The charts for these 4 stocks point to more upside on the horizon.

All anyone will be talking about in the retail space this coming week will be Amazon’s (NASDAQ: AMZN) Prime Day, the 36 hour mega sale on everything from electronics to home goods to clothes, and even food, beginning on Monday.

But while Amazon is the most dominant name in the retail space right now, CNBC’s Jim Cramer says there’s a new breed of niche players in the space that are worth keeping an eye on.

Big names like Costco (NASDAQ: COST), Target (NYSE: TGT), and Walmart (NYSE: WMT) have gone to bat in the battle against Amazon, but Cramer says smaller names like Etsy (NASDAQ: ETSY), LuluLemon (NASDAQ: LULU), Pinterest (NYSE: PINS), and Stitch Fix (NASDAQ: SFIX) are carving out their own spaces within the industry.

“In a retail environment dominated by a handful of players that we all know … there are smaller operators that we have found ways to like and win with,” Cramer said. “The charts … suggest that all four could have more room to run.”

Cramer discussed the charts of all four stocks as analyzed by technician Tim Collins from RealMoney.com.

First up was Etsy. The stock is up nearly 37% so far this year and jumped roughly 5% on Tuesday after launching a new free shipping program.

The chart shows that the stock has consolidated over the past four months, and according to Cramer, that could mean the stock is headed higher.

“A stock that’s spent four months consolidating… [is like] a coiled spring, which is how you get the kind of magnificent rally we had [Tuesday] on really very little news,” Cramer said, noting that the stock has been stuck in an ascending triangle formation with a support at $61 and resistance at $70.

While Collins believes it could take a few attempts to push past that $70 resistance level, the stock is headed for more upside.

“When it comes to Etsy, the stochastic just made what we call a bullish crossover… and that is a very bullish signal that we have learned time and again is a great way to try to predict moves,” Cramer said.

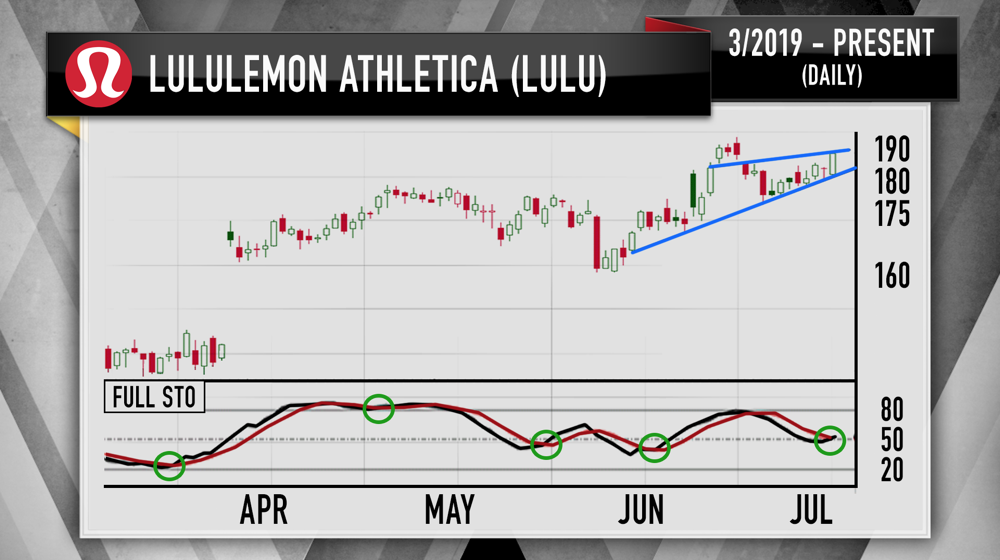

Moving on to LuluLemon, Collins’ analysis points to a major rally for the athletic wear maker.

LuluLemon posted 14% same-store sales growth in its most recent quarter, and Cramer says that Collins’ analysis showed a bullish crossover indicator, which the chartist says has historically helped the stock run higher.

The stock is currently trading at $183, as of Thursday’s close, but “Collins thinks it can pole vault over $200,” Cramer said. Such a jump would see the stock at least 9% higher on top of LULU’s 50.5% gain so far this year.

But investors beware, “if LULU pulls back below its floor of support at around $175 to $180, he thinks maybe you should throw in the towel, as this chart could quickly morph into a bearish head and shoulders pattern,” Cramer warned.

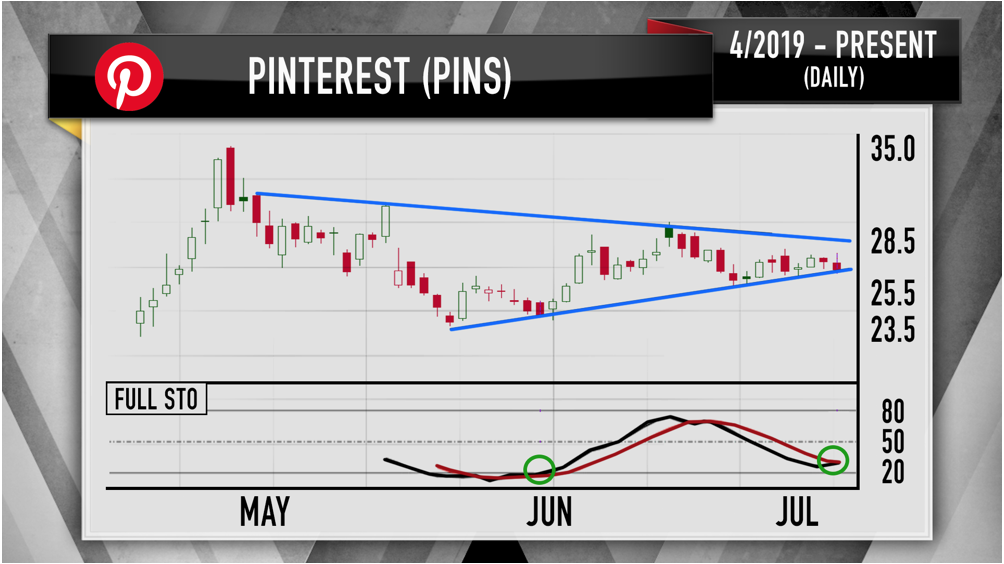

On to Pinterest. While this stock isn’t a retailer, the vision board social media platform has the potential to compete with a juggernaut like Amazon in the future.

Since it made its public debut in April, the stock has traded in tight range between $25 and $29.

“If Pinterest can climb above $28.50, Collins believes it will be smooth sailing to the $30s,” Cramer said. But if the stock falls below $25.50, “it might sink to $23.50. But get this: it bottomed in May. Collins says he’d be a buyer if that happens.”

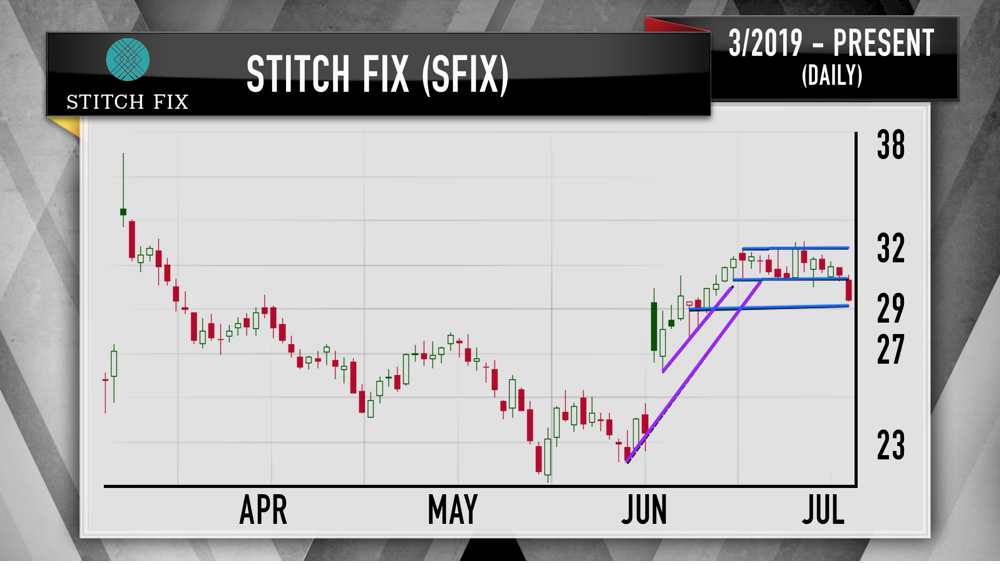

Last, but not least, Cramer discussed digital personal styling service, Stitch Fix.

Stitch Fix hasn’t been an easy stock to own in the two-and-a-half years it has been publicly traded. The stock debuted at $16.90 in November 2017 and jumped 210% to a high of $52 in less than a year before falling below the IPO price to $16.05 just four months later in December 2018. The stock has since recovered to $28 and is up nearly 65% so far this year.

In June, the company reported a strong quarter which pushed the stock up $4 to $27 in just one session. Shares continued to rally before cooling off over the last couple of weeks, producing a bullish flag pattern, according to Cramer and Collins. Such a pattern points to a move higher.

“Collins recommends buying it right here,” Cramer said, noting that Collins believes the stock has support at $29 and could jump as high as $40 if it can break through the resistance at $32.

“Bear in mind, Stitch Fix could keep bouncing around in this flag pattern for another few weeks,” Cramer said. “[Collins] suggests buying half your position now, and then putting on the other half after a breakout above $32. I get where he’s coming from.”

Of the four stocks, analysts are most bullish on Stitch Fix and Pinterest, and their average price targets for these stocks suggest possible upside of 27% and 15%, respectively.