Stocks with this feature have outperformed the rest of the market after the Fed cuts rates, and these 7 stocks fit the bill.

Stocks, bonds, and gold have rallied since the Fed struck a more dovish tone at their June meeting.

With the July meeting right around the corner, the market is pricing-in a 100% chance of a quarter-point rate cut, which could send stocks soaring even higher.

But according to Goldman Sachs, stocks with this one feature are likely to crush the rest of the market after a rate cut.

Low volatility stocks, with their muted price swings, like utilities and high-dividend stocks, historically have outperformed in the 12 months following the beginning of a Fed rate cut cycle.

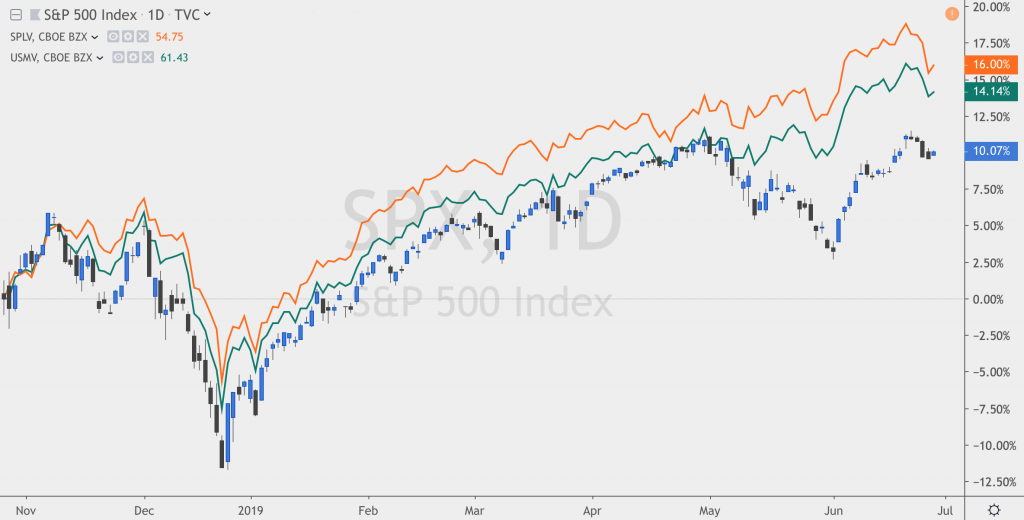

“Low volatility stocks have outperformed significantly since the start of May as economic uncertainty and the odds of a Fed rate cut rose,” Goldman Sachs chief U.S. equity strategist David Kostin wrote in a note.

“In addition to monetary policy, intensifying trade rhetoric, slowing economic growth, and rising geopolitical tensions have dominated investor attention in recent weeks,” Kostin continued.

Low volatility stocks also happen to be those stocks that are thought of as defensive plays, and investors have been flocking to the group as the trade war has intensified and signs of an economic slowdown have come into sharper focus.

So far this year, the two biggest low-volatility ETFs—the iShares Edge MSCI Min Vol ETF and the Invesco S&P 500 Low Volatility ETF—have added $8 billion in inflows, roughly a quarter of total inflows to all U.S. equity ETFs, according to the firm.

Goldman also screened for low volatility stocks, and their low-vol basket—which includes names like Berkshire Hathaway (NYSE: BRK.A, BRK.B), Caterpillar (NYSE: CAT), Chevron (NYSE: CVX), eBay (NASDAQ: EBAY), Honeywell (NYSE: HON), Kimberly-Clark (NYSE: KMB), and Coca-Cola (NYSE: KO)—has returned 7% since the beginning of May, while the S&P 500 has remained flat in the same period.

The big winners of the group so far this year have been Chevron, which is up 14%, Kimberly-Clark, which is up 17%, Honeywell, up 31%, and eBay, up 40%.

Goldman is projecting two rate cuts this year, and is anticipating an early end to the balance sheet rolloff, which could send low volatility stocks climbing higher.