Illumina Inc. (ILMN) sent shockwaves through the entire S&P 500 on Friday after shares experienced an enormous double-digit loss. Investors quickly panicked after the healthcare diagnostics firm sharply lowered its revenue expectations, an announcement that dragged ILMN to its worst close since June 3.

Friday’s drop comes as a huge shock since shares of the company — which specifically develops and sells systems capable of genetic sequencing — had been outperforming several peers this year. Close competitor Regeneron Pharmaceuticals Inc. (REGN), for instance, is down nearly 22% this year while Illumina had gained 21.2% before Friday’s session. As a market leader, Illumina’s fresh volatility has investors wondering if the firm’s outlook is genuinely bleak or if the firm is simply trying to manage expectations so it can top analyst estimates once it eventually releases earnings.

Here’s a closer look at the news crashing ILMN stock — and what investors should consider about the company moving forward…

The News

Late Thursday night, Illumina offered a lackluster preview of its second-quarter revenue and brutally slashed its full-year 2019 guidance. The company said it expects roughly $835 million in revenue for Q2, up a modest 0.6% from the $830 million during the year-ago quarter. However, the revised expectation is about 6% below the $887.9 million analysts had projected. The firm also said it now expects 6% revenue growth in 2019, drastically lower than the previous guidance range of 13% to 14%.

CEO Francis deSouza lamented the revised outlook, expressing that he’s “obviously disappointed with our second quarter financial results.” He went on to comment how “our preliminary analysis suggests that these challenges are transitory and do not reflect a macro change to the fundamentals of our business.”

How Investors Reacted

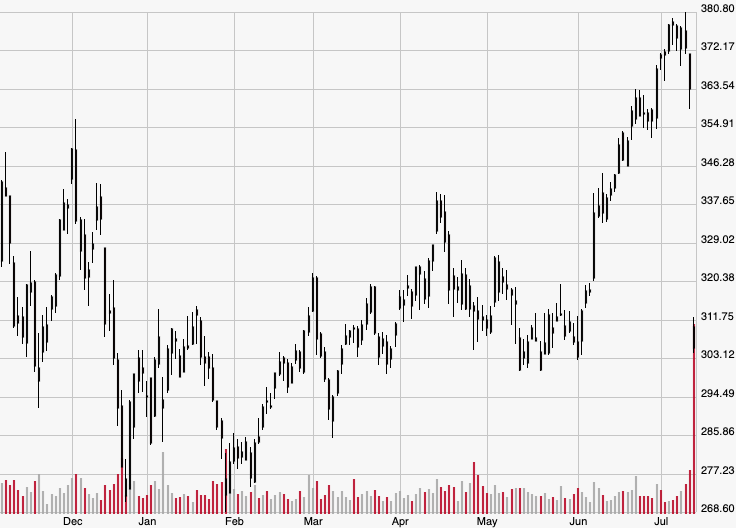

Investors got ahead of the looming Q2 earnings plunge by immediately dumping their positions following the revised guidance. Shares of ILMN plummeted 16.1% on Friday, going from $363.66 at Thursday’s close to $305.05. That’s the lowest since June 3 when the stock settled at $303.72 per share.

Illumina was also the S&P’s worst-performing component, losing more than triple the percentages of runners-up Johnson & Johnson (JNJ) and Mettler-Toledo International Inc. (MTD). JNJ dropped 4.15% from $140.11 to $134.29, while MTD declined 2.2% from $854.07 to $835.13 by the session’s close.

The Bigger Picture

Though the market for genome-sequencing machines is somewhat obscure, Illumina worrying about revenue outlook is indicative of the market at large. This is particularly notable considering the company’s primary reason for the guidance revision is its lackluster direct-to-consumer (DTC) business, which mainly consists of microarray kit sales.

While the firm said DTC revenue may arrive roughly $10 million lower than expected in Q2, problems with this side of the company have been around since the start of 2019. Sales of home-use microarrays — which are tools that simultaneously detect the expression of thousands of genes — fell 3.3% from Q1 2018 to Q1 2019. It’s clear from Friday’s news that deSouza backtracked on statements he made in that Q1 2019 earnings call, where he noted DTC sales would experience moderate growth this year.

But it’s important to also examine Illumina’s earnings history, which largely consists of analyst-topping reports despite weak growth in individual businesses. In the last four earnings periods, the firm topped Wall Street estimates by an average 16.48%, only missing expectations in one of the quarters.

After Friday’s announcement, Illumina may be attempting the magic trick of lowering estimates ahead of a report so it can easily surpass them and enjoy a post-earnings pop. After all, shares jumped more than 2% on April 25 when the company reported better-than-expected first-quarter financials.

Looking Ahead

Illumina is the dominant player in a niche market, which will always make it a strong hold for any healthcare-oriented investor. Even though the firm publicly expects weaker revenue the rest of the year, there’s no way of knowing if it’s saying that just to manage expectations or not.

That being said, investors should maintain a wait-and-see approach with ILMN. If the stock experiences a significant decline following the Q2 earnings release, it may be wise to buy the dip. However, investors should only buy if that dip is larger than the 16% loss experienced Friday, as that will be a key sign of continued weakness reflective of deSouza’s slashed full-year guidance.