial Capital analyst David Miller wrote on Wednesday that the streaming giant’s move to create content outside of the U.S. has both boosted international subscribers and has delivered new hits at home.

“Examples are Bodyguard, a crime drama filmed in Europe but which is playing well all throughout continental Europe; The Protector, a drama/fantasy series filmed and set in Turkey; and Baby, an Italian teen drama which is also finding cross-border appeal,” Miller wrote. “Too many media investors think of Netflix’s international business as simply U.S. content that is dubbed in various foreign languages, but in many cases the inverse of that is starting to take hold.”

While RBC’s Mark Mahaney wrote that he sees growing evidence that the market for streaming video will be so large that a handful of companies will survive.

“The landscape appears more challenging, based on what we have seen from survey work and commentary from leading Internet & Media management teams, we believe there is a massive opportunity facing Internet TV that will be able to support 2 or 3 providers, and that Netflix—based on its scale, brand, and value proposition—will be one of those,” Mahaney wrote.

But Gina Sanchez, CEO of Chantico Global, struck a more cautious tone on Netflix and says the company may have more difficulty continuing to grow with increased competition moving into the space.

“Netflix is obviously the one with the most to lose,” Sanchez said. “My concern is actually that Netflix may actually paint itself into a corner. Everybody is gunning for territory that Netflix has already created. Netflix has a massive spending budget in order to continue to move a needle that quite frankly is getting harder and harder to move in terms of revenue.”

“You look at the average number of subscriptions that cord cutters have. You’re talking about three-plus subscriptions. Quite frankly, viewers are getting subscription fatigue,” Sanchez said. “At some point you’re going to have to see some consolidation.”