No. 5: FLIR Systems Inc. (FLIR)

FLIR — which stands for forward-looking infrared — is the world’s largest designer of thermal imaging cameras and equipment. Shares of FLIR dropped 4.9% during Wednesday’s session from $54.70 to $52.04. That was the worst settlement since June 17 when the stock closed out the day at $51.02 per share. With that, FLIR is now up only 19.5% on the year from the Dec. 31 settlement of $43.54.

The plunge was surprising considering the company’s Q2 earnings surpassed analyst expectations. However, FLIR’s bottom line declined 33.3% year-over-year from $0.51 per share to $0.34 per share. Investors and insiders alike may have sold in anticipation of more declining earnings in the third and fourth quarters of 2019.

No. 4: Norfolk Southern Corp. (NSC)

Norfolk is one of the country’s largest freight railroad companies, with its tracks covering more than 19,000 miles across 22 states. Shares of NSC stock declined 5.9% from $196.67 on Tuesday to a near four-month low of $184.99 at Wednesday’s close. The stock now commands a 2019 gain of nearly 24% since closing at $149.54 on Dec. 31.

As with most companies this week, investors were reacting to Norfolk’s second-quarter earnings report during Wednesday’s session. The firm earned $2.70 per share for the April-June period, which missed Wall Street’s $2.77 estimate by 2.5% despite growing 8% from the $2.50 per share earned in the same period last year. Norfolk noted that its trains hauled 4% less freight in Q2 due to the decision to raise shipping rates earlier in the year.

No. 3: Amphenol Corp. (APH)

Amphenol — a producer of electronic and fiber optic cable systems based in Connecticut — saw its stock fall 6.1% on Wednesday from $98.36 to $92.38 per share. That was the lowest close since June 6 when shares ended the day at $91.93. At $92.38, APH stock has now gained only 14% since settling at $81.02 on Dec. 31.

Investors dumped their positions en masse on Wednesday after the firm beat analysts’ top-line expectations but missed on the bottom line. Amphenol raked in revenue of $2.02 billion between April and June, surpassing estimates by 0.2% and increasing 2% from $1.98 billion in Q2 2018. However, earnings per share (EPS) clocked in at $0.92, which missed the $0.93 estimate by 1.1%.

No. 2: MarketAxess Holdings Inc. (MKTX)

MarketAxess is a financial tech company that owns and operates a trading platform for institutional investors with an emphasis on fixed-income instruments like corporate bonds. Shares of MKTX fell 9.1% on Wednesday from $367.81 to a more than three-week low of $334.25. Despite that nearly double-digit decline, the stock is still up an immense 58.2% on the year from $211.31 to $334.25.

The cause of Wednesday’s decline was yet another earnings miss. MarketAxess earned $1.27 per share on revenue of $125.5 million. While revenue surpassed Wall Street’s estimate by 0.8%, the EPS missed the $1.30 estimate by 2.3%.

No. 1: Rollins Inc. (ROL)

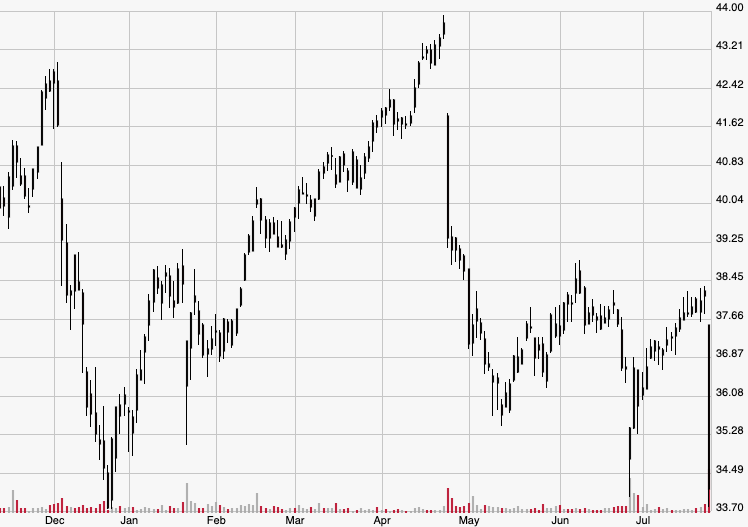

The S&P’s worst performer on Wednesday was Rollins, the pest control company that serves over 2 million customers in North America, South America, and several other territories. Shares of Rollins cratered 10.5% from $38.15 to $34.16, the worst close since Dec. 24 when they ended the session at $33.79. ROL stock has been spiraling out of control since late April, falling 22% from a high of $43.75 on April 23 to Wednesday’s low. Despite the recent short-term volatility, shares are only down 5.4% in 2019 from the Dec. 31 close of $36.10.

Investors engaged in panic selling after the firm’s Q2 earnings release, though the results were mixed rather than flat-out negative. It earned $0.21 per share, which were in line with analyst expectations and also marked a 5% increase from the $0.20 earned a year ago. Revenue, however, came in at $524 million, missing Wall Street’s expectations by 0.13%.