Shares of Apple Inc. (AAPL) were on the move Monday as CEO Tim Cook and a slew of celebrities attended the tech titan’s highly anticipated press event at Cupertino’s Steve Jobs Theater. The event’s purpose was to announce new services-sector initiatives, which primarily involve pushing beyond the current Apple Music service and into the competitive video-streaming market.

Here were the three biggest announcements from Monday’s event…

The Three Biggest Unveilings

The first was Apple TV+ – a paid, ad-free video-streaming service that will serve as a hub for Apple’s brand-new original content and programming.

The company’s streaming service has been subject of massive speculation for years, particularly regarding the firm’s push into producing original content. In early 2017, analysts expected Apple to invest as much as $1 billion a year on new programming that would ostensibly be launched on the Apple Music platform. Later that year, the number climbed to $4.2 billion through 2022. By this year, the general public became aware of Apple’s own streaming service separate of Apple Music, and the company confirmed Monday that the new product will launch this fall.

While Cook didn’t disclose specific price details, he – along with big Hollywood names like Oprah Winfrey, Jennifer Aniston, and Reese Witherspoon – announced new programming that would be released exclusively on the Apple TV+ service. The shows include two docu-series from Winfrey, Witherspoon and Aniston’s drama “The Morning Show,” and other works from high-profile directors like Steven Spielberg and J.J. Abrams.

Netflix Inc. (NFLX) currently dominates the streaming space by a mile, but Apple’s enormous global community of users gives it an unprecedented edge. While the streaming giant boasts about 139 million users worldwide, Apple has roughly 1.4 billion people – or more than 18% of the global population – using its devices in some capacity. At the annual rate it plans to spend on new programming, Apple could easily surpass Netflix’s reach within the next decade at most.

The second big announcement was Apple News+, the newest incarnation of the built-in news app available on most Apple devices.

Cook was a bit more forthcoming in terms of the new app’s pricing, announcing that users can have access to more than 300 new premium magazine and news outlets – including The Wall Street Journal and the Los Angeles Times – for a subscription price of $9.99 per month. Apple News+ is an adaptation of Texture, the bundled news app Apple acquired last year that has been touted as a “Netflix for magazines.”

But several major outlets are notably absent from the app, drawing speculation over whether or not it’s actually worth the money. For instance, The New York Times and Washington Post won’t be featured, leaving Apple without access to their more than 4 million combined digital subscribers. Mark Thompson, CEO of The New York Times Co. (NYT), expressed his hesitancy over the news app, saying, “We tend to be quite leery about the idea of almost habituating people to find our journalism somewhere else.” He continued by noting that the company remains “generically worried about our journalism being scrambled in a kind of Magimix (blender) with everyone else’s journalism.”

Finally, Apple’s third big reveal on Monday was the Apple Card, a new credit card that will serve as a joint venture between the tech giant and Goldman Sachs Group Inc. (GS).

The credit card is due out this summer and won’t require a card at all, instead being available for use on all iOS devices through the built-in Wallet app. It offers a rewards system in which 2% of the amount of any Apple Pay purchase can be redeemed as cash through the Wallet app. Customers can reap 3% rewards on purchases of any Apple products.

Cook made highly optimistic statements about the card, even going as far as saying it would be “the most significant change in the credit card experience in 50 years.”

How Investors Reacted

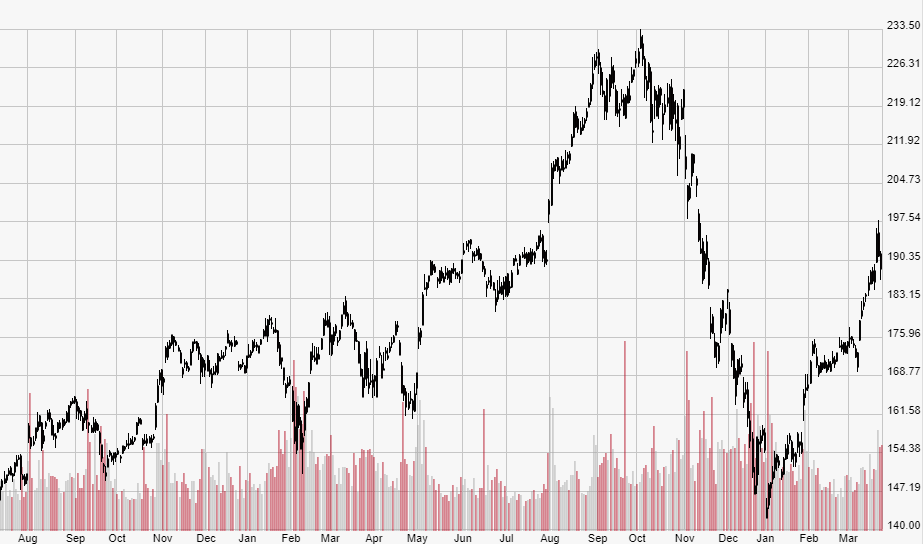

Shares of AAPL were in the red on Monday, experiencing peak losses of 2.4% before climbing a bit higher to close at $188.74 for a 1.2% loss. However, according to analysis conducted by Bespoke Investment Group, Apple stock typically falls on the day of announcements and rises the day following announcements. Shares are still up 19.7% on the year from $157.74 on Dec. 31 to $188.74 on Monday.

Looking Ahead

Apple always stirs up frenzy around its big product announcements, but the firm doesn’t always deliver on the bottom line as a result. Its services sector is particularly tricky since it’s taken the company years for it to constitute a sizable slice of overall revenue.

However, there’s no denying Apple’s massive global influence, so any new initiatives into the crowded streaming market should definitely be embraced in the short term. Still, investors should take a wait-and-see approach as these new moves slowly factor in to Apple’s earnings reports the next few quarters.