One technical analyst says its time to ditch the FAANGs in favor of these 5 stocks.

We’ve reached peak FAANG, and now it’s all about the BAANG stocks.

That’s according to John Roque, technical analyst at Wolfe Research, who says a group of gold miners he’s dubbed BAANG are better buys now over the mega-cap FAANG names as these growth stocks have started losing steam.

The group is made up of Barrick Gold (NYSE: GOLD), AngloGold (NYSE: AU), Agnico Eagle Mines (NYSE: AEM), Franco-Nevada (NYSE: FNV), and Gold Fields (NYSE: GFI).

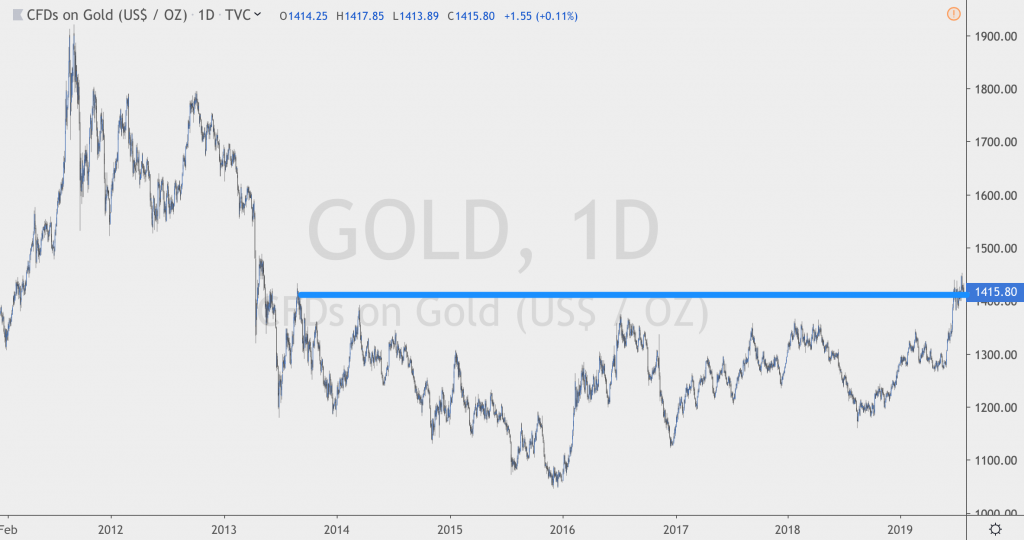

“We made this index BAANG in homage to the fading FAANG,” Roque told CNBC. According to Roque, these miners are so “much like gold. So gold has broken out but it’s still way down from its highs in the 1,900 thereabouts and we think both gold and those stocks have more room.”

Gold is currently trading at $1,415, its highest level since 2013, and is up more than 10% so far this year.

The yellow metal has risen this year as investors have sought a safe haven amid rising geopolitical tensions and as the Fed considers reducing its benchmark rate as a preventative measure.

So far this year, all of the BAANG stocks have delivered double-digit returns with Barrick Gold up 25.85%, AngloGold up 49.64%, Agnico Eagle up 33.12%, Franco-Nevada up 27.23%, and Gold Fields up a whopping 54.83%.

Meanwhile, of the FAANG stocks, Facebook (NASDAQ: FB), Netflix (NASDAQ: NFLX), and Google-parent Alphabet (NASDAQ: GOOGL, GOOG) are all trading in the red on a yearly basis.

These tech stocks have struggled amid threats of greater regulation and government antitrust investigations. And while Big Tech stocks have led the market for much of the bull run over the last 10 years, the group is beginning to lose its luster amid growing concerns about their size, data safety, rising trade tensions, and as the global economy has begun to slowdown.

Netflix took a plunge late last week after reporting declining subscriber numbers. Both Amazon and Facebook are expected to report earnings this week, while Apple (NASDAQ: AAPL) is expected to report later this month.

Of the BAANG stocks, Roque likes Franco-Nevada best. Just last Friday, Canaccord Genuity reiterated their rating on FNV and set a price target of $127, suggesting possible upside of 43% over the next twelve months.