The bond market is sending out a warning about what might be right around the corner.

After logging its worst week of the year last week, Wall Street has traded flat this week amid rising trade tensions between the U.S. and China.

On Wednesday, the Dow dropped 100.72 points, or 0.4%, to 25,776.61, the S&P 500 fell 8.09 points, or 0.3%, to 2,856.27, and the Nasdaq dropped 34.88 points, or 0.5%, to 7,750.84, after the Dow and S&P 500 both ended Tuesday up 1%.

But as stocks appear to be mostly weathering the trade war storm, the bond market is pointing to darker skies ahead.

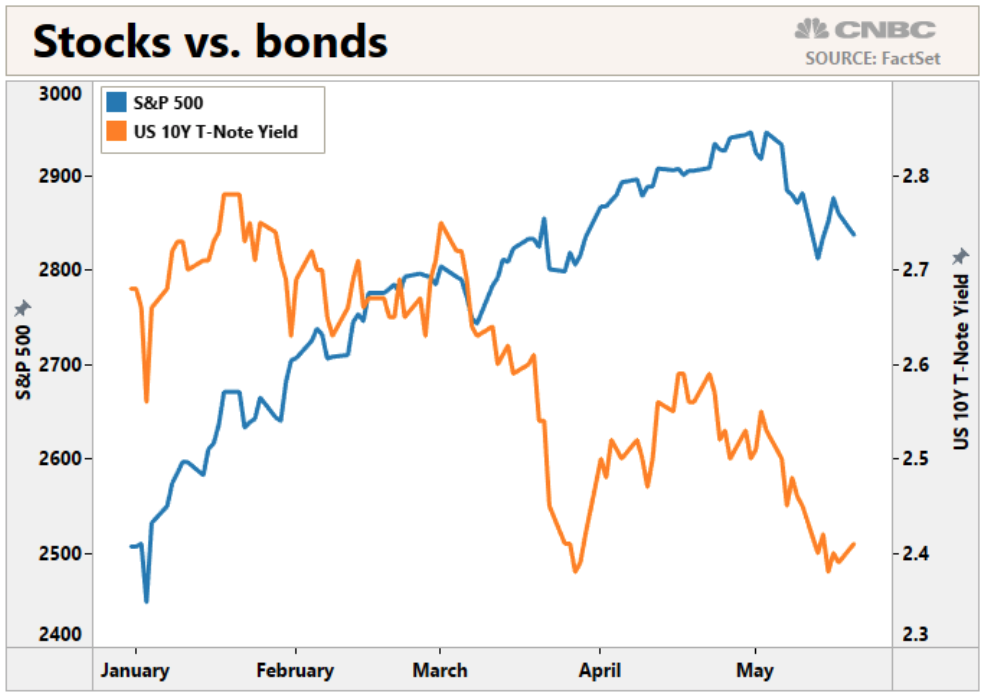

Bond yields haven’t been as resilient as stocks, with the benchmark 10-year Treasury yield trading at 2.4%, roughly 40 basis points below its 2019 high and within 10 basis points of its year-to-date low.

Bonds are typically considered a safer investment compared to stocks as they generally are not as volatile. Thus, money usually flows into bonds when investors see political trouble on the horizon or downside economic risks.

“We have continued to see bonds as the better descriptor of the current fundamental environment, evident in our overweight allocation to bonds and underweight allocation to stocks,” wrote Tim Hayes, chief global investment strategist at Ned Davis Research, in a note from last Friday. “And that’s even more apparent now that the escalating trade war and more dire economic implications have been sending bond yields lower globally.”

At the beginning of this month, President Trump ratcheted up the trade war by hiking tariffs on $200 billion worth of goods to 25%, and China responded in kind by raising levies on $60 billion worth of U.S. goods.

Then last week, the Trump administration escalated tensions further by blacklisting the giant Chinese telecom, Huawei, prompting companies like Google (NASDAQ: GOOGL, GOOG), Intel (NASDAQ: INTC), and Qualcomm (NASDAQ: QCOM) to suspend their business operations with the company. Late Monday, the Commerce Department granted a 90-day reprieve for mobile phone companies and internet broadband providers to work with Huawei, slightly easing fears.

All of these events helped lead the 10-year Treasury yield to drop by about 15 basis points since May 3.

“It remains to be seen how the latest round of tariffs will affect the global economic data to come,” Hayes said. “The trade war worries will most likely remain a negative influence on bond yields and stock prices until a clear turn toward trade peace becomes apparent.”

Hayes also pointed out that while stocks are up sharply so far this year—having risen more than 20% since late December—money has been flying out of equity funds all year. And according to data from ICI, roughly $135 billion has been pulled out of stock funds so far in 2019 while investors have added $169 billion in assets to bond funds.

“The contrast in outflows from stocks and inflows to bonds is another sign that bonds have been sending the right message, not stocks,” Hayes concluded.

Dave Haviland, managing partner at Beaumont Capital Management, agrees and noted that just four sectors in the S&P 500 have been driving the index and have reached all-time highs this year: tech, consumer discretionary, real estate, and utilities.

“We think there are some chinks in the armor,” Haviland said. “If you look at those four sectors, you get the go-go growth of discretionary and tech, which is basically ‘FANG.’ Then you’ve [got] the more conservative, higher yielding real estate and utilities walking alongside them.”

“It reminds me a little bit of 1998-1999, when about 10 companies—about half tech and half health care—kept dragging the S&P 500 even higher,” Haviland continued. “The overall market conditions did catch up to them and they rolled over.”