This stock could see big upside over the next year. Here’s why.

Stocks have been rallying since the Fed’s dovish turn earlier this month, with the S&P 500 now sitting just shy of the record high reached last week.

Many investors have been sitting on the sidelines in this rally but for those who are looking to play catch-up, one expert says this big name stock is the right pick.

“One name that stands out—household name, it’s in this high-beta index—is Netflix (NASDAQ: NFLX),” said Ari Wald, Oppenheimer’s head of technical analysis. “The stock is pretty much unchanged over the last year, but we’re siding with what is still a long-term uptrend that is pointed higher.”

Netflix is the second-best performer among the FANG stocks—Facebook (NASDAQ: FB), Amazon (NASDAQ: AMZN), Netflix, and Google-parent Alphabet (NASDAQ: GOOGL, GOOG)—this year and is up 38% year-to-date.

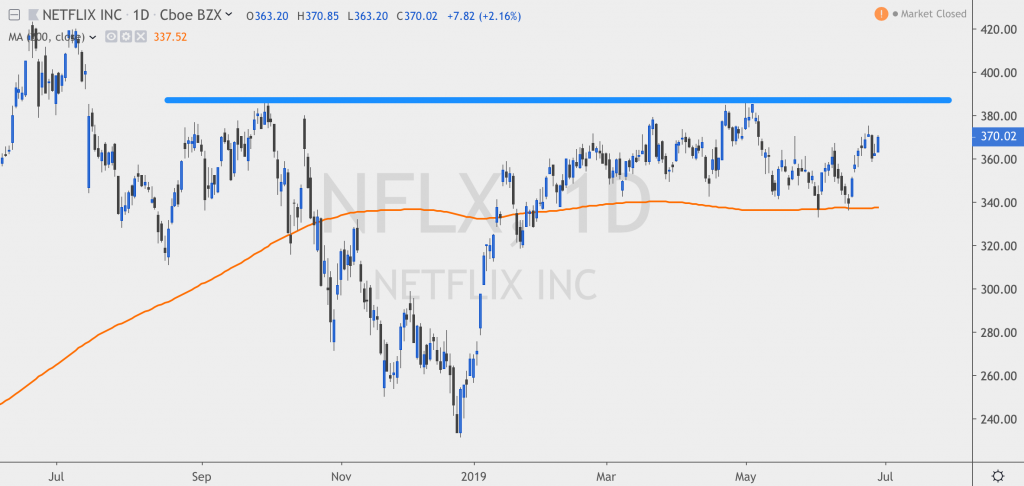

But after its rally at the start of the year, the stock has been stuck in a tight trading range. However, while shares have largely held flat for the past few months, Wald says Netflix is now positioned for a breakout.

“The key support level is $337. That’s the 200-day moving average,” Wald said. “From a trading basis, put your stop there, but I think you get the breakout through $385. That’s the level that has held back the stock through this year-long range. I think you get the breakout and that marks the resumption of Netflix’s long-time uptrend.”

In order to reach its 200-day moving, Netflix shares would need to fall around 9% and the breakthrough level of $385 would represent upside of 4% from Thursday’s closing price and 14% from the $337 level.

Wald isn’t the only Netflix bull on Wall Street. Just last week, Piper Jaffray analyst Michael Olson reiterated the firm’s Overweight rating on the stock and set a price target of $440, suggesting possible upside of 19% over the next twelve months.

Olson believes Netflix’s total addressable market may be considerably larger than some estimates given its potential to penetrate mobile-only households.

“When looking at current Netflix adoption as a percentage of internet or pay-TV households, we see international significantly lagging domestic, suggesting potential for dramatic international growth in the coming years,” Olson wrote in a note.

Olson estimates that Netflix currently has a presence in 18% of international broadband households, excluding China, and just 8% of international households with mobile-only users.

“Looking to CY21, investor anticipation around potential for >20% penetration of Netflix across global (ex-China) internet households could lead to a ~50% move in Netflix in the next 12 to 18 months,” Olson wrote.