Investors sprinted for the hills during a panic-stricken session on Wednesday in what became the Dow Jones Industrial Average’s largest daily decline of 2019. The bellwether index plummeted 3.05% to 25,479.42 after market participants witnessed the yields on the 10-year Treasury note — the most widely watched bond instrument issued by the U.S. government — fell below the yields of 2-year notes for the first time since 2007. That was right before the economy collapsed, and since then a yield inversion has been seen as the most dire indicator of a recession on the horizon.

Arguably worse factors were China and Germany reporting dismal economic data, further demonstrating how global growth rates may indeed be screeching to a halt. China reported that its industrial output for July increased only 4.8% year over year, far below the 5.8% analysts had expected and constituting the country’s slowest pace of output since February 2002. Retail sales growth was also weaker than expected, growing 7.6% in July from a year earlier compared with 9.8% in June. Analysts widely forecasted a growth rate of 8.6%.

As for Germany — the largest economy in Europe — it experienced negative growth in the second quarter, with GDP contracting 0.1% during the April-June period. That’s a huge blindside when compared to the 0.4% growth experienced during the first three months of the year. While weak auto sales are to blame, the U.S.-China trade war also has an outsized impact on the German economy, as it relies on exporters that sell a large amount of goods to both nations.

The yield-curve inversion remains the spookiest to investors despite how many money managers cautioned that a recession or prolonged stock-market downturn isn’t necessarily imminent. With bond yields at multi-year lows, many investors say there are no good alternatives to U.S. stocks for those seeking returns. For instance, the S&P 500 sports a dividend yield of roughly 2%, well above the 1.596% yield on the 10-year Treasury note.

Speaking of the S&P, the index was obviously also blistered from the economic panic, falling 2.9% to 2,840.60. Three of the index’s components endured brutal double-digit losses, and the fact that all three reside in a historically volatile sector means more bad news is likely on the way.

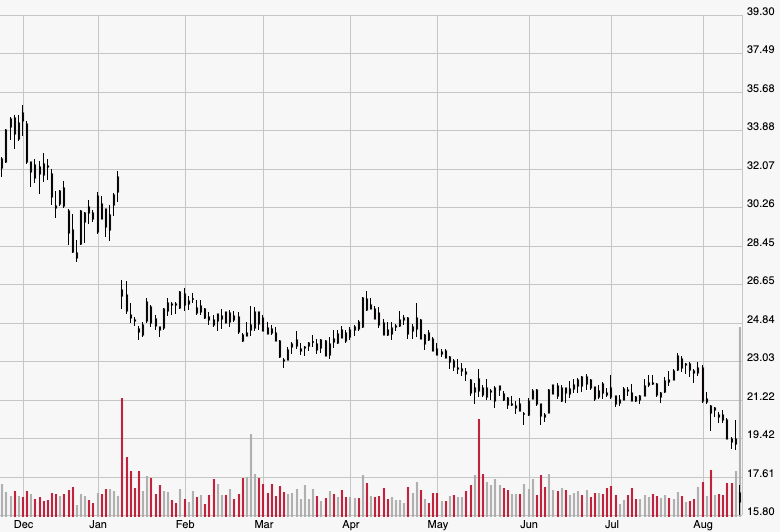

The S&P 500’s biggest loser by far was Macy’s Inc. (M), the storied department store chain with about 680 stores nationwide under the Macy’s and Bloomingdale’s banners. Shares of M stock crashed 13.2% from $19.36 to a more than nine-year low of $16.80. The last time shares were at that level was on Feb. 10, 2010 when they ended their session at $16.75. Wednesday’s loss was another massive dose of salt in the wound for the stock, which has dropped a whopping 43.5% from the Dec. 31 close of $29.78.

The crash came on the heels of the retailer’s abysmal second-quarter earnings report marred by a massive earnings per share (EPS) whiff and heavily revised guidance. Macy’s earned $0.28 per share, which missed Wall Street’s $0.45 estimate by 38%. It also lowered its profit outlook for the full year and now projects 2019 EPS between $2.85 and $3.05 a share, down from a range of $3.05 to $3.25.

Macy’s hasn’t been insulated from the ongoing “retail apocalypse” bludgeoning department stores, which remain pressured by Amazon.com Inc. (AMZN) and more people buying their clothes online. CFO Paula Price tried to stay optimistic by noting how “consumer spending continues to be healthy.” However, with the three aforementioned macroeconomic uncertainties floating in the markets right now, Macy’s may run into turbulence that it, as Price said, “cannot control.”