Technical indicators signal a violent sell-off could be right around the corner. Here’s what you need to know now.

The stock market may be hovering near all-time highs, but there’s danger lurking and a major sell-off could be just around the corner.

That’s according to JPMorgan (NYSE: JPM), which says that if the Fed doesn’t deliver on the rate cut the market is expecting next week, things could get scary very quickly.

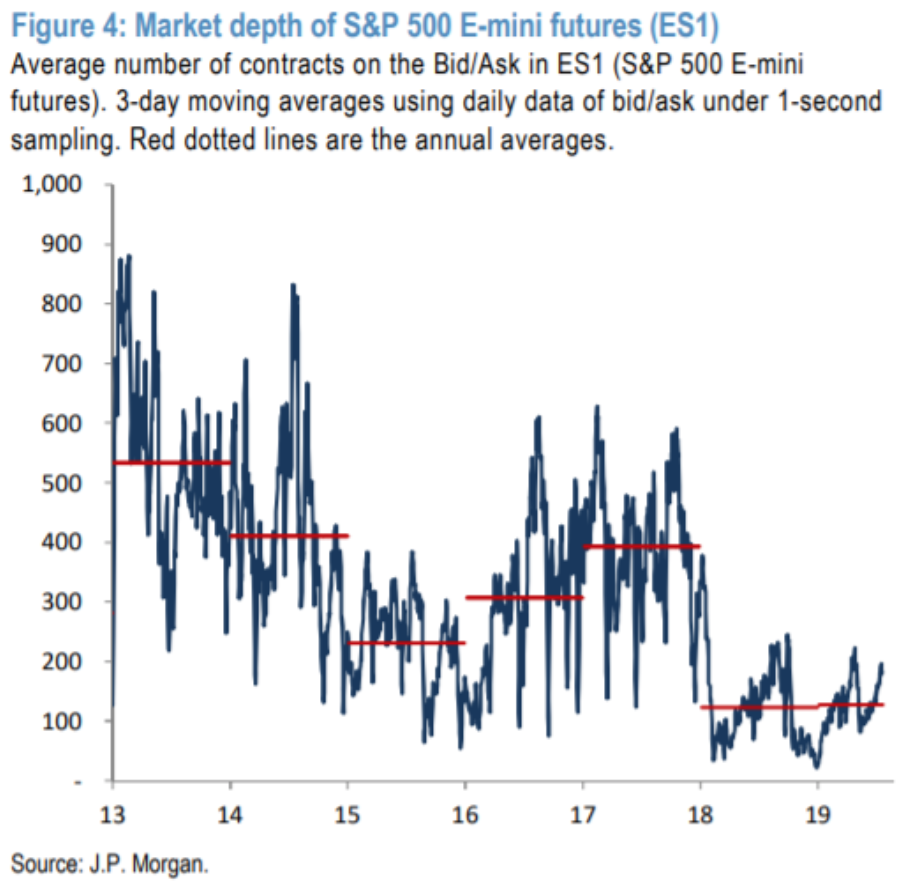

According to the firm, the market’s depth—which is measured by the volume of orders on the bid and ask sides for the S&P 500 futures contract—is so shallow now that it is becoming increasingly vulnerable to wild moves.

“In our mind, this persistently low market depth leaves U.S. equities vulnerable from here if central banks fail to validate market expectations or U.S. recession risks resurface,” JPMorgan analyst Nikolaos Panigirtzoglou wrote in a note to clients.

So far this year, the S&P 500 is up an eye-popping 19%. However, this strong performance has come alongside light inflows and trading activity as well as low market liquidity, Panigirtzoglou noted, while the average market depth has been near historical lows.

Depth was also shallow last year when the market saw a few violent falls, including the sell-off in December that saw the S&P 500 briefly trading in bear market territory.

Right now, the imminent risk for an aggressive sell-off would come at the conclusion of the Federal Reserve’s July meeting next week. The market has priced in a 100% chance of a quarter-point rate cute at the meeting, though much of the market is hoping for a deeper cut.

This unanimous expectation developed when Fed Chairman Jerome Powell stated that the central bank would do whatever was appropriate to sustain the current expansion. Then last week, New York Fed President John Williams expressed that it would be better for central banks to take “preventative measures than to wait for disaster to unfold,” which the market took as a signal that a rate cut was imminent.

While the Fed clarified that Williams’ statement was drawn from academic research and was “not about potential policy action at the upcoming FOMC meeting,” the market still anticipates a rate cut announcement next week. And if that doesn’t materialize, stocks could be headed south very quickly on the news.

Craig Johnson, chief market technician at Piper Jaffray, also noted that there are other warning signs that investors should heed.

“Market breadth remains an ongoing concern as evidence suggests there has been a growing divergence between the recent record highs on the SPX and overall participation,” Johnson wrote in a note.

“Over the last several weeks there has been a declining percentage of stocks registering 52-week highs on the S&P 500, despite its near 10% record-high rally,” Johnson added. “Based on the divergence in breadth accompanied with weak volume and deteriorating momentum, we believe risks for a deeper pullback are growing.”