In this shaky market, stocks like these offer safety according to Goldman.

The sky is falling.

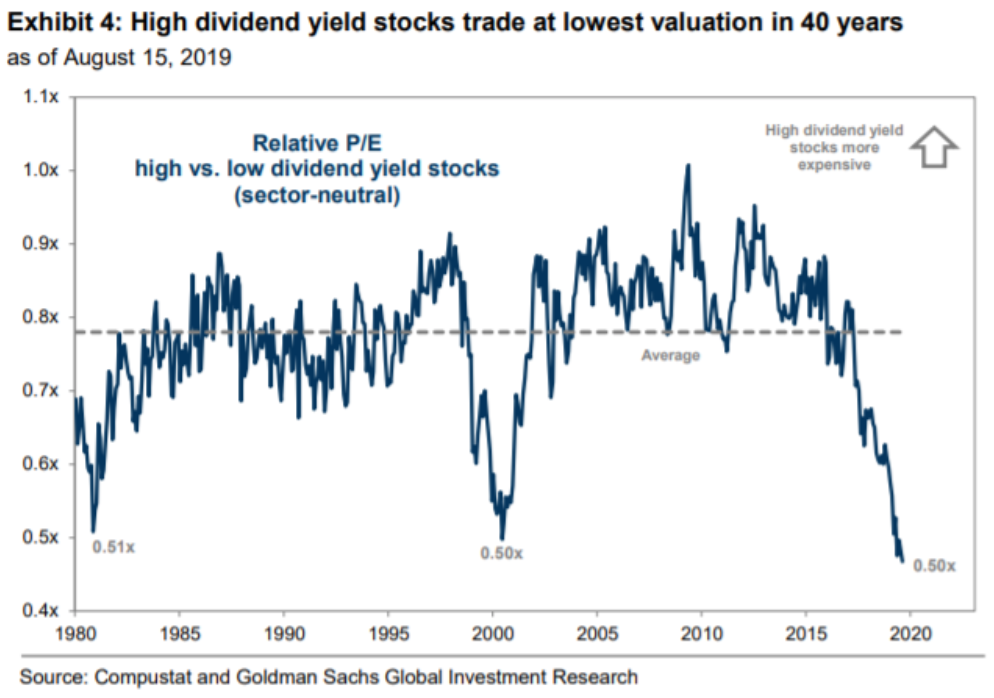

Well, not quite, but rates certainly are. And in such an environment, Goldman Sachs (NYSE: GS) is advising its clients to buy high-dividend stocks, which the firm says are trading at their lowest levels in nearly 40 years compared to stocks with low yields.

“With the 10-year Treasury yield at just 1.5% and the Fed likely to cut two more times this year, investors should look for opportunities in dividend stocks,” Goldman’s chief U.S. equity strategist David Kostin wrote in a note.

As fears about the trade war and a possible recession rise, investors have been piling into safe haven Treasuries, pushing bond yields to their historic lows last week as stocks crashed.

If the market continues to be shaky, Goldman suggests investors consider looking at stocks with more steady dividend income.

According to the firm, the market is pricing in “an overly pessimistic” level of dividend payouts, with swap-market prices implying just 0.7% growth over the next decade, Kostin noted.

Not only that, but the valuation gap between high and low dividend yielding stocks is nearing the widest point in the last 40 years.

But the reality is that domestic companies are steadily raising their dividends with S&P 500 dividends rising by 9% in the first half of this year, Kostin said. Goldman predicts that S&P 500 annualized dividend growth will be 3.5% over the next decade.

The firm screened for stocks with strong dividend growth and high dividend yields, based on their dividend estimates and payout ratios. The average stock in Goldman’s dividend growth basket has a dividend yield of 3.8%, higher than the average 2.1% for S&P 500 stocks.

The four stocks with the highest dividend yields in Goldman’s basket are AbbVie (NYSE: ABBV) with 6.8%, Kohl’s (NYSE: KSS) with 6.1%, At&T (NYSE: T) with 5.9%, and Seagate Technologies (NASDAQ: STX) at 5.7%.

Of these high dividend yielders, the Street is most bullish on AbbVie and Kohl’s, with average price targets indicating possible upside of 35.34% and 38.08%, respectively, over the next twelve months.