Biotechs are headed for a big rally, and analysts say these 3 stocks in the sector could see double-digit upside ahead.

Stocks have been rallying this week after news broke of the trade truce between the U.S. and China from this past weekend.

But one sector has been left out of the rally: healthcare.

In fact, the XLV Healthcare Sector ETF—which tracks the sector—is up just 9% so far this year, making it the worst performing sector in the S&P 500.

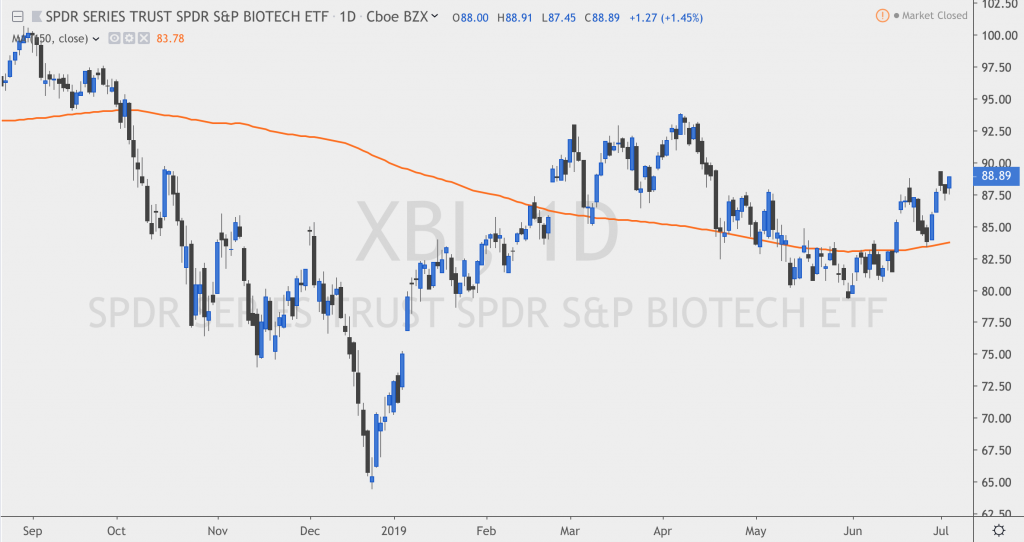

However, biotechs are one bright spot in the space. The XBI S&P Biotech ETF is up just under 24% so far in 2019, and one expert says the breakout in biotechs looks likely to keep going.

“Biotech has a bit of life of late, and that is appealing to a general momentum player, which is what technicals are all about, in the end,” Carter Worth of Cornerstone Macro said to CNBC.

“The 150-day moving average is actually inflecting upward for the first time in about two-plus years,” Worth said. “That’s an appealing setup to my eye, and I think it’s a good place to be long in an otherwise languishing area of the market.”

But the 150-day moving average isn’t the only interesting thing about XBI’s chart. There’s another technical indicator that signals that this breakout has legs.

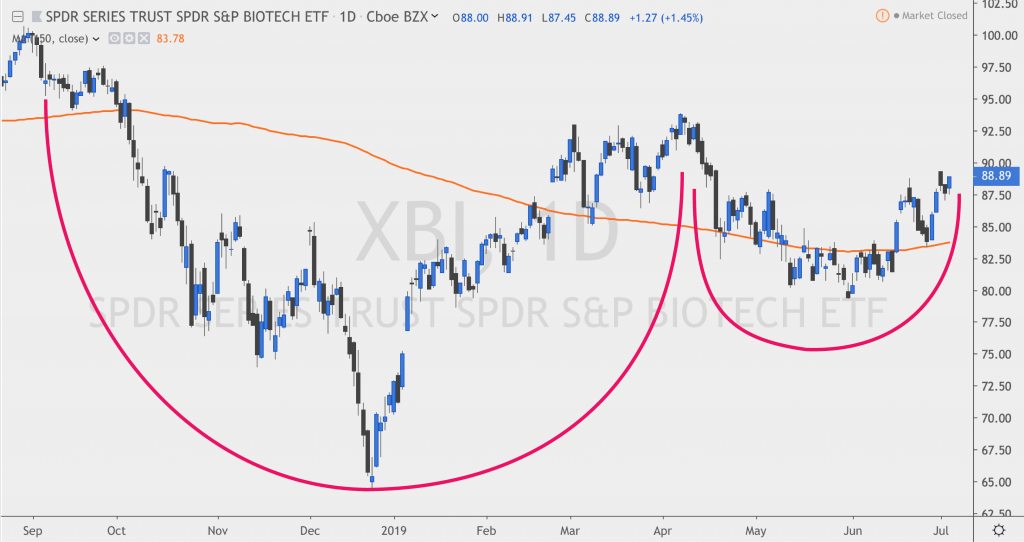

“Within this period, this head-and-shoulders bottom, we had this well-defined neck line,” Worth said, pointing to the end of 2018. And now that head-and-shoulders bottom has turned into another pattern that indicates an even bigger rally ahead.

“Ultimately, the thinking is, that this big cup-and-handle is resolved up and out. I like this,” Worth said.

Among the XBI ETF’s top holdings are familiar names in the biotech space including Array BioPharma (NASDAQ: ARRY), Alexion Pharmaceuticals (NASDAQ: ALXN), Mirati Therapeutics (NASDAQ: MRTX), and Incyte Corp (NASDAQ: INCY).

But of the top ten holdings in the ETF, analysts are most bullish on Sarepta Therapeutics (NASDAQ: SRPT), Immunomedics (NASDAQ: IMMU), and Fibrogen (NASDAQ: FGEN).

Analysts rate all three stocks Buys and their price targets suggest 37.44% upside ahead for Sarepta, 95.58% upside for Immunomedics, and 41.3% upside ahead for Fibrogen over the next twelve months.