Plus 4 stocks that are the best positioned as the trade war heats up.

In two tweets on Sunday, President Donald Trump threatened to hike tariffs on Chinese imports, instantly rattling markets that had been hopeful of an impending trade deal.

While negotiations continue between the U.S. and China, Trump said at a rally on Wednesday that China had “broke the deal.” Chinese Vice Premier Liu He is expected to have a working dinner with Treasury Secretary Steve Mnuchin and Trade Representative Robert Lighthizer this evening, just hours before the threatened tariff hike is expected to go into effect.

The Dow is down more than 700 points this week and the S&P 500 has lost over 3% since the tweets heard round the world. And if the tariffs go through, companies with high revenue exposure to China—including semiconductors and retailers—will likely be the biggest casualties, according to Wall Street analysts.

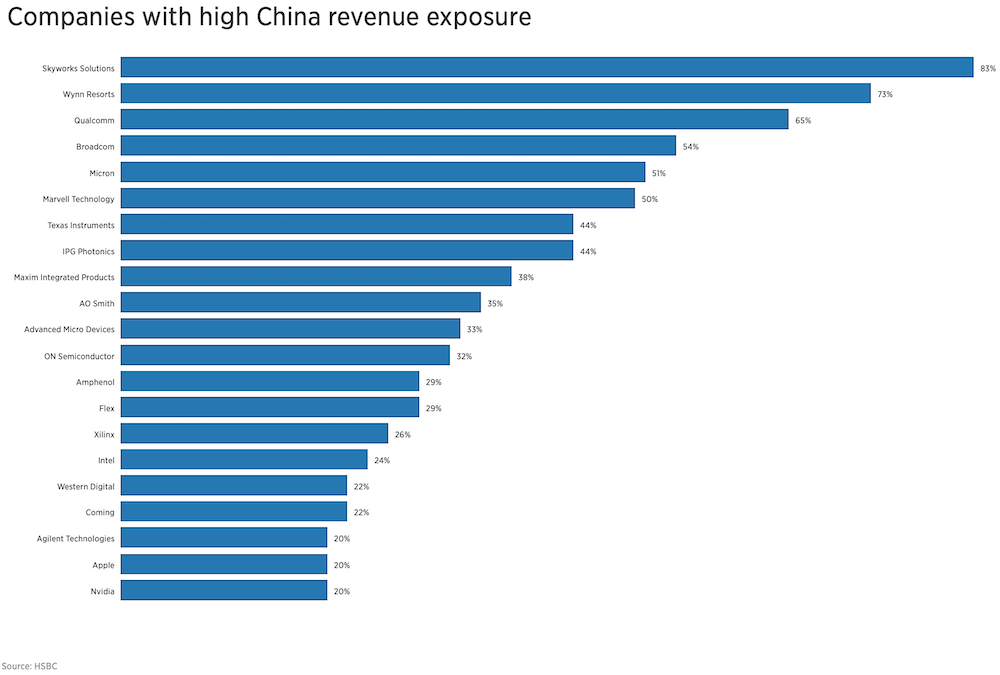

HSBC put out a list of companies that could be the most sensitive to tariffs due to their footprint in China, including multiple tech sector names like Skyworks Solutions (NASDAQ: SWKS), Broadcom (NASDAQ: AVGO), Micron (NASDAQ: MU), and Intel (NASDAQ: INTC).

A few of the names on that list are already taking a hit. Intel is down nearly -8 for the week, while Nvidia (NASDAQ: NVDA) is down -7% and Apple (NASDAQ: AAPL) is down -4%.

“Semiconductor suppliers have relatively high ‘ship-to’ revenue exposure to China,” Needham senior semiconductor analyst Quinn Bolton said in a note from Monday. “This high exposure to China puts the semiconductor sector at greater risk to the escalation in the U.S.-China trade war than many other segments of technology.”

Bolton also pointed out MaxLinear (NYSE: MXL), Ambarella (NASDAQ: AMBA), Monolithic Power Systems (NASDAQ: MPWR), and Semtech (NASDAQ: SMTC), each of which have more than 50% of sales in China based on their 2018 results or 2019 guidance.

According to UBS equity analyst Michael Lasser, several retailers could also come under pressure as elevated tariffs raise costs for the imported goods they sell.

“If the move to 25% tariffs goes through and it persists for an extended period, we believe the impact to many hardline, broadlines, and food retailers would be significant,” Lasser wrote in a note. “The brunt of a full 25% tariff would likely be quite inflationary as the retailers have indicated they would use strategic price actions, where possible, to mitigate the impact.”

Lasser said home furnishing retailers Bed Bath & Beyond (NASDAQ: BBBY), Williams-Sonoma (NYSE: WSM), and Restoration Hardware (NYSE: RH) could have “significant risk” given their high exposure to products from China.

As for the stocks that are nearly immune to the trade threat, and thus well-positioned should the new tariffs stoke the trade war further, RBC analysts like Atkore International (NYSE: ATKR).

Atkore manufactures electrical distribution products, and the company reported solid earnings earlier this week.

“Management remains confident in its ability to manage tariff headwinds. The company has minimal direct tariff exposure, and for the products that it does import form overseas, its competitors source these products from overseas too,” RBC said.

RBC analyst Deane Dray also likes AquaVenture Holdings (NYSE: WAAS). The company, which provides water purification system solutions, has “essentially zero exposure to US-China tariffs or recent news headlines of escalating trade tensions,” Dray wrote.

UBS analysts like power and utility stocks like American Electric (NYSE: AEP) and Entergy Corp (NYSE: ETR) as they are “made for performing in rising trade tensions,” according to the analysts.

“Within utilities, the most defensive names will be fully-regulated companies,” UBS analyst Daniel Ford wrote.