No. 5: Wynn Resorts Ltd. (WYNN)

Shares of Wynn Resorts — the giant casino operator that flung into the spotlight in February 2018 after former CEO Steve Wynn resigned amid sexual misconduct allegations — vaulted 3.6% during Friday’s session from $106.32 to a more than one-week high of $110.15. The stock has whipsawed all over the place in 2019, ranging from a high of $149.30 on April 26 to a low of $103.57 just over a month later. Overall, WYNN is up 11.4% year-to-date from the Dec. 31 close of $98.91.

While no company-specific news seemed to be galvanizing investors Friday, WYNN stock certainly experienced above-average volume in early trading hours. According to data from Yahoo! Finance, trading volume spiked to 104,780 shares around 11:30 a.m., far above the average 20,000 share volume experienced around the open. Company insiders may be positioning themselves for the fall by adjusting their stakes accordingly, which typically involves hundreds of thousands of shares.

No. 4: Campbell Soup Co. (CPB)

The soup and snack producer saw its stock climb 3.9% from Thursday’s close of $43.31 to $45, which was the best settlement since Feb. 20, 2018 when shares ended the day at $46.08. At $45, CPB stock has logged a 2019 gain of more than 36% from the $32.99 close on Dec. 31.

Campbell’s rally comes on the heels of a strong quarterly earnings report that beat Wall Street’s profit estimates. The firm earned $0.42 per share, surpassing analysts’ expected $0.41 by 2.4%, and raked in overall net sales of roughly $2 billion. Analysts praised Campbell’s ability to boost sales of snacks like Goldfish and Kettle Brand potato chips responsible for $967 million of those overall sales.

No. 3: Cooper Companies Inc. (COO)

Shares of Cooper Companies — a global medical device maker whose contact lens business makes up the majority of total sales — plummeted 5.7% on Friday, going from $328.59 to $309.75 for the worst close since June 3 when they settled at $301.76. Friday’s performance marks COO’s first significant downturn of the year, and shares are now up only 21.7% from the Dec. 31 settlement of $254.50.

Despite missing revenue estimates, investors rallied behind Cooper’s strong earnings per share (EPS) for the most recent quarter. EPS came in at $3.23, surpassing analysts’ estimated $3.16 by 2.2%, while the firm’s $679.4 million in revenue missed the $686.9 million estimate by 1.1%. It’s worth noting how revenue from Cooper’s contact lens business — called CooperVision — clocked in at $509.1 million, making up a whopping 75% of the company’s total revenue during the April-June period.

No. 2: Alexion Pharmaceuticals Inc. (ALXN)

Alexion — known for producing Soliris used to treat rare disorders atypical hemolytic uremic syndrome (aHUS) and paroxysmal nocturnal hemoglobinuria (PNH) — sank toward its lowest levels of 2019, as shares dropped 10.2% from $112.17 to $100.76. That’s the lowest settlement since Jan. 3 when shares closed at $100.21. At $100.76, ALXN stock is up only 3.5% on the year from the $97.36 close on Dec. 31.

ALXN nosedived after the firm received a challenge from competitor Amgen Inc. (AMGN) currently developing a similar version of Alexion’s blockbuster Soliris. Amgen tanked the stock almost instantaneously after announcing it wanted to invalidate Alexion’s Soliris patents in order to gain an edge in the marketplace. Investors clearly panicked at even the possibility of Alexion getting defeated, selling the stock en masse.

No. 1: Ulta Beauty Inc. (ULTA)

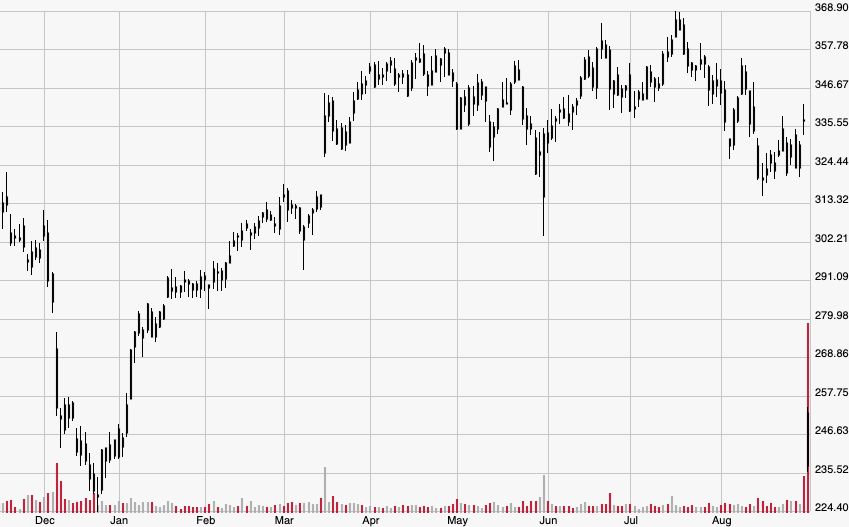

The most devastating decliner by a mile was Ulta Beauty, which owns and operates nearly 1,200 beauty retail stores across the United States. The stock saw its biggest one-day decline ever, crashing a whopping 29.55% from $337.45 to $237.73, the lowest level since Christmas Eve last year when shares ended the session at $229.06. It’s worth noting that the S&P 500 bottomed on that same day, which means that ULTA erased in a single day the gains of essentially the entire stock market over the same period. The stock is now down 3% year-to-date from the Dec. 31 close of $244.84.

Not only did Ulta miss both profit and revenue estimates in its latest earnings report, but it also lowered its full-year 2019 guidance, which investors reacted to the most. The firm lowered its same-store sales growth expectations from 6% to 4% to 6% for 2019, down from the previous range of 6% to 7%. It also cut its EPS forecast from the previous $12.83-$13.03 range to $11.86-$12.06, sharply indicating rough times ahead for the retailer.