Analysts believe these 5 stocks will lead the Dow higher over the next twelve months.

It was one record after another this week.

First the S&P 500 hit 3,000 for the first time.

Then the Nasdaq closed at a new all-time high.

And then the Dow Jones Industrial Average climbed to 27,000 for the first time ever on Thursday as the market was spurred on by the possibility of easier monetary policy from the Federal Reserve.

All those zeros helped keep the party going on Friday. At the time of this writing, the DJIA had jumped above 27,230.

But as the index moves beyond the 27,000 mark, many are wondering which stocks will lead the DJIA to 28,000 and beyond.

Looking at the stocks that have the most upside according to analysts’ price targets, it’s possible seeing the Dow at 28,000 may depend on a resolution to the ongoing trade war between the U.S. and China.

In fact, of the top five stocks that analysts expect will climb the most in the next twelve months, the upside for three of these stocks will likely hinge on a resolution to the U.S.-China trade war.

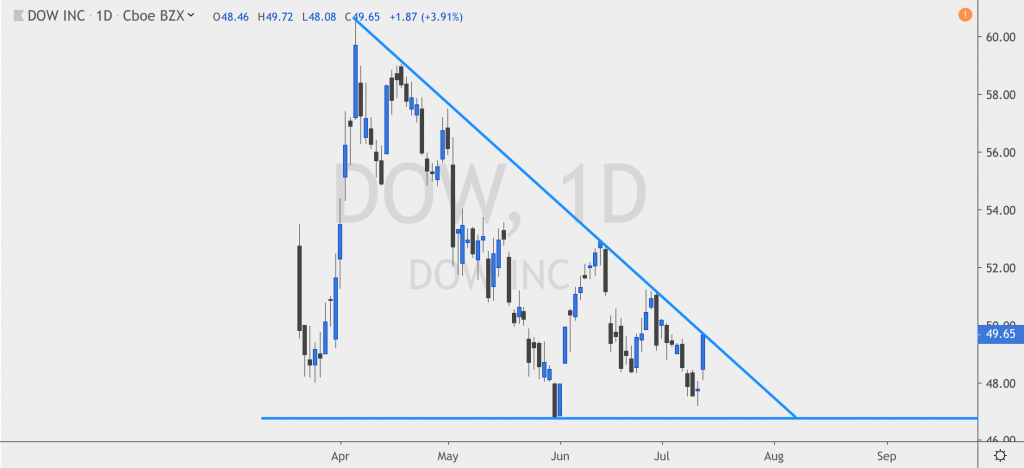

At the top of the list is chemical manufacturer Dow, Inc. (NYSE: DOW), which analysts say could see nearly 25% upside over the next twelve months.

The technical picture is interesting for this stock as well. Since Dow, Inc. was spun off from DowDuPont at the beginning of April, the stock has been stuck in a falling wedge pattern. The stock could find a bottom around $46.50 before breaking out of the wedge and heading higher.

Next on the list is Boeing (NYSE: BA), with possible upside of 20%, followed by Goldman Sachs (NYSE: GS) with over 16% upside, Merck (NYSE: MRK) with just under 16% upside, and United Technologies (NYSE: UTX) with nearly 14% upside.

In June, the U.S. and China agreed to restart trade negotiations, which increased optimism that a deal could happen in the near term.

If a trade deal doesn’t materialize, analysts may dramatically lower their forecasts for Dow, Boeing, and United Technologies, but should a trade deal happen, we could see these stocks climb far higher.