Investors beware: the VIX looks like it’s about to skyrocket higher.

The market’s fear gauge is starting to look like a ticking time bomb.

That’s according to Sven Henrich, founder and lead market strategist at Northman Trader.

The CBOE Volatility Index, or the VIX, has been stuck at relatively low levels even as stocks are hitting record highs.

The VIX tracks option prices to measure near-term expectations of volatility, or in other words, the odds that the market will see wild swings in the near future. When the VIX rises higher, it typically means that investors are growing more concerned about the market and are placing protective bets.

And Henrich says it’s just a matter of time before the VIX spikes higher from its current muted level.

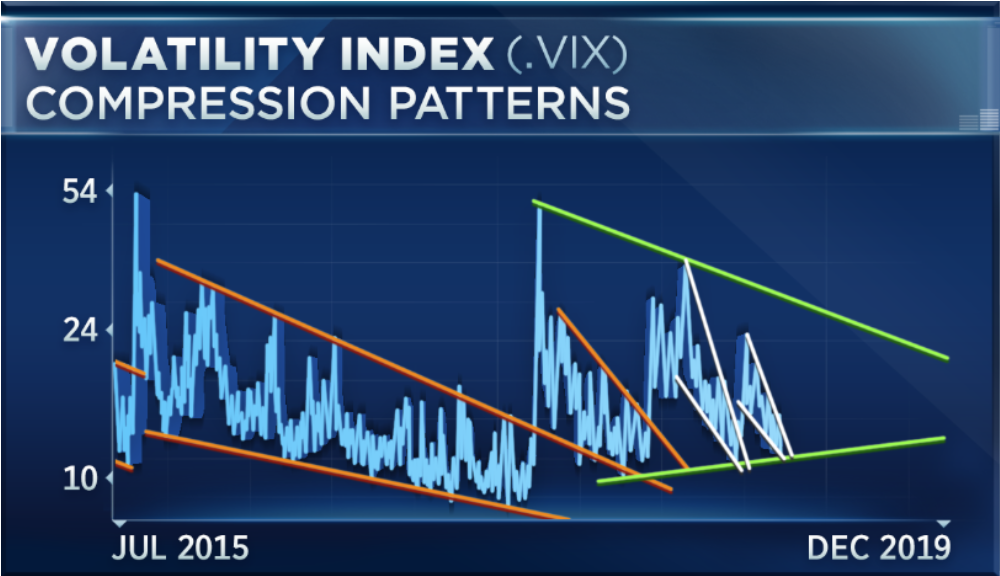

“The VIX follows some very specific patterns that show compression,” Henrich told CNBC. “If you look back to, let’s say, the last few years, we’ve seen a large compression pattern from 2016 to 2017.”

According to Henrich this compression builds up “energy” that may soon explode higher.

“When that energy compresses too much, then we see these spikes,” Henrich said. “We have seen these spikes with quite a bit of regularity, but they always need some sort of trigger.”

And now that we’re in the month of August, which typically sees the lowest trading volumes of the year, investors could be caught off guard by the wild swings in the VIX that could soon occur.

Henrich noted that there’s “a lot of complacency right now” in the market. And last week saw “news of antitrust investigations for Nasdaq [companies]. What’d the Nasdaq do? Made new all-time highs. It’s not pricing in any bad news whatsoever.”

The strategist then pointed out that the VIX is currently forming a narrow wedge pattern that looks like it’s ready to pop to the upside.

The VIX is “compressing tighter and tighter, and it’s building up this pattern,” Henrich continued. “So, it’s ready for another breakout. The question is the when and the how.”

Henrich also warned that there are other technical risks building as well, including the gap that the VIX needs to fill between the 24 and 25 levels last seen in January when Fed Chairman Jerome Powell said in a speech that the central bank would be “patient” with monetary policy, as well as several similar gaps to the downside in the S&P 500.

“One additional point, very important: from a Nasdaq perspective, while we see the Nasdaq making new highs, there’s no visible expansion in new highs versus new lows in these indicators,” Henrich said. “It’s very much flatlined. So, again, we’re seeing participation waning in favor of a few individual stocks on the Nasdaq.”

While this week did see the Fed deliver on the expected quarter-point reduction in its benchmark rate, the market sank after Powell called the move a “midcycle adjustment” and indicated that it didn’t mean policymakers would be following up this rate cute with an aggressive rate-reducing program.

This week also saw President Trump put more pressure on the trade war between the U.S. and China with his surprise announcement on Thursday of new tariffs on another $300 billion worth of Chinese goods beginning on September 1.

On the news, the VIX jumped to a nearly two-month high as stocks sold off in wake of the new threat in the trade war. While the market has been eerily quiet lately, the VIX jumped more than 13% Thursday after the President’s tweet declaring the new tariffs, and could be the catalyst that sends the fear gauge skyrocketing higher.