In the last few days, the Healthcare sector has drawn a little extra attention, since it has been one of the best-performing sectors in the market in the last month while other, more cyclical sectors have seen increasing bearish turns due to trade-related uncertainty and volatility. Healthcare stocks certainly do have some sensitivity to trade – especially as it relates to healthcare equipment manufacturers and suppliers, many of whom operate on a global scale – but this is also a sector that isn’t subject to the same kind of cyclical economic ebbs and flows that most sectors and industries are.

That is one of the reasons, I think, that a lot of stocks in the Healthcare Equipment industry are trading at or near multiyear, or even all-time high levels right now. For most value investors, long, upward trends usually aren’t a motivating factor to drive interest in a company as a potential value; but it is also true that the simple fact that a stock has been moving up doesn’t automatically mean it is overvalued. That’s why a number of these stock have come across my radar in the last week or so.

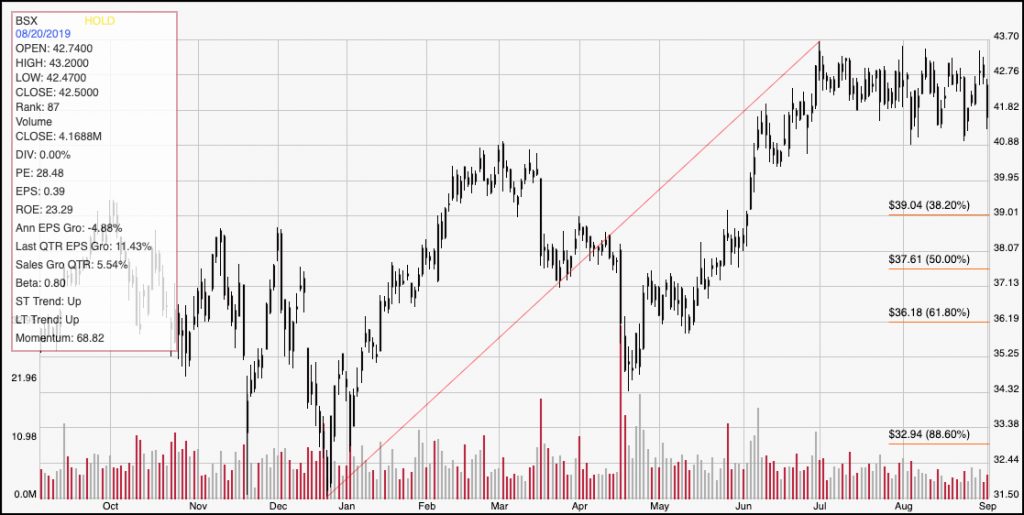

Boston Scientific Corp (BSX) isn’t one of the biggest companies in this industry, but they do occupy an interesting niche – interventional medical devices used in a variety of medical fields, including cardiology, endoscopy, urology and electrophysiology. The stock is up almost 18% year to date, but has been holding at the top of its trading range since the beginning of July, between a high at around $44 and recent lows around $41. That’s a consolidation range at the top of a trend that begs the question: is there room for more, or is this a stock that is poised to reverse to the downside? Let’s see if our numbers provide any clues.

Fundamental and Value Profile

Boston Scientific Corporation is a developer, manufacturer and marketer of medical devices that are used in a range of interventional medical specialties. The Company offers its products by seven businesses: Interventional Cardiology, Cardiac Rhythm Management, Endoscopy, Peripheral Interventions, Urology and Pelvic Health, Neuromodulation, and Electrophysiology. It operates in three segments: Cardiovascular, Rhythm Management and MedSurg. Its Cardiovascular segment consists of Interventional Cardiology and Peripheral Interventions businesses. Rhythm Management consists of Cardiac Rhythm Management and Electrophysiology businesses. MedSurg consists of Endoscopy, Urology and Pelvic Health, and Neuromodulation businesses. Its Interventional Cardiology product offerings include balloon catheters, rotational atherectomy systems, guide wires, guide catheters and embolic protection devices and diagnostic catheters used in percutaneous transluminal coronary angioplasty (PTCA) procedures. BSX has a current market cap of $58 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined about -5%, while sales increased by 5.65%. In the last quarter, earnings improved by 11.43% while Revenues increased about 5.5%. BSX’s Net Income versus Revenue is a red flag, showing signs of erosion in its operating margins, as Net Income as a percentage of Revenues dropped from 13.8% in the last twelve months to 5.85% in the last quarter.

Free Cash Flow: BSX’s Free Cash Flow is modest, at $842 million. That translates to a Free Cash Flow Yield of 1.41%. It should be noted, however that at the beginning of 2019, BSX’s free cash flow was zero, so this is an improvement. Contrasted against the declining Net Income pattern, however, I would be interested to see if this number can continue to improve in the quarters ahead to determine if it is an actual sign of strengthening fundamentals.

Debt to Equity: BSX has a debt/equity ratio of .81, which doesn’t tell a very accurate story in this case. The company’s balance sheet shows that liquidity is a concern, with only $123 million in cash and liquid assets against about $7.59 billion in long-term debt. While servicing their debt isn’t likely to be a problem, their declining Net Income, combined with poor liquidity could present problems in the quarters ahead. Look for increasing cash along with improving quarterly Net Income as a sign the company is making progress.

Dividend: BSX does not pay an annual dividend.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for BSX is $6.77 per share. At the stock’s current price, that translates to a Price/Book Ratio of 6.15 against a historical average of 4.28, which puts the stock’s “fair” value at about $29 per share. That’s about -30% away from the stock’s current price, which certainly marks the stock as overvalued. The stock is also trading about -14% above its historical Price/Cash Flow ratio; along with the Price/Book ratio, that puts BSX’s long-term fair price between $29 and $35 per share

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s strong upward trend from December of 2018 to its all-time high around $44, reached in early July. It also provides the base line for the Fibonacci retracement lines shown on the right side of the chart. For the last couple of months, the stock has held in a pretty tight range between $44 and $41 on the low end. It is currently dropping towards the bottom of that range. The stock’s all-time high is around $45, which is another technical element that I think is playing a role right now in putting a cap on the stock’s ability to move higher. If the stock breaks current support at around $39, it should find new support right around $39, where the 38.2% Fibonacci retracement line sits. That might actually be a positive sign in the long run for growth-oriented investors, since a pullback from the current high, with a pivot low and bounce higher could be a useful catalyst to help the stock sustain the longer upward trend. A drop below $39, however would probably mark a reversal of that upward trend, with continued downside into the $36 range where the 61.8% retracement line sits.

Near-term Keys: BSX’s fundamentals don’t really imply the stock should have much reason in the near term to break above $44, so any kind of near-term bullish forecast for the stock really doesn’t come into play unless the stock either does break above its all-time high around $45, or finds support around $39. Either of those conditions could provide an interesting bullish signal to buy the stock or to work with call options. If the stock drops below $41, you might consider a near-term bearish trade by shorting the stock or working with call options; however the better signal for a bearish trade would come from a push below $39 per share.