Remember bitcoin? It’s surging higher again.

Bitcoin is hot again.

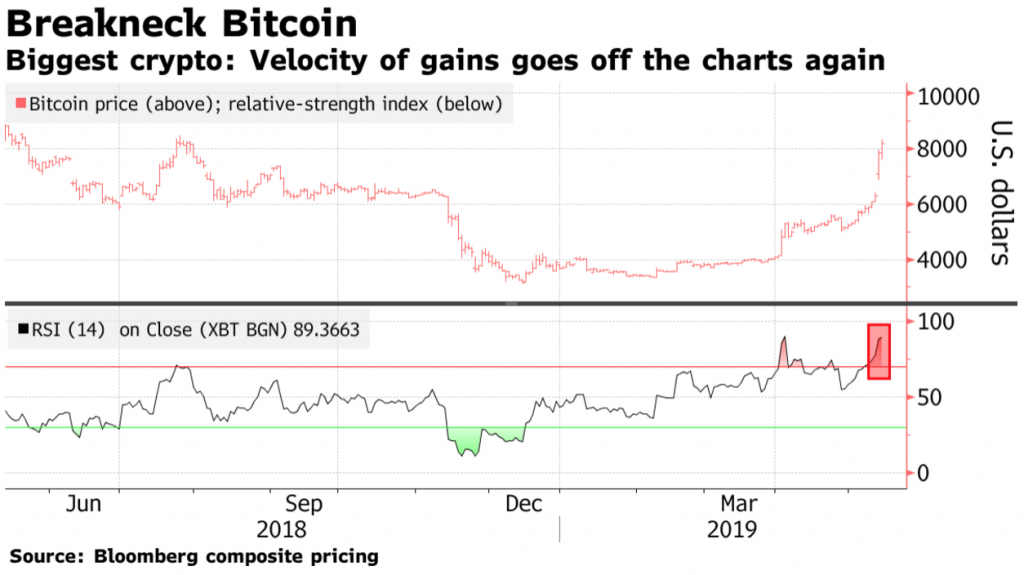

The OG of cryptocurrencies has climbed to $8,229 as of this writing, and has surged 125% so far this year extending its longest winning streak since 2013.

Bitcoin crashed last year after the frenzy around it in late 2017 that pushed it to over $20,000, and this rally is giving fresh momentum to the beaten down crypto.

Just hours after jumping 25% on Monday with no discernible reason, bitcoin—the largest cryptocurrency in the world—added another 6% on Tuesday, helping to push the coin’s total market value to nearly $250 billion, a level not seen since last August.

There has been a lot of speculation around what is driving bitcoin higher, from a possible squeeze on short positions to investor relief that recent hackings and scandals haven’t disrupted the broader market. Still others have chimed in that bitcoin has become a haven during market turbulence, making the case that the crypto is an uncorrelated, safe-haven asset as markets are on a wild ride.

“If you were in China and you wanted to diversify, it would seem logical that Bitcoin would be a short term alternative,” Andy Brenner, head of international fixed income at National Alliance Securities, wrote in a note to clients on Monday. “While we do not see the direction flows of who is buying bitcoin, we can see that the bid for bitcoin in this latest run has coincided with a big down tick in the value of the Chinese Yuan versus the dollar.”

But as bitcoin sits just under its 52-week highs, some experts are wondering if a pull-back could be right around the corner.

“We had rallied above [key resistance] but then failed on two different occasions,” said Anthony Grisanti of GRZ Energy on Wednesday. “[Bitcoin] has doubled in the last five months, so I would expect a bit of a pullback, and on the downside, there’s a very interesting gap there, from $6,870 to $6,425.”

“If we start getting some profit-taking in this market, it will fill in that gap, but that’s actually very healthy for markets going forward,” Grisanti continued.

While the technicals may point to a pull-back, Bob Iaccino of Path Trading Partners believes there’s a catalyst behind this surge in bitcoin that could change the ecosystem and make the cryptocurrency far more friendly to consumers and businesses.

“I do believe I know part of the reason why [Bitcoin is booming], and that has to do with the inception and the application of software called the Lightning Network, which actually makes small transactions a lot easier for those who hold bitcoin,” Iaccino said.

“Where you look at Visa, who can transact 65,000 transactions per second, Bitcoin’s [prior level] was about seven, and now with the implementation of the Lightning Network, which is a software add-on, you can actually get these smaller transactions off the blockchain network, making adoptability of bitcoin as a currency a lot easier.”

Jeremy Allaire, the co-founder and CEO of Circle, said bitcoin’s recent rally is most likely the result of positive news in the cryptocurrency space—like the news that Fidelity Investments will soon allow customers to buy and sell cryptocurrencies—and less of a “risk off” trade.

“Crypto fundamentals have been strong and building since early this year, when it was clear that we were oversold, and the continued parade of positive news and new retail and institutional offerings launching are firmly behind this bull market move,” Allaire said.