Shares of the 168-year-old financial services giant Western Union Company (WU) fell to more than two-week lows during Tuesday’s session after a U.S. tech giant made a huge crypto reveal. Investors felt threatened by the news, sinking WU stock to its worst close since June 3.

Western Union’s primary bread and butter is money transfers and other types of payments, which puts the firm in a particularly disadvantaged position when it comes to the crypto market. Many cryptocurrencies are considered disruptors of traditional financial transactions, forcing several powerful CEOs – like Warren Buffett and, initially, JPMorgan Chase & Co.’s (JPM) Jamie Dimon – to call them fraudulent. Investors are growing more and more concerned about whether or not old-money companies – like Western Union – can learn new-money tricks in order to stay relevant in the constantly changing financial landscape.

Here’s a detailed look at the crypto news that sank WU stock – and what it means for the financial sector moving forward…

The News

In a highly anticipated announcement, Facebook Inc. (FB) revealed on Tuesday the details of its brand-new cryptocurrency called Libra. Using the same blockchain technology fueling Bitcoin and other popular cryptos, Libra is expected to launch next year and will let users send money with nearly 0% fees. In addition to the crypto itself, Facebook will create a subsidiary company called Calibra that will serve as a digital wallet and ensure Libra payments don’t mix with personal Facebook account data. This will prevent the social media platform from using info for targeted ads as well as keep the platform from tethering those transactions to Facebook profiles.

CEO Mark Zuckerberg noted how Libra is an essential component of Facebook’s overall mission to focus more on privacy following years of data scandals. He wrote in a public Facebook post that “privacy and safety will be built into every step,” including allowing people to use third-party wallets other than Calibra and providing refunds if users happen to lose their Libra coins to fraudsters.

How Investors Reacted

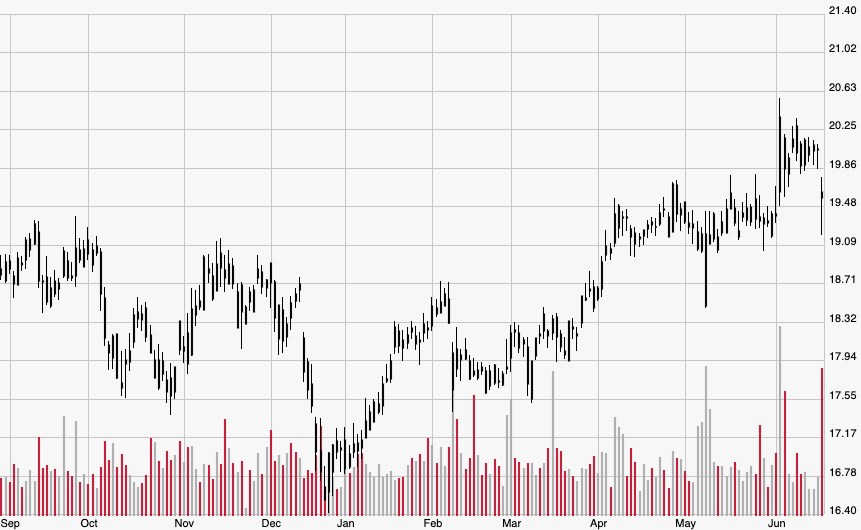

Investors reacted negatively to the news and dragged Western Union shares 2.3% lower during Tuesday trading hours from $20.06 to $19.59 for the worst settlement since June 3. The stock bucked the broader S&P 500 and Dow Jones Industrial Average, which rallied 1% and 1.3% on the day thanks to news of dovish central bank actions and President Trump tweeting that trade talks with China will occur at the upcoming G20 summit. Despite Tuesday’s loss, WU stock is still up a solid 14.8% year-to-date from the Dec. 31 close of $17.06.

The Bigger Picture

Though investors have long known about Facebook’s looming announcement, most didn’t realize just how much of a legitimizing effect it could have on the overall crypto market. The bulk of this effect stems from the number of high-profile companies partnering with Facebook on Libra, including Uber Technologies Inc. (UBER), Visa Inc. (V), and venture capital titan Andreessen Horowitz. Each has invested at least $10 million for a stake of the Libra project, with Facebook only receiving a single vote on matters relating to the crypto or Calibra. This orchestrated corporate embrace of Libra could ultimately lead more companies away from traditional money-transfer firms like Western Union and toward crypto businesses.

But Libra could not only continue to poach Western Union’s corporate customers but also its regular customers. One of Libra’s biggest applications will be cross-border payments, which allow people to send money to different countries by transferring funds between regional currencies and Libra itself. This cuts out banks like Western Union that are traditionally paid to accommodate exchange rates and make these transactions possible. According to Western Union’s most recent earnings, those “consumer-to-consumer” transactions constitute 80% of the firm’s revenue.

It’s also important to understand that traditional money transfers are surprisingly expensive. While Libra boasts a near-zero rate, data from TechCrunch shows the average percentage fee to send money internationally is 7%. That means for every $1,000 investors send abroad, they have to pay an additional $70.

Looking Ahead

With Bitcoin’s triple-digit return this year far outperforming stocks, bonds, gold, and oil, crypto is starting to be taken seriously again. Facebook’s announcement couldn’t have come at a better time, and traditional financial services firms like Western Union will likely continue to feel the pinch as mainstream crypto adoption continues.

All things considered, investors should avoid WU stock for the time being. It still trades at elevated levels even after Tuesday’s loss, and all the aforementioned factors point to downside in the near term at least.