Shares of Apple Inc. (AAPL) surged higher during post-market hours on Tuesday following the release of fiscal Q3 earnings. The world’s largest technology firm surpassed analyst estimates on the top and bottom lines, enticing investors to push AAPL toward its highest level in nearly nine months.

Much of the sentiment surrounding Apple’s last few earnings reports has centered on lagging iPhone sales once considered the company’s bread and butter. However, Apple seems to be pulling off the impossible task of pivoting away from product sales and more toward services revenue, a long-term strategy that has investors wondering if the company can keep it up in fiscal Q4 and beyond.

Here’s everything to know about Apple’s latest financials — and what investors can expect from the market’s most closely followed company moving forward…

The News

In the April-June period, Apple reported earnings per share (EPS) of $2.18, flying past Wall Street’s expected $2.10 estimate by 3.8% but declining 6.8% from the $2.34 reported in the year-ago quarter. The revenue numbers were far more peachy, as the firm’s $53.8 billion surpassed the $53.39 billion estimate by 0.8% and marked a year-over-year increase of 0.9% from $53.3 billion in fiscal Q3 2018. That marked a return to revenue growth for the first time since reporting fiscal Q4 2018 financials.

Revenue from specific areas of the business were less impressive, including the iPhone sales of $25.99 billion that missed the $26.31 billion estimate by 1.2%. Sales from services — which include Apple Music and Apple Pay and have been Apple’s focal point since iPhone sales started flatlining — came in at $11.46 billion, 1.3% below analysts’ expected $11.61 billion.

Still, CEO Tim Cook praised his firm’s successful revenue rebound and singled out how it was a “great services quarter” that was largely due to “significant progress on iPhone, and off-the-charts significant progress on China.”

How Investors Reacted

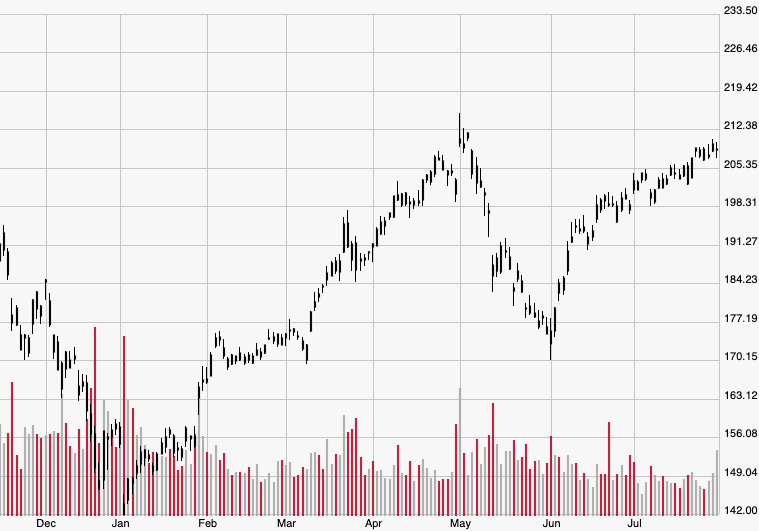

Investors seemed to solely focus on the return to overall revenue growth, boosting shares 4.1% after hours to $217.40. If the stock were to close at that price on Wednesday, it would be the best settlement since Nov. 1 when shares ended that session at $222.22 each. At $217.40, AAPL stock is up 37.8% on the year since closing out Dec. 31 at $157.74 per share.

The Bigger Picture

There’s no denying how the iPhone remains the most widely owned tech device in the world, but its runaway success could have only led to the current state of affairs: more than 900 million iPhones are used every day, so it’s increasingly difficult to find new people to buy them.

The $25.99 billion in revenue from iPhone sales is mostly flat from last year and, according to eMarketer, marks the first time in at least six years iPhones didn’t constitute a majority of the firm’s quarterly revenue. That’s largely because of rising costs and cheaper alternatives, but it’s also largely due to the fact that people are simply holding onto their old iPhones for longer.

This has forced Apple to refocus its business in recent quarters from devices to services, a strategy that, for the most part, is paying off. Revenue from Apple Music, Apple Pay, subscriptions, and other in-house services climbed 13% year-over-year last quarter. Cook noted that it would’ve increased by 18% if the firm discounted international exchange rates and a lawsuit payment.

But it’s important to remember how much Apple loves to buy back its stock, a strategy often seen as an internal hedge against any stock volatility. The firm has long been one of the biggest share repurchasers in the world, spending over $17 billion on nearly 88 million AAPL shares just last quarter alone. Buybacks can be an easy way to artificially inflate a stock price, but in this case, Apple actually seems to be doing it with the good intention of growing its services sector.

Looking Ahead

Apple is never really a bad stock to own: investing in AAPL is like investing in the entire tech industry since the company seems to carry the weight most of the time. There’s no reason to think the stock won’t float higher while Cook continues to aggressively prep the firm for the future by prioritizing services over iPhone sales.

That being said, AAPL still hovers near nine-month highs, which means it could swing lower in the near term. Previous owners should definitely hold their positions, and investors looking to enter the stock should wait for a dip below the $200 level. Regardless, any short-term volatility will likely give way to a stronger run higher in the long term.