Investors are flocking to the shiny yellow metal in droves. Will the rally continue?

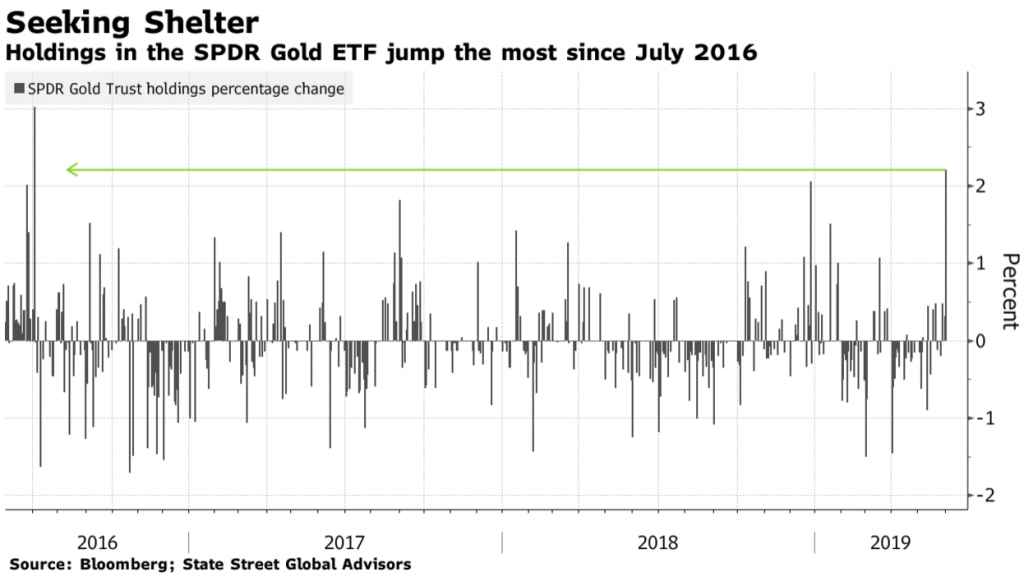

Hear that sound? It’s investors stampeding into the largest bullion-backed ETF faster than they’ve done so since 2016.

The SPDR Gold Shares ETF went on a tear this week as fears about the impact of trade wars on the economy grew and as the market speculated the Fed will cut rates in the near future, fueling demand for the shiny metal.

By Monday, assets in the ETF had jumped 2.2%, or 16.44 metric tons, the biggest gain since July of 2016. The shift to the traditional safe haven asset came as gold prices jumped above $1,300 per ounce, the highest price since this past February.

So far this year, gold has struggled even as the trade war raged on, Fed policy makers signaled rates were on hold for the year, and as the dollar gained for four months. But early this week, St. Louis Fed President James Bullard said that a rate cut may be necessary soon, which spurred markets to discount at least two quarter-point reductions by the end of this year. In a lower rate environment, bullion—which doesn’t bear yields—tends to benefit.

Fed Chairman Jerome Powell also said early this week that the central bank will closely monitor the economic impact of trade conflicts, a change of tone from his former “patient” stance.

“Powell’s speech yesterday (Tuesday) about how he is going to watch the economy for the potential of lowering the interest rate, that seemed to provide a very good bid to gold,” said Michael Matousek, head trader at U.S. Global Investors. “The market was pricing in two rate cuts before, now the probability of the rate cuts are increasing.”

“Ongoing concerns regarding global economic growth is supporting gold at the moment,” said David Meger, director of metals trading at High Ridge Futures, who added that the U.S.’s trade conflicts with China and, now, Mexico are taking a toll.

“Recent commentary by U.S. Federal Reserve officials that they are at least willing to look at rate cuts if the data warrants it has also helped commodities across the board,” Meger said.

“Gold is once again trying to reclaim its role as a safe haven amid growing trade tensions and consequent risks to growth,” said Joni Teves, a strategist at UBS Group. According to Teves, the price of gold “looks like it is getting comfortable above $1,300, with aspirations of testing this year’s highs.”

As of Thursday evening, the GLD ETF was up 3.44% while the price per ounce of gold sits at $1,333, not far from its yearly high of $1,346.

“We are seeing more people jumping into gold because it was a sleeping giant between $1,275 – $1,300 for months and people gave up on gold,” said George Gero, managing director at RBC Wealth Management. “The economic news, political news and tariff uncertainties helped gold move out of the narrow range.”

But as gold climbs closer to its most recent high, will it continue to climb past the $1,346 level? Maybe not, according to Saxo Bank commodity strategist Ole Hansen: “Gold has run a long way in its rally in a short span of time, so I would not be surprised to see it consolidate.”