This tech stock has been surging higher, and one technician says it has got more upside ahead.

Microsoft (NASDAQ: MSFT) rose to a new all-time Thursday after the tech giant reported quarterly earnings and revenue that beat analysts’ expectations.

The beat was largely driven by a 39% year-over-year surge in cloud revenue.

“This quarter was an absolute ‘blow out quarter’ across the board with no blemishes and in our opinion speaks to an inflection point in deal flow as more enterprises pick Redmond for the cloud,” Wedbush analyst Dan Ives wrote in a note. “While the stock has been very strong and a trillion dollar market cap is now reached, we believe the cloud party is just getting started in Redmond as evidenced by the robust guidance MSFT provided.”

And now that Microsoft is at all-time highs, one technician says the stock could go even higher.

“Microsoft is really a momentum story and has been for more than several months now,” said Katie Stockton, founder of Fairlead Strategies. “It’s a long-term uptrend, it’s an intermediate term uptrend.”

So far this year, the world’s largest publicly traded company is up 34%, outpacing both the XLK Info Tech ETF’s 30% climb and the S&P 500’s 19% gain. And over the last two years, Microsoft has nearly doubled in value.

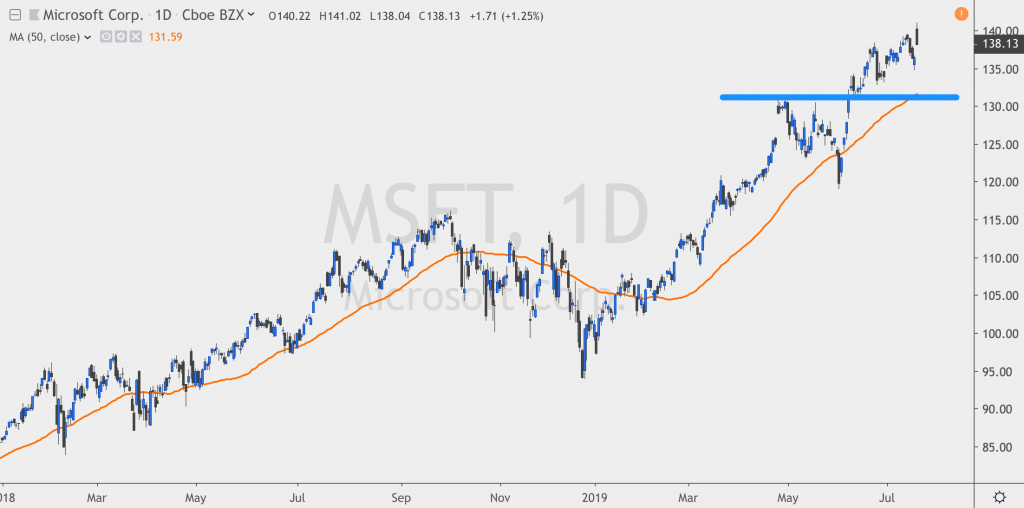

“The stock, of course, having been where it has been, has a lot of support. Initially, it’s right around $131. It doesn’t mean it has to get back to that level, but it certainly would be very safe, in terms of preserving its uptrend on a pullback of that magnitude,” Stockton said.

Back in early June, MSFT broke above the $131 level, and has since held above $135. In order to return to the $131 support, the stock would need to fall 5% from current prices.

“The last breakout that we had from Microsoft on the chart yielded a very aggressive, and maybe too aggressive, long-term target of about $156 for Microsoft – so, that shows you potential upside when you don’t have any resistance left on a chart,” Stockton said.

$156 would see MSFT 13% higher, and would be a new record for the stock.

Nancy Tengler, chief investment strategist at Butcher Joseph Asset Management, says the fundamentals support such a move as well.

“We see the company hitting on all cylinders,” Tengler said. Tengler went on to note that Azure, Microsoft’s cloud computing platform, has been reporting high double-digit revenue growth, representing the strongest growth of all of the company’s product and service segments.

“Azure is growing at, you know, 70%-plus year over year. We expect them to beat this quarter. If you look at the surveys from customers, at the margin, business is moving to Microsoft away from Amazon. So, we think that is the primary source of the good news.”

“We still like this stock. It’s one of our largest holdings, and we’ve been trimming it as it continues to appreciate, but it still represents almost 5% of our holdings,” Tengler continued.

There are twenty-seven Buy ratings for the stock and two Strong Buy ratings. Analysts’ average price target for MSFT is $146.72, suggesting possible upside of 6% over the next twelve months.

On Friday, twelve analysts set, reiterated, or boosted their price targets. Raymond James rated the stock a Strong Buy and boosted their price target to $163 – 18% higher than current prices.