Even in the midst of escalating tariffs between the U.S. and China and all of the anxiety about trade that has engendered, especially over the last six weeks, the Technology sector remains one of the most profitable sectors to have been putting your money this year. As measured by the S&P 500 Technology Sector SPDR (XLK), the sector is up almost 23% year to date. It remains a bit below the high it reached in April, but after declining about 10% through all of May, it has rebounded about 6% in just the last week.

While the tech sector in general has enjoyed a nice upward run even when you consider that drop in May, investors in Symantec Corp. (SYMC) have missed out on all of the fun. Over the past year, the stock is down a little over -55% since September of last year. That decline includes a massive overnight drop in mid-May from around $29 to less than $20 after the company announced it was launching an internal investigation centered around accounting irregularities. That’s the kind of news that will scare away most investors, including die-hard fundamental and value investors, and it saw the stock push down to lows in the $18 range before the end of last year. After staging a temporary rebound to around $24 by April, the stock has dropped back again and is retesting those multi-year lows right now.

SYMC is a stock that might not sound familiar at first blush to the average consumer, but this is a company that has been around since the early 1980’s, building its reputation in that decade on security and antivirus software that became Norton Antivirus, the software that even most average computer users have heard about and is still a leading application in the security space. Throughout the 1990’s and into the new millennium, the company expanded its reach via acquisition to include storage management and deployment software and enterprise-level security software and services. They haven’t stopped actively seeking out ways to expand their reach via R&D and acquisition; 2016 and 2017 acquisitions of BlueCoat and LifeLock gave them a strong foothold in the web security and personal identity theft protection services, along with taking a 30% stake in digital security certificate provider DigiCert in late 2017.

The company’s portfolio has impressive depth, breadth and scope, but until the last quarter, the company has been mired in problems that would drive most fundamental investors away, including being forced to restate earnings, revenues, and Net Income numbers thanks to account irregularities. That turbulence led activist investor Starboard Value to take an lmost 6% stake in the company in late 2018 and see three new members appointed to SYMC’s board of directors. Earlier this year, long time CEO Greg Clark stepped down and was replaced by Greg Clark. In the last quarter, there are solid indications the company could be through the worst of those financial difficulties. With some other fundamental elements looking quite positive, this could be a good opportunity to buy a Tech laggard at a major discount. Let’s take a look.

Fundamental and Value Profile

Symantec Corporation is a United States-based cyber security company. The Company offers products under categories, such as threat protection, information protection and cyber security services. Under threat protection, it offers Advanced Threat Protection, Endpoint Protection, Endpoint Protection Cloud, IT Management Suite, Email Security, Cloud, Data Center Security and Cloud Workload Protection products. Under the information protection category, it offers Data Loss Prevention, Encryption, Service, VIP Access Manager, and Data Loss Prevention and CloudSOC products. The Company also offers consulting services, customer success services, cyber security services and education services. Its cyber security services include DeepSight Intelligence software, which provides an analysis of attacks. SYMC’s current market cap is $11.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew about 11.5% while revenues declined, at a little under -3%. In the last quarter, earnings dropped by about -21.6% while revenues dropped -1.8%. The company is currently operating with a paper-thin profit margin profile, after Net Income for most of 2018 was restated owing to the accounting regularities I already mentioned. In the last twelve months, Net Income was just .6% of Revenues, and increased to 2.85% in the last quarter. These sound unremarkable, but this is also where the turnaround appears to be manifesting itself. In the same quarter a year ago, Net Income was actually -$500 million (on a restated basis); the fact the numbers have started to turn positive is a good indication the company’s turnaround efforts are gaining traction.

Free Cash Flow: SYMC’s free cash flow is healthy, at $1.3 billion. This is a number that has increased steadily since the last quarter of 2016 when it bottomed at around -$500 million.

Debt to Equity: SYMC has a debt/equity ratio of .69. Their balance sheet shows about $2 billion in cash and liquid assets versus about $3.4 billion in long-term debt, which is a pretty good indication that the company should have no problem servicing the debt they carry.

Dividend: SYMC pays an annual dividend of $.30 per share, which translates to a yield of about 1.6% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for SYMC is $8.98 and translates to a Price/Book ratio of 2.09 at the stock’s current price. This is an intriguing aspect of SYMC’s story, since the stock’s decline throughout 2018, and the last month has put the stock more 53% below its historical Price/Book ratio. That puts a long-term target price for the stock in the $29 range, which is a level the stock hasn’t seen since November of 2017.

Technical Profile

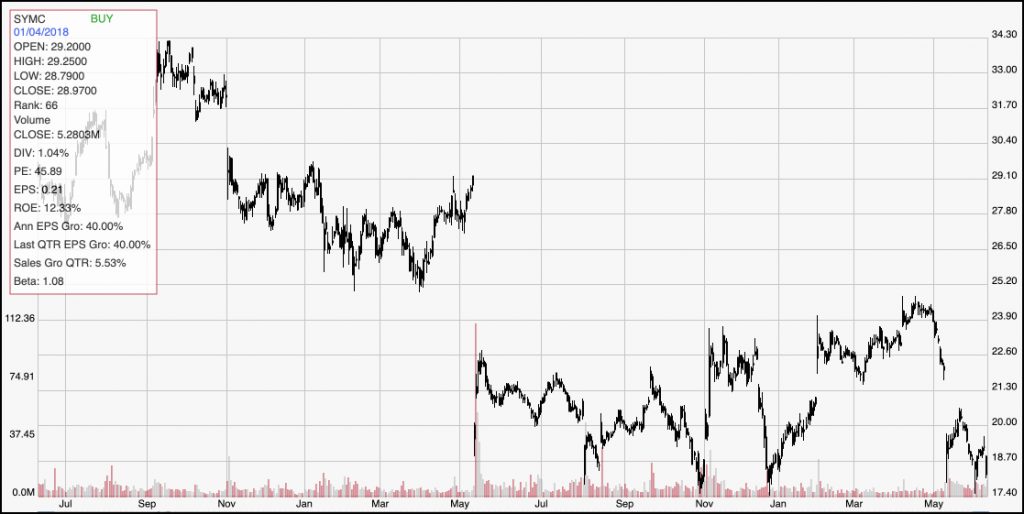

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The stock’s decline throughout 2017 and 2018 is clear, and is punctuated by the gap in mid-May 2018 that marks the company’s disclosure of its internal investigation, along with the most recent slide back to those lows in the $18 range. That decline, however, could also equate to useful opportunity for bullish investors under the right circumstances. A break above $20 could signal a short-term trend reversal, with room to run to about $24 where the stock topped out in April. To stage a legitimate, sustainable upward trend, the stock would need to break the $24, but could give the stock good momentum to drive to around $28, and possibly to even start to test the upper ranges of its value proposition around $20.

Near-term Keys: If the stock pushes above $20, and can hold that level for the next couple of days, there is probably a pretty good bullish opportunity for a short-term momentum trade using call options with an eye on $24 as a near-term target price. a drop below $18 could open up an opportunity to short the stock or to work with put options, with the stock next most likely points of support somewhere between $15 and $16 based on pivot lows seen back in 2013 and 2016. What about the value proposition? The stock has some interesting fundamental strengths that could put a patient investor in good position for a long-term gain. If you don’t mind dealing with near-term volatility on both the upside and the downside, this could be an interesting stock to work with.