The billionaire investor just issued a warning, and says this is the asset to buy now to prepare for what’s coming.

Ray Dalio just jumped on the gold bandwagon.

In a post on LinkedIn, the billionaire investor and founder and co-chairman of Bridgewater Associates—the world’s largest hedge fund—wrote that we’ll see a “paradigm shift” over the next few years as an enormous amount of debt and non-debt liabilities such as pension and health care comes due and can’t be funded with assets.

Such a scenario will lead to “some combination of large deficits that are monetized, currency depreciations, and large tax increases.”

Assets “that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold,” Dalio wrote.

“Additionally… most investors are underweighted in such assets, meaning that if they just wanted to have a better balanced portfolio to reduce risk, they would have more of this sort of asset,” Dalio continued. “For this reason, I believe that it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio.”

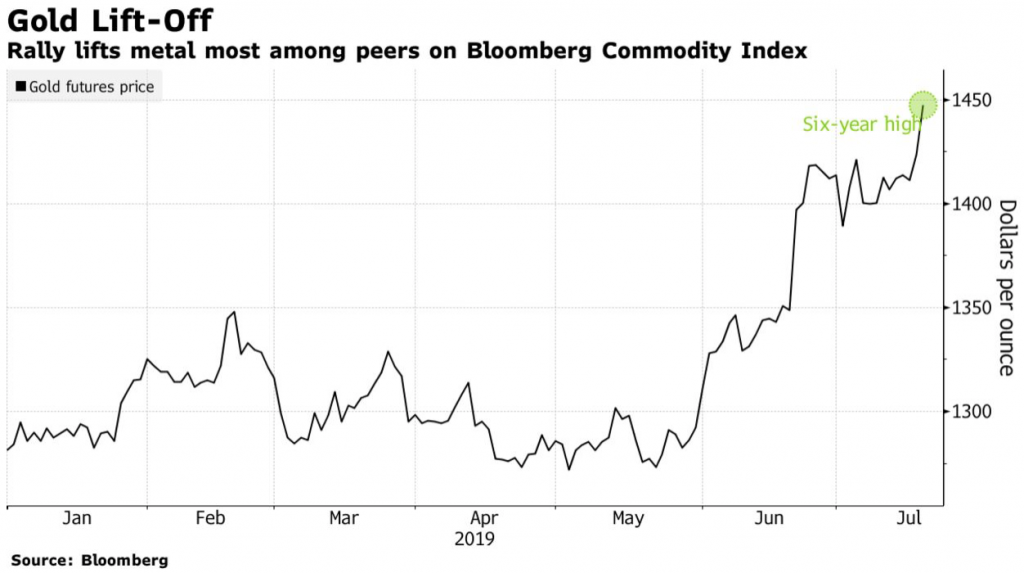

After Dalio published the post, gold jumped to around $1,421 per ounce. As of Thursday, the shiny yellow metal is up to $1,444.55 per ounce.

Dalio’s call comes just two weeks before the Fed is widely expected to cut its benchmark rate by at lease a quarter point after a three-year cycle of raising rates from the near-zero levels implemented during the financial crisis.

The investing legend wrote that investors will need to change their mindset about what will work after the longest bull market in Wall Street history ends.

“In paradigm shifts, most people get caught overextended doing something overly popular and get really hurt,” Dalio wrote. “On the other hand, if you’re astute enough to understand these shifts, you can navigate them well or at least protect yourself against them.”

“To me, it seems obvious that [central banks] have to help the debtors relative to the creditors. At the same time, it appears to me that the forces of easing behind this paradigm (i.e., interest rate cuts and quantitative easing) will have diminishing effects,” he wrote.

“For these reasons, I believe that monetizations of debt and currency depreciations will eventually pick up, which will reduce the value of money and real returns for creditors and test how far creditors will let central banks go in providing negative real returns before moving into other assets.”

While Dalio isn’t sure of the timing of this paradigm shift, he believes “it is approaching and will have a big effect on what the next paradigm will look like.”

Dalio isn’t the only goldbug.

In the past month, banks including Goldman Sachs, Citigroup, and Morgan Stanley have raised their forecasts for bullion or cheered its prospects, while holdings in gold-related ETFs rose to a six-year high.

Gold is gaining attention from institutional investors as the prospect of slowing economies, lower interest rates, and rising global tensions are driving demand for the metal as a store of value. Since late May, Gold—which benefits from low rates since it doesn’t pay any interest—has produced the best returns in the Bloomberg Commodity Index.

“Safe-haven flows into the asset class in light of geopolitical risks and unresolved trade tensions continue to support the gold price,” said Darwei Kung, head of commodities and portfolio manager at DWS Investment Management Americas Inc.