It seems inevitable right now that no matter what other element may be at play in the market, the conversation right now inevitably turns back to trade and tariffs. The big news in the market yesterday initially was the latest Fed meeting, and its decision to keep interest rates steady for the time being. The element that moved the market late in the trading sessions was the removal of the term “patient” from the Fed’s statement in describing its posture moving forward towards considering future adjustments in its interest rate policy. That simple act gave analysts and investors alike ammunition to start betting on an increasing chance the Fed will cut rates at least once before the end of 2019.

That should have been the big story for the day – but it was interesting in reading the commentary of various analysts to see the Fed’s meeting framed against the larger backdrop of trade. It almost seems that the market is coming around to the realization that trade tensions between the U.S. and China are likely to continue for the foreseeable future, and that an actual resolution could still be a long ways off. If that is true, then the Fed’s apparent willingness to make its monetary policy more accommodative would appear to be the most straightforward way for the central bank to counteract the negative effect of ongoing tariffs.

Just a couple of weeks ago, the Trump administration and Mexico announced agreement on their own respective trade deal, staving off threats by the President to impose increasing tariffs on a variety of Mexican goods. That news plays in favor of stocks in a variety of industries with ties, as importers or suppliers, to Mexico. One of those is Pilgrims Pride Corporation (PPC), a Food company with a significant portion of its business in Mexico. Another, perhaps unexpected bullish element for this producer and distributor of chicken products is an April report from the USDA that the spread of African Swine Flu in China is more widespread than many feared and could force that country to lift its ban on U.S. poultry imports to make up the difference and meet Chinese consumer demand for protein products.

All of that sounds positive – and it could well turn to be. PPC has rallied strongly year to date, increasing in value almost 67% from a late December low at around $15 to its current price a little above $25. It also appears to be setting up an interesting bullish, short-term technical pattern against the backdrop of that bullish rise, since it has actually dropped from a mid-May high at close to $30 per share. If it can find support soon, it could pivot back and provide a new near-term opportunity that might work well. The value proposition is a bit mixed, however, and there are a few holes in the stock’s fundamental profile that leave me a little cautious.

Fundamental and Value Profile

Pilgrim’s Pride Corporation is a retail feed store. It is a producer and seller of chicken with operations in the United States, Mexico and Puerto Rico. It is engaged in the production, processing, marketing and distribution of fresh, frozen and value-added chicken products to retailers, distributors and foodservice operators. It offers a range of products to its customers through national and international distribution channels. Its fresh chicken products consist of refrigerated (non-frozen) whole chickens, whole cut-up chickens and selected chicken parts that are either marinated or non-marinated. Its prepared chicken products include ready-to-cook and individually frozen chicken parts, strips, nuggets and patties, some of which are either breaded or non-breaded and either marinated or non-marinated. As of December 25, 2016, the Company marketed its portfolio of fresh, prepared and value-added chicken products across the United States, Mexico and in approximately 80 other countries. PPC’s current market cap is $6.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by almost -34% while revenues were mostly flat, but negative at -.8%. Over the last quarter, the picture is decidedly more positive, since earnings increased by about 288% (not a typo) while sales growth was a modest, but useful 2.56%. The company operates with a very narrow margin profile, which isn’t unusual in the Foods industry. Net Income over the last year was just 1.94% of Revenues, but improved in the last quarter to about 3.08%. A troubling detail is that on a trailing twelve month basis, Net Income was more than $700 million at the end of the first quarter of 2018, but decreased in the most recent quarter to just $212 million.

Free Cash Flow: PPC’s free cash flow is modest, at about $261 million over the last twelve months. That translates to a Free Cash Flow Yield of 4.13%.

Debt to Equity: PPC has a debt/equity ratio of 1.19, which is higher than I normally prefer to see, but is also not unusual for food stocks. The company’s balance sheet demonstrates their operating profits are adequate to service their debt, however liquidity is a concern looking ahead. PPC’s balance sheet shows about $399 million in cash and liquid assets versus a little more than $2.55 billion in long-term debt.

Dividend: PPC does not pay an annual dividend.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for PPC is $8.60 per share and translates to a Price/Book ratio of 2.93 at the stock’s current price. Their historical average Price/Book ratio is 4.06, which suggests the stock is trading right now at a discount of nearly 38%, and that puts the stock’s long-term target at almost $35 per share. That is just a couple of dollars per share away from the stock’s multi-year high, reached in November of 2017 before the stock began a downward trend that wasn’t reversed until the beginning of this year.

Technical Profile

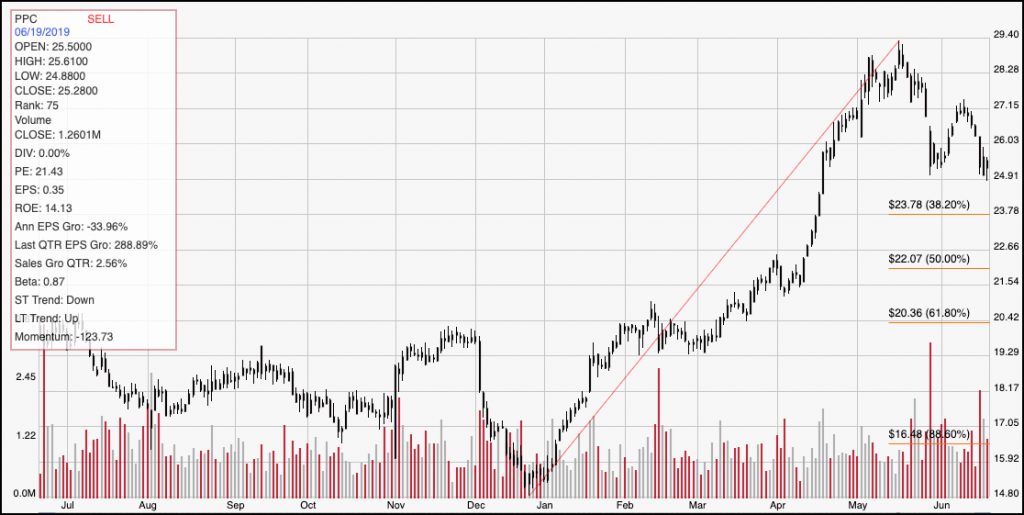

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s upward trend from December 2018 to its peak in mid-May of this year; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. The stock has dropped a bit from its high at almost $30 per share, but looks like it could be near to pivot support in the $25 price range. It is also just a little above its 38.2% Fibonacci retracement line, which is another generally positive technical sign for the stock’s near-term price stability. If it can pivot and move higher from support between $24 and $25, there could be room for the stock to move in the near term to retest its high a little above $29. If it drops below the $23.75 mark shown by the 38.2% retracement line, however, the stock could quickly drop to any between $21.50 and $20 per share, which is where the 61.8% retracement line is currently sitting.

Near-term Keys: The stock’s fundamentals are just weak enough to make me a little skeptical of its long-term value proposition. I would prefer to see improvement in Free Cash Flow, Net Income, and a further reduction in long-term debt before I would be willing to concede a fundamental basis for the stock’s long-term upside. That said, if the stock does pivot and move higher, a push above $27 could provide an interesting short-term opportunity to buy the stock or work with call options. If the stock’s expected support in the $24 area doesn’t hold, and it actually drops below the 38.2% retracement line, it should be taken as a strong signal to short the stock or consider working with put options, with downside room all the way to between $20 and $21 per share.