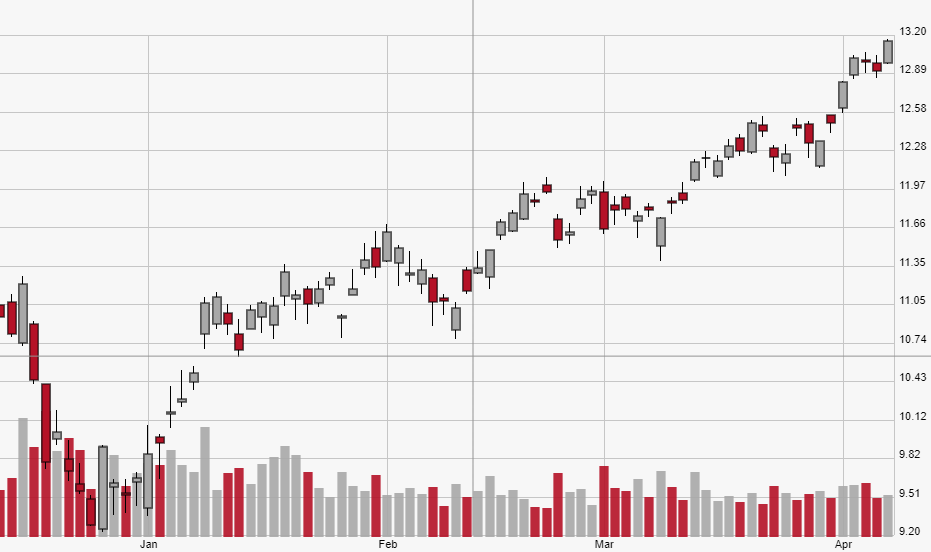

West Texas Intermediate (WTI) – the benchmark for oil prices in the United States – has enjoyed an incredible rally lately, and those gains continued Friday as prices closed at their highest level since early November. At Friday’s $63.25 close, WTI prices are now up more than 11% in just the last month.

Oil is a notoriously fickle market, with prices constantly being pulled in every direction due to a variety of domestic and international factors. As prices continue to claw their way higher, energy investors and traders alike want to know whether or not oil demand will maintain its strength in the long term, inevitably boosting prices at the same time.

Here’s why oil prices closed at a five-month high on Friday – and what market participants can expect from the oil market moving forward…

The News

Oil’s rally during Friday’s session came on the heels of new indications that supply may be tightening, both in the U.S. and abroad.

The first piece of data came from Baker Hughes Inc. (BHI), the oilfield services company whose weekly U.S. rig counts reflect the overall state of domestic oil supply. The firm reported that the total number of U.S. oil rigs increased in the last week from 816 to 831. While an increase typically drags prices lower due to the common notion that more rigs means more supply – and consequently lower demand – it can often be interpreted as a direct response to lower supply. That sentiment alone can sometimes galvanize insider energy traders into buying up futures contracts, which pushes WTI prices higher.

The second factor that fueled the price rally was overall sentiment regarding global supply, which Jefferies Financial Group Inc. (JEF) analyst Jason Gammel said is likely to fall in the near term due to “Saudi (if not OPEC+) production discipline, sanctions on Iranian/Venezuelan exports, and seemingly resilient demand.” He additionally mentioned that U.S. supply continues to wind down at a confident pace, as “total U.S. commercial inventories are down 38 [million barrels] in the past 10 weeks, a good sign that OECD inventories are contracting.”

How Investors Reacted

Oil traders boosted WTI prices – reflected in the most current May futures contract – up 1.6% on the day to $63.08 per barrel. That marked a 4.9% weekly gain and the fifth straight weekly gain in a row. WTI has now surged 39% year-to-date.

Many oil stocks also responded well to the plethora of supply factors brought to light Friday, including Apache Corp. (APA), EOG Resources Inc. (EOG), and Anadarko Petroleum Corp. (APC). Those three firms were the S&P 500’s top three gainers for the day, respectively climbing 6.6%, 5.3%, and 4.3% during Friday’s trading session.

The Bigger Picture

The way prices will respond to the weekly Baker Hughes data is often easy to predict: if the number of active rigs go down, prices will go up, and vice versa. However, the factors Gammel outlined in his note, including Saudi output and international sanctions, are much more unique to this past week’s gain.

While Saudi Arabia used to be concerned with manipulating supply in order to maintain its dominance over the U.S., the former has been the world’s biggest producer since at least last summer when daily output reached 11 million barrels. Once the U.S. took the top spot, the Saudis have mainly been concerned with keeping prices aloft to the point where their own supply can still turn them a profit. Any news of Saudi Arabia decreasing production can still move the needle, which is why prices spiked following S&P Global Platts’ report Friday that the country’s daily output dropped by 570,000 barrels to 30.23 million barrels in February.

The picture gets much more political when considering the sanctions on Iran and Venezuela. Any investor keeping even a light tab on D.C. knows that President Trump isn’t friendly toward Iran, constantly berating the Middle Eastern nation for not reducing its nuclear stockpile per the Iran nuclear deal and generally antagonizing the country to curry favor with close ally Israel. Trump has already issued sanctions against Iranian oil exports and has more recently gone after other nations buying the country’s oil. This has given investors the confidence that global supply will be hamstrung amidst this complicated international movement of oil, and that confidence will likely continue at least up until Trump’s May 2 deadline to determine if he wants to issue fresh waivers on governments importing Iranian supply.

As for Venezuela, Trump has taken an even more hardline stance. With President Nicolas Maduro’s totalitarian government running Venezuela’s economy into the ground and committing general crimes against humanity, the U.S. and its allies are currently attempting to delegitimize Maduro in favor of interim President Juan Guaido. To cut off funds to Maduro’s government directly, the U.S. has placed sanctions on Venezuela’s oil industry, which essentially sits atop the world’s largest reserves. This similarly promotes the narrative that international supply will be reduced, even to a much larger degree than the situation in Iran.

Looking Ahead

The general consensus around the world is that most global supply is at a standstill. Saudi Arabia – still the de facto leader of OPEC, the world’s most powerful oil cartel – is taking strides to keep prices in check, which has resulted in the country smartly capping domestic supply in the short term. Frozen exports in Iran and Venezuela are also burgeoning the supply question, pushing not just international price benchmarks like Brent higher but also WTI prices in the U.S.

With supply looking to be lower for longer, there’s no reason for investors to think demand will wane. That means investors can also expect WTI prices to remain near – or even push beyond – the record levels witnessed on Friday.