Shares of Carnival Corp. (CCL) nosedived during Thursday’s session following the release of its second-quarter earnings report. While the world’s largest cruise company by total passengers beat analysts’ top- and bottom-line expectations, investors went into panic mode when the firm drastically cut its full-year earnings per share (EPS) forecast on the heels of a devastating announcement from the Trump administration.

The cruise industry is unique in that it depends on both consumer sentiment and international relations. Despite the fact that cruise revenue in 2018 grew 4.6% year-over-year, these businesses can sink if relations between two countries – and the major cruise ports within their borders – begin to sour. That’s why Thursday’s news has investors rattled over whether or not the cruise industry’s most influential company can rely on strong consumer demand to balance out the negative geopolitical sentiment.

Here’s a closer look at CCL’s decline – and what the company’s future holds in 2019…

The News

Early Thursday morning, Carnival released its earnings for the second quarter ended May 31, and they widely surpassed Wall Street estimates. The firm earned $0.66 per share for the period, besting the expected $0.61 by 8.2% but declining 2.9% from $0.68 a year ago. That marks the company’s fourth consecutive quarter of surpassing EPS estimates. As for revenue, Carnival raked in $4.84 billion, which surprised analyst expectations by 6.75% and grew 11% from the $4.36 billion earned during the year-ago period.

But the bad news centered on the newly pessimistic full-year 2019 earnings forecast. The company lowered its EPS forecast from the $4.35-$4.55 range to $4.25-$4.35 due to new federal restrictions on cruise travel to Cuba. On June 4, the Trump administration said it would end an educational travel program to Cuba as well as travel of “passenger and recreational vessels” due to the nation’s support of Venezuela. Carnival also cited lower net revenue yields – which include bookings and on-board spending – in the second half of the year as a primary reason for the revised forecast.

The company also made the unusual move of moving up its earnings release to quickly disclose voyage disruptions related to its Carnival Vista cruise liner, which is suffering from propulsion problems that have lowered the ship’s overall speeds. In his earnings call, CEO Arnold Donald made somber comments regarding the collection of issues that sank the firm’s EPS guidance, saying, “We are disappointed at the revised guidance, very disappointed with the situation with Vista [ship], our teams are working hard to mitigate all that.”

How Investors Reacted

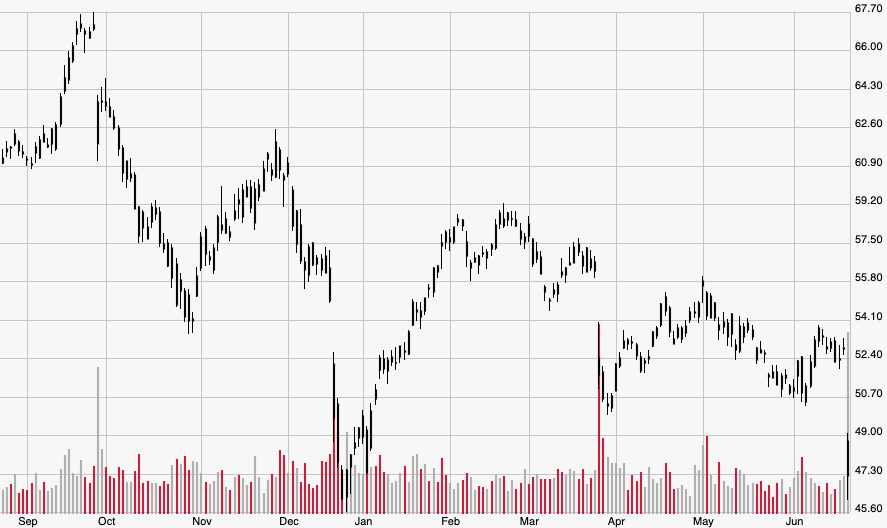

Market participants largely overlooked the earnings beat and focused on the dismal new forecast. They dragged shares of CCL 7.6% lower on the day from $52.84 to $48.81, the worst close since Jan. 3 when the stock settled at $47.37. With Thursday’s loss, Carnival is now in the red for the year, down 1% from the Dec. 31 close of $49.30.

The news also tanked other cruise stocks, as many investors expect Carnival’s peers to react similarly to the Cuba travel ban in their upcoming reports. Shares of Norwegian Cruise Line Holdings Ltd. (NCLH) and Royal Caribbean Cruises Ltd. (RCL) – the world’s largest cruise liner by revenue, with its $6.53 billion in 2018 crushing Carnival’s $4.17 billion – fell 2.7% and 3.2%, respectively.

The Bigger Picture

While it was somewhat baked into stock prices, it took Carnival’s premature earnings release for investors to realize the Cuba ban has put the company in crisis mode. Since the ban is relatively new, this may just be the start of the suffering as major cruise companies continue to realize just how crucial Cuba is to their businesses.

Industry watchdog Cruise Line International Association (CLIA) recently released data regarding the country’s significance to cruise profits, and the numbers speak for themselves. After the ban was announced, the CLIA said a lack of cruise service to Cuba would affect about 800,000 total passenger bookings. For context, that’s roughly 14% of Carnival’s 5.72 million total passengers last year. The company’s revenue would ostensibly be cut by a similar percentage if 800,000 cruise tickets were to be canceled in the near term.

However, Carnival still has time to cover that potential loss and keep the earnings growth alive. Even though investors seemed to forget during Thursday’s session, earnings have crushed estimates four quarters in a row and revenue still climbed year-over-year in the second quarter, with a large bulk of that coming from U.S. cruise departures. The CLIA has also noted it expects about 30 million people to board cruises this year, marking a 6% increase from last year.

Looking Ahead

As the world’s biggest cruise operator, Carnival is still in the prime position to suffer the least from the Cuba cruise ban. While it may hurt the sector overall, Carnival has proven resilient in times of geopolitical turmoil, and its resiliency should hold for the rest of the year.

That being said, investors should take a wait-and-see approach. If CCL stock continues below the 12-month bottom of $47.86, consider taking a small position. The CLIA’s growth forecast indicates the industry is in a long-term boom, which means Carnival will be the first to reap the benefits.