The first half of 2019 is now officially in the books, and oil prices just kicked off Q3 with a bang. The price of West Texas Intermediate (WTI) — which is the price benchmark for all oil produced in and exported out of the U.S. — nabbed its best close in over a month on Monday thanks to some great supply-side news out of Vienna, where the Organization of the Petroleum Exporting Countries (OPEC) is holding its highly anticipated summit this week.

Oil is experiencing a strong resurgence right now, with the commodity having just posted one of its best monthly gains of the year. OPEC meetings always move the needle on energy markets, but the biggest result of Monday’s session could result not just in short-term price gains but a more prolonged and exciting rally in the months ahead.

Here’s the big news that just pushed prices to new highs — and how this week’s meeting could pave the way for massive gains in the second half of the year…

The News

The cartel of 14 nations — the largest by oil production being Saudi Arabia, Iraq, Iran, and the UAE — agreed to extend production cuts for an extra nine months through March 2020. The agreement also encompasses major non-OPEC producers like Kazakhstan and Russia, the latter of which is particularly poised to benefit from the cuts as Russian energy firms struggled to boost output over the winter. The deal currently calls for daily output cuts of 1.2 million barrels, even though several countries have lowered daily production by even larger amounts as Iran and Venezuela remain in the crosshairs of U.S. sanctions. Saudi Arabia, for example, churned out only 9.73 million barrels per day last month, which is more than 5% below the agreed-upon ceiling of 10.3 million barrels.

OPEC’s decision to keep production capped comes amid several watchdogs — including the International Energy Agency (IEA) — forecasting lower demand in energy-consuming powerhouses like China and India. Andrew Dodson, founder of hedge fund Philipp Oil, noted how the global market is getting excited about the cut extension, but OPEC appears more and more worried about demand.”

How Investors Reacted

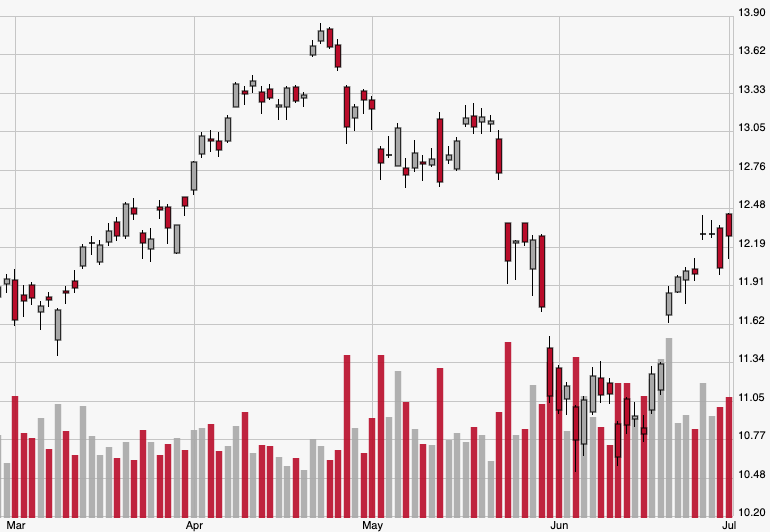

Investors pushed front-end oil futures up 1.1% to $59.09, the highest settlement since May 28 when they ended the day at $59.14. However, that was far below the intraday high of $60.28, indicating market participants were skittishly adjusting their positions while the meeting unfolded. The United States Oil Fund LP (USO) — an exchange-traded fund designed to track WTI’s movement — gained 2% on the day to $12.28.

The Bigger Picture

Oil has been one of the best-performing commodities lately, and Monday’s news was a surefire indicator that the good times may keep rolling for energy traders and investors. WTI rose 9.3% in June, beating out other safe-haven commodities that themselves saw exceptional rallies due to trade tensions and interest-rate anxiety. Gold and silver, for instance, only rose 7.8% and 5.3% last month, respectively.

However, oil prices were poised for a June rebound following a brutal drop the month before along with the rest of the market. WTI’s 16.2% decline in May decimated the benchmark’s chance for a quarterly gain, leaving it with a loss of 2.8% in Q2. Longer-term prices have fared far better though, and OPEC’s continued production cuts combined with WTI’s more than 30% overall gain in 2019 are more than enough to keep investors confident.

But Monday’s gain is also worth examining on its own, as history shows WTI prices tend to make interesting moves around OPEC meetings. Data compiled by Dow Jones & Co. shows that the average change for WTI on the day of all OPEC between 2002 and June 2016 is -0.08%. The data measured the price action on the day of the meetings, and if a meeting happened to occur on a weekend or holiday, the data accounted for the day of trading after that meeting.

It’s important to note that the average decline in oil prices for all OPEC meetings during that 14-year period was larger than the average gain. Of the meetings where prices fell, they saw an average drop of 2.5%. As for all meetings where prices increased, they averaged a 1.9% jump. The biggest data outlier was Nov. 28, 2014, the day after Saudi Arabia and OPEC decimated global oil prices by refusing to cut output at a time when prices had already been crashing since the summer. On that specific date, prices plunged by more than 10% to $66.15 a barrel.

Looking Ahead

Both domestic and international oil markets are in a good place right now thanks largely to international factors more than domestic ones. Sanctions on Iran and Venezuela’s oil industries as well as OPEC’s continued adherence to output cuts through next March indicate oil prices should keep rising despite the usual week-to-week data-induced volatility that investors have come to expect. In terms of the best ways to play the bullish momentum, everyday investors should consider oil stocks instead of oil futures since futures are a highly speculative market.