A new month means new catalysts that could send stocks climbing higher, according to JPMorgan strategists.

JPMorgan said last week that investors should shy away from buying the dip in stocks until September. Fast-forward to now, and the firm says the market is starting to look good again.

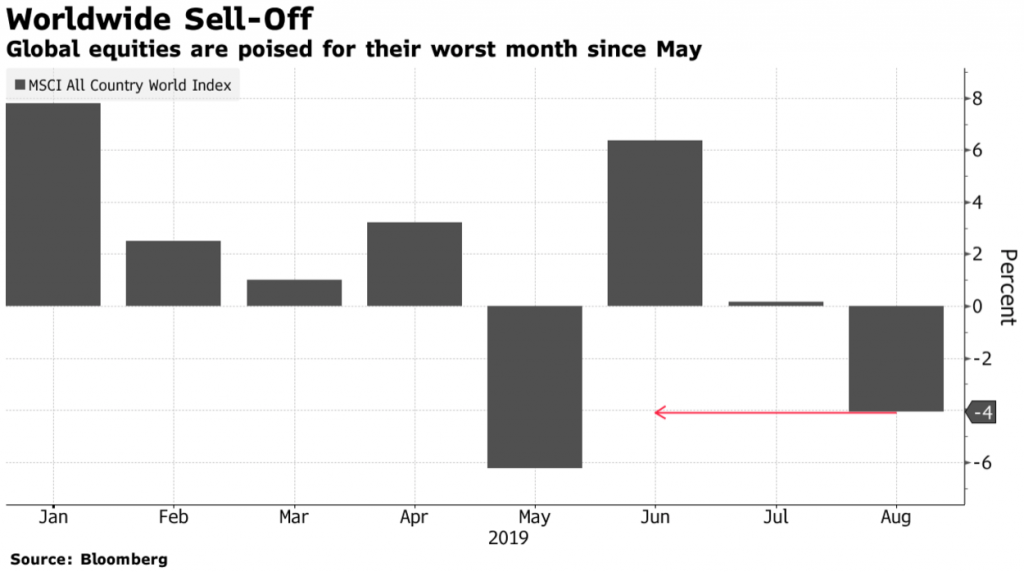

Strategists led by Mislav Matejka wrote in a note from Tuesday that after August’s sell-off, the time to buy stocks is fast approaching as equities will begin to move higher starting with an up-trend in September.

“While we have been advocating a consolidation call during August, we continue to expect that the pullback will not extend for longer than the May one did, and still believe that the market will advance into year-end,” the strategists wrote.

The last weeks of August saw an escalation in the ongoing trade dispute between the U.S. and China, sending stocks reeling and stoking concerns about the outlook for the global economy.

Major asset managers including Legal & General and Manulife Investment Management have already taken profits on their risk assets and have entered into a wait-and-see mode.

“The consolidation seen over the past few weeks has contributed to an improvement in a number of tactical indicators that were stretched entering the month,” they said.

But JPMorgan sees several positive catalysts coming up in September that have the potential to lift equities.

September could see the European Central Bank restart its quantitative easing program. There’s also the potential for a second rate cut at the Federal Reserve’s meeting mid-month.

“The positives then are likely to be better technicals, restart of ECB’s QE, possibly bigger 2nd Fed cut, signs of activity trough, as well as travel & arrive with respect to tariffs, with a chance of the latest ones not being implemented after all,” the strategists wrote.

JPMorgan’s bullish outlook is at odds with UBS Global Wealth Management, which turned bearish on equities earlier this week for the first time since the eurozone crisis in 2012. UBS has cut its stock positioning relative to high-grade bonds to reduce exposure to the trade war and political uncertainty, according to a note from UBS’ Global Chief Investment Officer Mark Haefele.

However, JPMorgan believes that positive earnings deliveries are a key way to ensure that market pullbacks don’t become extended. According to the strategists, consensus profit projections are “rather conservative,” and they believe an outright earnings contraction was only historically experienced during recessions.

“In other words, unless one is a subscribed believer in a U.S. recession over the next 12 months, on should not expect earnings to be contracting,” the JPMorgan strategists wrote. “It is too early to expect the next U.S. recession and one should be constructive on equities.”