As an investor that prefers to focus on value, my preference is to emphasize stocks that are currently trading at significant discounts to their basic valuation metrics. That usually means that most of my attention is directed on stocks that are also trading at or near to yearly or historical lows. That also means that stocks you’ll find near the top of their yearly ranges almost always get passed over. That’s even more true if the stock has been following a multiyear upward trend.

Value investing is often at odds with one of the most basic principles of technical analysis, which suggests that stocks tend to follow the direction of their prevailing trends. That’s an idea that also makes intuitive, even emotional sense to most investors; a stock is more likely to go up if it has already been going up. It’s one of the reasons that I think most talking heads focus on stocks that have already shown impressive performance, or even better, that are pushing to a fresh, new set of all-time highs.

As market uncertainty has remained high for most of the past month and half, a lot of sectors and industries have come under quite a bit of pressure, with a lot of stocks dropping -10% or more in a very short period of time. One of the sectors that has held up better than just about any other is the Healthcare sector; as measured by the S&P 500 Healthcare Sector SPDR ETF (XLV), these stocks have rallied about 2% in the last week, are only about -0.5% off of the levels they were at a month ago, and -1.6% below 52-week highs that they last saw in early December of 2018.

This is a sector that includes a number of large cap stocks, many of which are trading not too far from all-time highs they reached just a couple of months ago. Because of their strong performance, and very extended, long-term upward trends, these are stocks that nearly all fail to pass through any of the various screeners I’ve set up around my basic valuation metrics. Current market conditions, and economic trends beg the question, however whether these are stocks that are ripe for a bearish turnaround, or whether the sector’s general stability in the face of increasing volatility and investor fear could offer a different kind of growth-oriented opportunity. This week I’d like to look at few of these stocks in more detail, and add an extra layer of analysis based on growth prospects. We might find some interesting opportunities to work with. We’ll start with Danaher Corp. (DHR), one of the largest stocks in the Health Care Equipment and Supplies industries.

Fundamental and Value Profile

Danaher Corporation (Danaher) designs, manufactures and markets professional, medical, industrial and commercial products and services. The Company operates through four segments: Life Sciences, which offers a range of research tools that scientists use to study the basic building blocks of life, including genes, proteins, metabolites and cells, in order to understand the causes of disease, identify new therapies and test new drugs and vaccines; Diagnostics; which offers analytical instruments, reagents, consumables, software and services; Dental, which provides products that are used to diagnose, treat and prevent disease and ailments of the teeth, gums and supporting bone, and Environmental & Applied Solutions, which consists of various lines of business, including water quality and product identification. As of December 31, 2016, Danaher’s research and development, manufacturing, sales, distribution, service and administrative facilities were located in over 60 countries. DHR has a current market cap of $101.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings and sales both increased by 3.5%. In the last quarter, earnings improved by a little more than 11% while Revenues increased about 5.6%. DHR’s Net Income versus Revenue is healthy and is strengthening, running at 12.22% over the last twelve months and at 14.18% in the last quarter. DHR is a company that has historically increased earnings and revenue via a combination of organic and acquisition-driven growth. In February of this year, the company announced one of its most ambitious acquisitions ever, with the purchase of GE Biopharma for $21.4 billion. The deal is generally seen as a positive because GE’s biotechnology business is one of DHR’s biggest competitors; however the sheer size of the deal means integration with the rest of its Life Sciences segment could be a challenge.

Free Cash Flow: DHR’s Free Cash Flow is healthy, at about $3.3 billion. That translates to a Free Cash Flow Yield of 3.28%.

Debt to Equity: DHR has a debt/equity ratio of .33, which is a good reflection of the company’s conservative approach to leverage. Their balance sheet shows about $5.4 billion in cash and liquid assets against $10.1 billion in long-term debt. Their balance sheet, including their strong Net Income profile indicates they have more than adequate operating profits to service their debt, with very healthy liquidity to cover any potential shortfall.

Dividend: DHR pays a modest annual dividend of $.68 per share, which at its current price translates to a dividend yield of about .5%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for DHR is $42.67 per share. At the stock’s current price, that translates to a Price/Book Ratio of 3.33 against a historical average of 2.55, which puts the stock’s “fair” value at about $109 per share. That’s about -23.2% away from the stock’s current price, which certainly marks the stock as overvalued. Among the metrics growth-oriented investors like to use, however includes comparing the stock’s individual numbers against its industry. On that basis, the stock could actually be very undervalued, since the industry average is nearly three times higher than the stock’s current Price/Book ratio.

Technical Profile

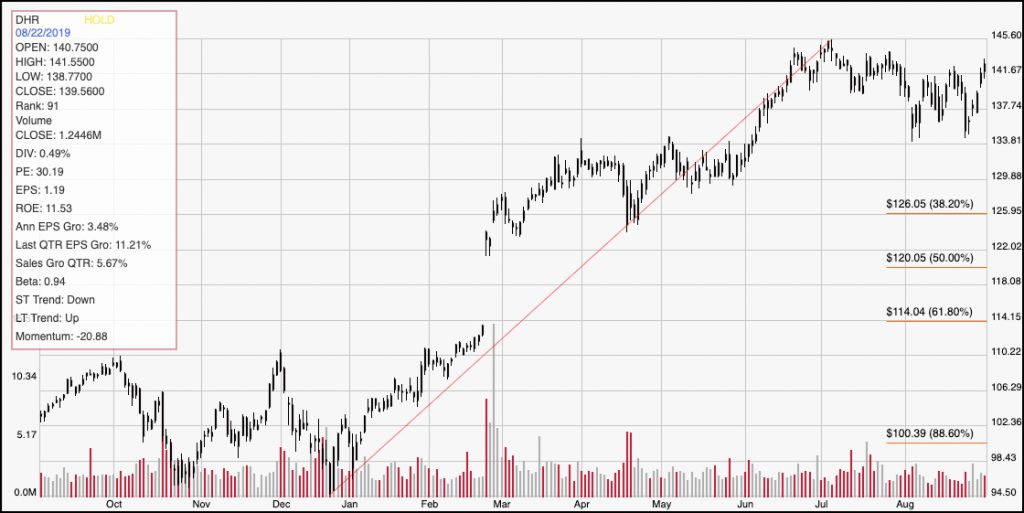

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s strong upward trend from December of 2018 to its all-time high around $146, reached in early July. For the last couple of months, the stock has retraced somewhat below that high, but has held solid support in the $134 price range. As of this writing, the stock is just a few dollars away from that all-time high point, with short-term momentum rallying the stock off of that support level. If that momentum can hold, and push the stock to a new high above $146, the stock’s current trading range between support and resistance could offer a new bullish target at around $158 per share. A break blow $134, however, could see the stock drop all the way to $126, where the 38.2% Fibonacci retracement line seems to offer the most likely support level to buffer a bearish drop.

Near-term Keys: The stock’s fundamentals are very strong, and while a new set of tariffs over the Labor Day weekend would seem to make any near-term bullish forecast in the broad market unlikely, the truth is that if the stock can break resistance at around $146, there could be a very interesting opportunity to buy the stock, or to work with call options for a short-term trade, with upside potentially in the $158 price area. I am also paying attention to the stock’s near-term support around $134, however, since a break below that level would mark a useful signal to consider the shorting the stock. I do believe the DHR is significantly overvalued right now, which to me means that any drop below this point should point to a more extended drop in price. In the short term, I would use a push below $134 to consider shorting the stock, or working with put options, with a target price at around $126 acting as a good exit point.