Progress on the trade front has given the market a new set of momentum over the past couple of weeks – enough that the major indices are nearing the all-time highs they set at the end of July. Even so, the unpredictability associated with tariff news and the trade war itself has resulted in a lot of volatility that has kept a lot of stocks at or near historical lows; it also pushed a lot of stocks that had been star performers for a big part of the year to near-bear-market correction levels in August.

As I’ve watched the market’s activity over the last year, and most particularly over the last few months, I’ve been intrigued by the Healthcare sector. That’s because it is a sector that I think could be in better position than most to remain strong, not only for the time being but also for the next few years. I think that could be true even when the economy, and therefore the market, does finally turn bearish. Strength in this sector, I believe is likely to be driven primarily by the fact that the demand for all types of healthcare remains pretty constant, no matter what the state of the economy is.

Last week I reviewed a number of stocks in the Healthcare Equipment industry that I think look like they could present some interesting opportunities; however if you’re looking for a stock that you could clearly call a value stock, that isn’t really the industry to focus on. Biotechnology and pharmaceutical stocks, however present some of the most interesting, value-oriented opportunities available in the market right now, and so I think if you want to consider long-term possibilities that are worth paying attention to, these are the areas of the Healthcare sector that are the most worthwhile.

That leads me to the stock I’m focusing on today. Gilead Sciences Inc. (GILD) is a large-cap biopharmeceutical stock with a major presence in some of the most cutting-edge areas of bioscience. The stock is more than -26% off of the high it reached at the beginning of 2018, and is in a long-term downward trend from that point; but it also looks like that trend has flattened significantly, with very strong support only a few dollars below the stock’s current price. The stock has some interesting elements showing a significant level of strength, however, including a very strong balance sheet. Does the stock’s relatively low current price, and fundamental strength create a compelling value? I think it could.

Fundamental and Value Profile

Gilead Sciences, Inc. is a research-based biopharmaceutical company that discovers, develops and commercializes medicines in areas of unmet medical need. The Company’s portfolio of products and pipeline of investigational drugs includes treatments for Human Immunodeficiency Virus/Acquired Immune Deficiency Syndrome (HIV/AIDS), liver diseases, cancer, inflammatory and respiratory diseases and cardiovascular conditions. Its products for HIV/AIDS patients include Descovy, Odefsey, Genvoya, Stribild, Complera/Eviplera, Truvada, Emtriva, Tybost and Vitekta. Its products for patients with liver diseases include Vemlidy, Epclusa, Harvoni, Sovaldi, Viread and Hepsera. It offers Zydelig to patients with hematology/oncology diseases. Its products for patients with various cardiovascular diseases include Letairis, Ranexa and Lexiscan. Its products for various inflammation/respiratory diseases include Cayston and Tamiflu. It had operations in more than 30 countries, as of December 31, 2016. GILD has a current market cap of $84 billion.

Earnings and Sales Growth: Over the past year, earnings declined -1.71%, while sales were flat, but positive at 0.66%. In the last quarter, earnings increased just 3%, while sales improved by 7.65%. GILD’s unimpressive earnings pattern is offset by a very healthy operating profile that is strengthening; in the last twelve months, Net Income was more than 26% of Revenues, while in the last quarter that number increased to just over 33%.

Free Cash Flow: GILD’s Free Cash Flow is generally healthy, at about $7.7 billion. On a Free Cash Flow Yield basis, that translates to 8.99%. It should be noted that this number has declined steadily since the beginning of 2016, when Free Cash Flow peaked at $19.5 billion, but it has also improved over the last two quarters from about $6.6 billion. That improvement looks like it could be a sign the company is reversing the longer trend of free cash flow deterioration, which is a positive.

Debt to Equity: GILD has a debt/equity ratio of 1.13, which is a bit higher than I prefer to see; but by itself this number doesn’t really tell the whole story. Their balance sheet shows $27.1 billion in cash against $25.6 billion in long-term debt. Along with their very strong margin profile, this is a good indication that the company has plenty of financial flexibility, not only to service their debt, but also keep funding the strategy they’ve been following for a while, which is to grow earnings via acquisition, and returning value to shareholders via stock buybacks and dividend payouts..

Dividend: GILD pays a dividend of $2.52 per share, which translates to an annual yield of about 3.79% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for GILD is $17.96 per share. That translates to a Price/Book ratio of 3.69, versus a historical Price/Book ratio of 6.32, which actually means GILD is currently trading at a discount of about 71% from par with that average. That’s pretty compelling, and could make GILD a very interesting stock to watch, even under current market conditions.

Technical Profile

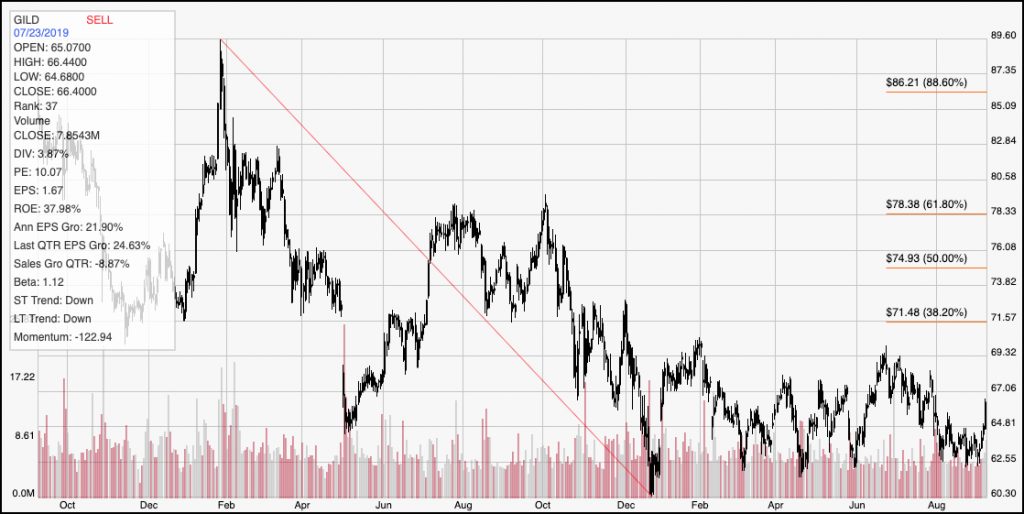

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: GILD’s downward slide from January 2018 to December of last year is easy to see. From that trend low at around $60, the stock rallied to about $70 by the beginning of February, but then dropped back again. Since the beginning of March, the stock has defined a clear consolidation range, with top-end resistance between $67 and $69 and support around $62. A break above $69 could mark an early indication that the downward trend could be reversing back to the upside, with room to run to the 38.2% Fibonacci retracement line shown at around $71.50 in the near term.

Near-term Keys: Given current market conditions, it may seem a little odd to suggest that a bearish, short-term trade on GILD Is a low-probability risk right now; but the fact is that unless the stock breaks its multi-year low around $60, its downward trend is unlikely to extend much further. That doesn’t mean that it won’t break that level; that is always a possibility. However, the longer the stock’s consolidation range holds, the more likely the stock becomes to break out of that range to the upside – especially when the company’s fundamental strengths are taken into consideration. Even so, the best signal for a bullish short-term trade on the stock won’t be seen unless the stock breaks above $69 per share; if that happens, you should take it as a good signal to buy the stock, or to work with call options with a near-term exit price somewhere between $71.50 and $75. What about the stock’s long-term prospects? The value proposition is very intriguing; and if you aren’t afraid of a fair amount of volatility, both from the stock and the broad market right now, this is a stock that offers an impressive dividend yield for those who are willing to be patient and hold on for the ride.