The “once in a decade opportunity” in these stocks hasn’t been seen in two decades.

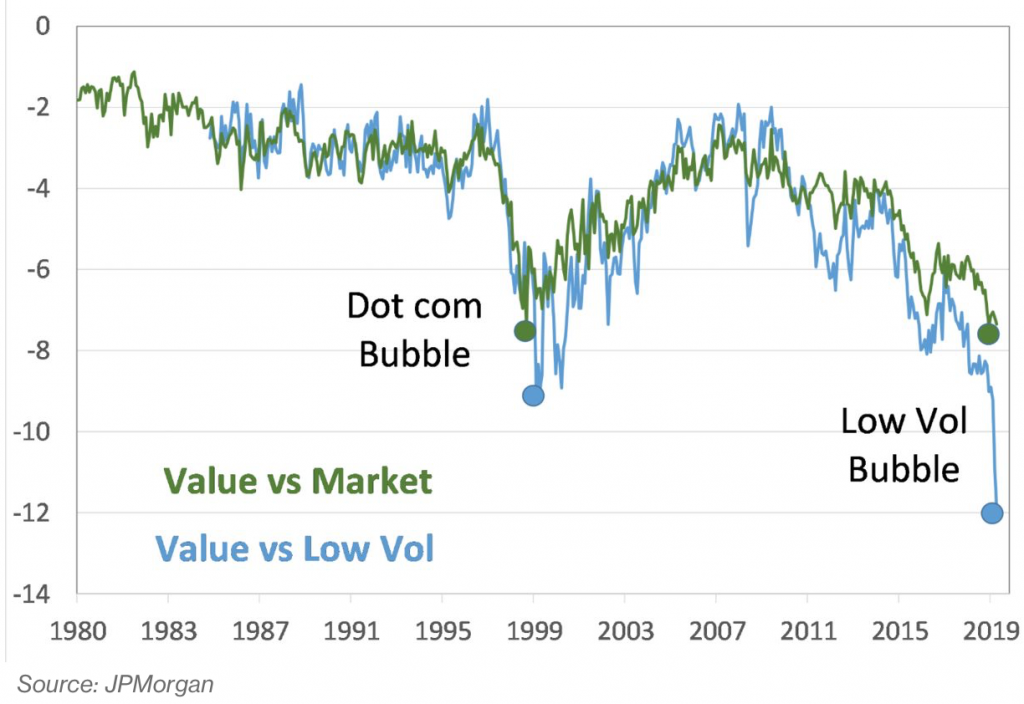

The last time value stocks were doing this poorly compared to growth stocks, the market was in the dying throes of the dotcom bubble.

And according to JPMorgan markets analyst Marko Kolanovic, this “largest divergence ever” between these two groups of stocks is presenting savvy investors with a new opportunity.

In a note to clients, Kolanovic explained that he sees the S&P 500 climbing to 3,200 over the next year representing a rise of about 6%, which the analyst noted is “quite a bit lower rate of returns … given that the S&P 500 returned over 20% in 6 months.”

“However, we think that the unprecedented divergence between various market segments offers a once in a decade opportunity to position for convergence,” Kolanovic said.

According to Kolanovic, there’s a record disparity “between value/cyclical stocks on one side, and low volatility/defensive stocks on the other side.” The quant guru said “the bubble of low volatility stocks versus value stocks is now more significant than any relative valuation bubble the equity market experienced in modern history.”

As far as what could trigger a convergence, Kolanovic says steadier economic data, a steepening of the yield curve sparked by Fed rate cuts, and progress in the trade talks between the U.S. and China could do the trick.

While an end to the trade war could still be months down the road, Kolanovic believes that something as small as hedge funds adjusting their positions one way or another in the next few months could spark a cascade effect that could eventually turn investors away from this year’s biggest market winners.

“This rotation would push significantly higher all the laggards such as small caps, oil and gas, materials, and more broadly stocks with low P/E and P/B ratios,” Kolanovic said.

While the scenario Kolanovic describes isn’t set in stone, it is clear that the smart money has been ramping up equities exposure.

“It certainly seems like this period is getting a bit long in the tooth,” wrote Chris Meredith, a fund manager at O’Shaughnessy Asset Management, in a note. Once technological innovations reach maturity, “value investing has historically outperformed,” Meredith wrote.