These 2 stocks look set for a breakout if trade tensions between the U.S. and China continue to ease.

There’s been a bit of a thawing in the trade war between the U.S. and China this week after China indicated it wouldn’t immediately retaliate against the latest tariffs from America announced late last week.

“Escalation of the trade war won’t benefit China, nor the U.S., nor the world,” Chinese Commerce Ministry spokesman Mao Feng said to reporters on Thursday. “The most important thing is to create the necessary conditions for continuing negotiations.”

And according to one expert, there’s one Chinese stock that could see a rebound if things continue in this direction.

That stock is Alibaba (NYSE: BABA).

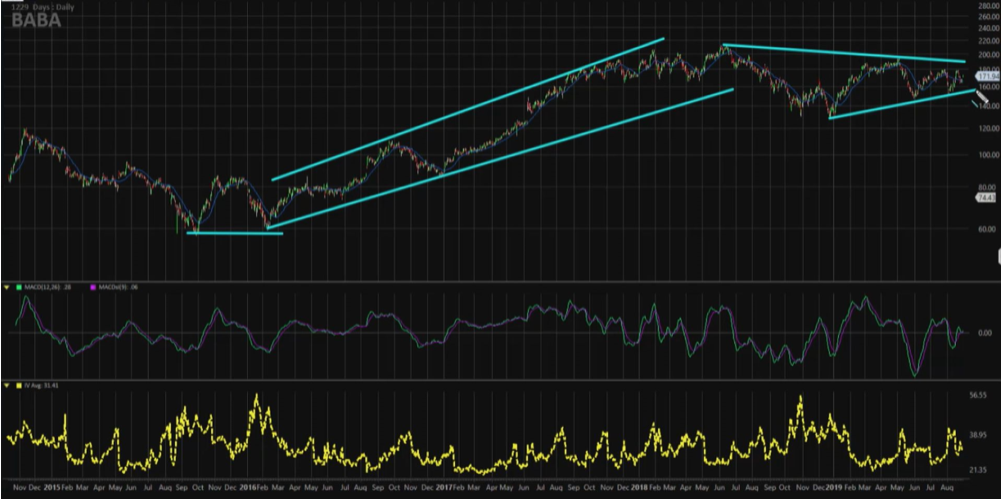

“After the IPO [in 2014], we cam down into a double bottom right around the $70 region,” TradingAnalysts.com founder Todd Gordon said, referring to the lows seen in 2015 and early 2016.

But from that point, shares of the Chinese e-commerce giant broke out, gaining 260% between September 2015 and the beginning of 2018.

“Since then, heading into 2018 and 2019, much like the overall market, we’ve seen a lot of sideways consolidation, and I would say despite everything that’s happened in China with the Chinese slowdown and the trade war, it has held in relatively well,” Gordon said.

According to Gordon, the chart is now forming a triangle pattern, reflecting consolidation and a sense of investor indecision.

“At some point, a group—either the bulls or bears—will step in and blow this consolidation out,” Gordon continued. “Usually what happens is the trend that was in place prior to the consolidation will emerge victorious.”

Gordon believes a breakout to $180 could push the stock forward to $190, suggesting possible upside of 8.5% from current prices.

In order to take advantage of a possible move higher, Gordon is putting on a call debit spread by being a 180 call with the October 18 expiration and selling a 190 call. This spread will pay off if it expires with Alibaba up as high as $190.

MKM Partners has their eye on a different Chinese stock: JD.com (NASDAQ: JD).

MKM’s chief market technician JC O’Hara says JD’s chart is flashing a signal that it’s on the verge of a major breakout.

“When you look at this chart, you can actually see a strong bearish to bullish reversal taking place and the formation that’s occurring is out of a cup-and-handle [pattern],” O’Hara said.

JD has been in a tight consolidation range between $26 and $32 since March.

“We want to pay attention to the $33 level. We break above $33, I think we have 10% to the upside,” O’Hara said.