Over the last week, one of the fears that has been driving the market (besides the new constant, which is trade) is the concern over whether the economy is finally at risk to start weakening. For some investors, that fear has led to a “flight to quality,” meaning that they’re starting to look for safe havens to put their money in to avoid increased market risk.

The term “flight to quality” can be interpreted in a lot of different ways. The traditional definition you’ll see most experts and financial planners use is to start using capital-preserving, interest-bearing vehicles like Treasury bonds, certificates of deposit or even bank savings accounts. These will pay a minimal amount of interest that will usually not keep pace with inflation in the long run, but for the time being offer the peace of mind of knowing that you won’t be at risk to lose money due to market-driven price fluctuations.

Another way to look at flight to quality is usually used by investors who are willing to tolerate short-term market fluctuations in exchange for fundamentally strong, dividend-paying stocks that can offer some kind of potential of attractive long-term growth. This is an approach that I’m in favor of in uncertain market conditions, because I think it blends naturally with the kind of value-oriented approach I like to use in any market. I also like looking for ways to mitigate some of the market risk in this strategy by seeking out stocks in sectors that generally perform well in any kind of economic environment. These are sectors where revenue streams are consistent because consumers need the products or services the sector offers on a continuous, constant basis.

One of the sectors that I think fits this description, but may not necessarily be “defensive” is the healthcare sector. Healthcare stocks, including pharmaceutical companies, are businesses that provide services the public always needs, which is why revenues for these kinds of businesses usually hold up well in any economic environment. Pharmaceutical stocks, in particular are also not strictly defensive in nature, for a number of reasons.

Most pharma stocks may generate billions of dollars in revenue every year, but for nearly all except the largest of these companies, those revenues usually come from from just a few products. One or two successful drugs can generate enormous profits for a company, and sustain their business for years at a time. Their product offerings are usually limited, however in part because of the highly regulated nature of the industry. Getting a drug from development to the consumer takes years of research, testing, with multiple clinical trials at multiple stages along the way. That means that getting a single drug to market is an incredibly time-consuming, capital-intensive undertaking. That reality is perhaps the biggest reason that a lot of investors think of pharmaceutical stocks as risky investments, and why the prices of many pharmaceutical stocks experience high levels of volatility as they swing from extreme high to extreme low in relatively short periods of time.

What is the best way to minimize the risk that a single drug won’t work out as planned, and so mitigate the price risk a pharmaceutical stock may carry for investors? Diversification – but that is much easier said than done. That’s why really only the largest companies in the industry really have the scale to have a truly diversified portfolio – but it also puts a big premium on continuous innovation. Patent laws and rights don’t extend into perpetuity, which means that while a single, successful drug may give a company an edge on its competitors, that will usually only last so long. For pharma giant Pfizer Inc. (PFE), a recent example is Celebrex, a nonsteroidal anti-inflammatory drug that treats arthritis, menstrual and other sorts of pain. When first introduced, it dominated the market, with sales in 2013 that were nearly $3 billion for that single drug alone. Once the patent on the drug expired in 2014, however other companies, including generic drug developers were able to start competing on equal ground, which meant that sales on the drug started dropping, to under $700 million in the last year. PFE understands this reality, however, which why they do a good job of maintaining a consistent portfolio of currently available drugs that each represent no more than 11% of the company’s total revenues per year. They also work hard to keep a continuous pipeline in place of new drugs coming to market to replace the old ones that are becoming obsolete either for competitive or developmental reasons.

All of that makes PFE and interesting company to pay attention to; but the real question is whether this is a stock that you should consider using for an investment right now? The stock’s movement since April should encourage growth-oriented investors; it bucked the broad market drawdown in May and has rallied nearly 16% over that two-and-a-half month period. Does that mean that the opportunity to use the stock as a value-based, long-term opportunity has passed? Let’s find out.

Fundamental and Value Profile

Pfizer Inc. (Pfizer) is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development and manufacture of healthcare products. Its global portfolio includes medicines and vaccines, as well as consumer healthcare products. The Company manages its commercial operations through two business segments: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). IH focuses on developing and commercializing medicines and vaccines, as well as products for consumer healthcare. IH therapeutic areas include internal medicine, vaccines, oncology, inflammation and immunology, rare diseases and consumer healthcare. EH includes legacy brands, branded generics, generic sterile injectable products, biosimilars and infusion systems. EH also includes a research and development (R&D) organization, as well as its contract manufacturing business. Its brands include Prevnar 13, Xeljanz, Eliquis, Lipitor, Celebrex, Pristiq and Viagra. PFE has a current market cap of $246.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 10.39%, while revenues were mostly flat, but positive by 1.64%. In the last quarter, earnings grew nearly 33% while sales dropped about -6.14%. The company’s margin profile is very healthy, and appears to be strengthening, with Net Income as a percentage of Revenues over the last twelve months at 21.3% and 29.6% in the last quarter.

Free Cash Flow: PFE’s free cash flow is healthy and at $13.4 billion over the last twelve months. That translates to a Free Cash Flow Yield of 5.46%.

Debt to Equity: PFE’s debt to equity is .60, which is generally considered a conservative number. The company’s balance sheet indicates operating profits should be adequate to service their debt, but it also indicates the company’s liquidity is decreasing – cash and liquid assets were about $11.6 billion in the last quarter versus almost $19 billion at the beginning of this year – while debt is increasing. Long-term debt was $35.7 billion in the last quarter versus $29 billion in June of 2018.

Dividend: PFE’s annual divided is $1.44 per share, which translates to a yield of about 3.24% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for PFE is $10.65. That means that the stock’s Price/Book ratio is 4.16. Their historical Price/Book ratio is 3.14, which suggests that the stock is overvalued by nearly -25% right now. By contrast, however the stock is actually undervalued, trading almost 29% below its historical Price/Cash Flow ratio.

Technical Profile

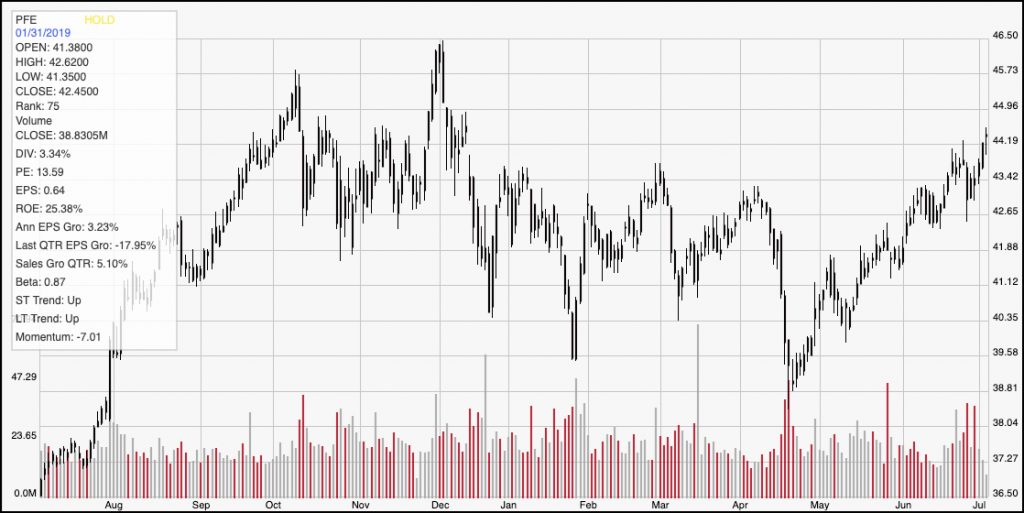

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The stock’s upward trend from mid-April to now is pretty easy to see, market by a steady pattern of higher highs and higher lows throughout, with the stock currently pushing above its most recent pivot resistance at around $44 per share. The next most likely resistance point is around $46.50, at the stock’s 52-week high last seen in late November 2018. The stock’s all-time high is around $48 per share. $44 should now act as support, but if it doesn’t hold, the next support point isn’t far away, at around $43 per share.

Near-term Keys: If you work off of the basis of the stock’s valuation metrics, it’s hard to say that the stock offers a compelling value argument right now. It is possible, of course, that PFE could push above its all-time high at around $48, but given the manner in which the market has priced this stock on a historical basis, it’s hard to predict that will be the case. The limited long-term upside means that I don’t think you can categorize PFE as either a growth or a value stock. Its best fit would likely be as a tool for short-term, momentum-based trades, with the stock’s current trend and latest resistance break offering an interesting signal for a bullish trade, either by buying the stock or working with call options. The near-term target is around $46.50, but if you’re willing to work with a somewhat longer time view (a few months rather than a few weeks), $48 isn’t out of the question.