This company just had its best day in four months after reporting blockbuster earnings.

The Chinese e-commerce giant JD.com (NASDAQ: JD) posted stellar earnings last Friday, pushing the stock up as much as 10% that day.

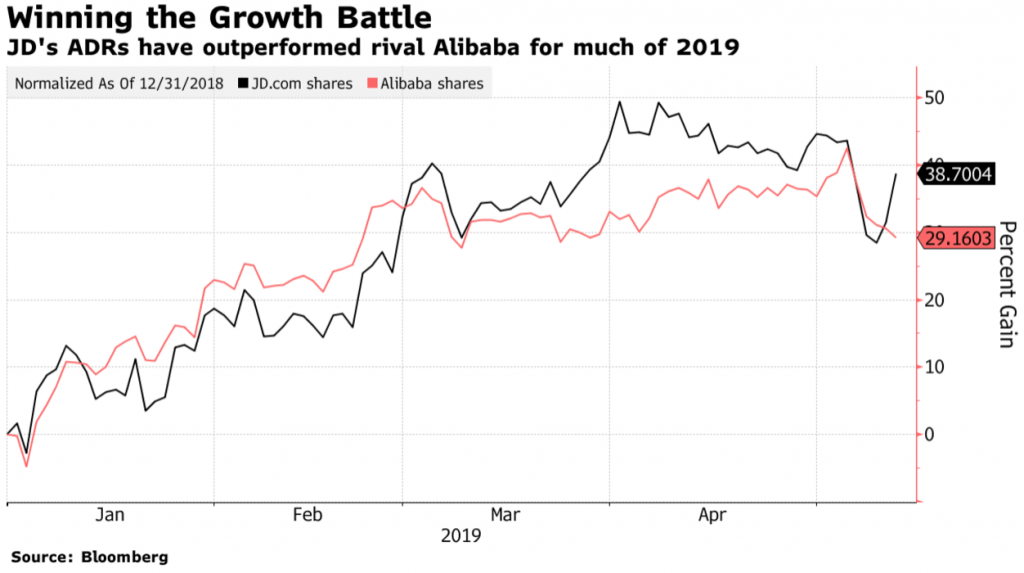

So far this year, shares are up 45% despite negative headlines surrounding the company’s CEO, Richard Liu.

In its first quarter, JD reported that active customer accounts grew 15% year-over-year to 310.5 million while revenue jumped 20.9% in the same period to 121.1 billion Chinese yuan ($17.7 billion), beating the consensus estimate of $17.6 billion.

While costs rose, non-GAAP operating margins improved by 80 basis points to 1.6%. Net income skyrocketed 344% year-over-year to $1.08 billion, while GAAP earnings per American depositary share jumped 335% to $0.74, up from $0.17 in the first quarter last year.

For Q2, JD anticipates net revenue of between 145 billion and 150 billion yuan, up between 19% and 23% from the same quarter last year.

This growth forecast for Q2 indicates “strong business momentum,” according to Citibank analyst Alicia Yap, though she warns that investors should watch to see how the trade war will impact consumer sentiment on China and their purchasing behavior on JD.com.

The company highlighted its expanded product offerings and new partnerships with global brands in the first quarter, as well as enhanced technology in its logistics system.

“JD.com’s focus on delivering the best and most trusted online retail experience to customers throughout China drove another strong performance for the first quarter,” JD’s CEO, Richard Liu, said. “We will continue to invest in key technologies and top industry talent as we work to reach an even broader customer base through cutting edge innovation. With our growing scale and increasingly efficient operations, JD.com remains well positioned to deliver strong shareholder value for the long term.”

Liu also noted that JD is following a modern version of the classic playbook for large-scale retail businesses.

“I just also want to just come back to the basics, what you mentioned on the various decentralized retail formats, you can also draw comparison to the various innovative boutique shops in the offline world,” Liu said. “At different times, you always have different new innovative retail formats, but in the end, the retail economies of scale driven by large procurement and also operating efficiency will remain intact.”

Liu argues that JD is carrying the traditional retail torch built on a next-generation digital workflow, which creates a unique business advantage.

“When you do such a scale, it is actually very difficult to be disrupted,” he said.

The company said that is has renewed a strategic tie-up with Tencent, which will give it high-level access to Tencent’s Weixin platform for an additional three years. The Weixin platform, along with WeChat, attracts 1.1 billion monthly active users, which should help JD “enhance its customer experience, reach a larger user base and further expand its presence on mobile commerce,” the company said.

As part of the deal, JD will pay Tencent roughly $800 million, as well as $250 million in Class A shares. The two companies are also expected to continue their cooperation in a number of other areas including communications, advertising, and membership services, according to JD.

JD is also growing its higher-margin services business—which includes JD Logistics’ services for other retailers, marketplace ads, the “Prime-like” JD Plus membership program, and JD Cloud—to offset the lower margins of its core marketplace.

The company’s services revenue rose 50% in 2018 and accounted for 10% of JD’s top line. In Q1, net services grew 44% annually, led by growth of 91% in its “logistics and other” services revenues. Should that growth persist, JD’s profitability should improve and enable it to reinvest more of its cash into the expansion of its ecosystem.

The company is making a big effort in the healthcare industry, and plans to raise more than $1 billion to finance its healthcare subsidiary, JD Health. On May 9, the company entered into a definitive agreement for the non-redeemable series A preferred share financing of JD Health, with investors including CPEChina Fund, CICC Capital, and Baring Private Equity Asia, among others.

JD will remain the majority shareholder of JD Health, and the financing will be used to expand the core business, attract industry talent, and explore new initiatives in the sector, according to JD.