One expert says this black swan event poses “the greatest risk to investors.”

The Dow notched its seventh straight gain at Thursday’s close, and is now sitting just 216 points below its 52-week intraday high.

Stocks have been rising this week as tensions ease between the U.S. and China ahead of next month’s trade negotiations in Washington. But even as optimism on the trade war front is rising, there are other unsettling headlines and indicators that increasingly call for caution.

The yield curve has inverted, manufacturing is contracting, global uncertainty is mounting, and businesses are already beginning to pare spending.

And while unemployment is near a five-decade low, there are signs that the labor market is weakening as hiring of temporary workers and weekly working hours have declined indicating that businesses are worried about falling demand and reducing hours and temporary staff is the first shoe to drop before layoffs start.

As some indicators are flashing red and yellow, there’s a growing chorus of voices calling out a recession on the horizon.

“We should be on recession watch before the 2020 election, DoubleLine Capital’s Jeffrey Gundlach said on Thursday. “We’re getting closer but we’re not there yet.”

Gundlach says there’s a 75% chance of recession before next year’s U.S. election, reiterating a call he made in August.

Another voice joined the chorus this week as well: TD Ameritrade’s Oliver Renick, who says there’s a black swan that could pose a “monstrous” risk to the stock market.

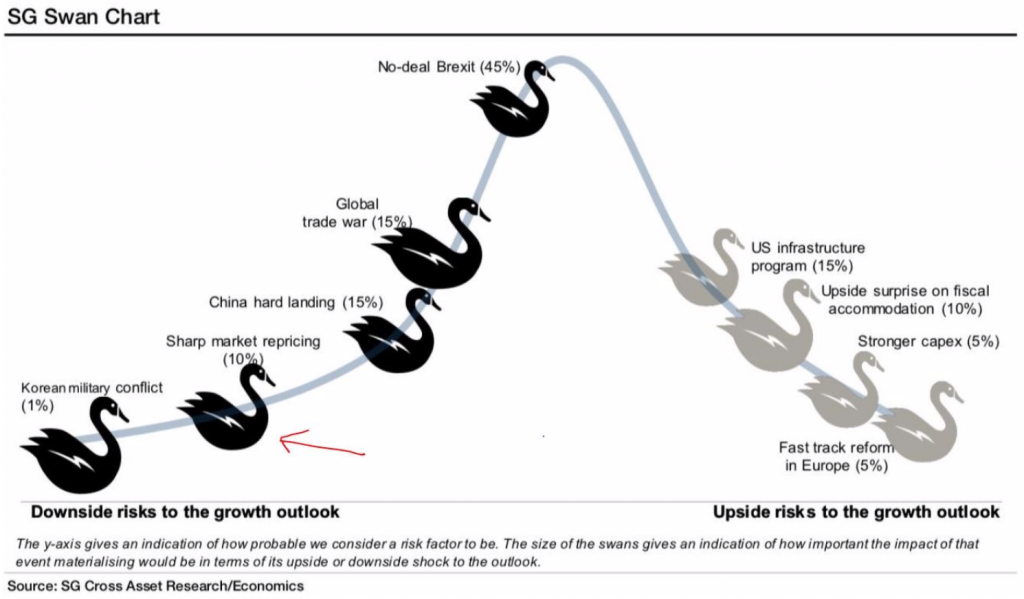

In a post on LinkedIn, Renick included a graphic from SocGen of the biggest possible black swan events. But while SocGen views the probability and potential scope of a sharp repricing of the stock market “as being low and small,” Renick disagrees and says a “sharp market repricing should be the fattest swan” on the diagram.

“The greatest risk to investors, the economy, and the tenuous state of geopolitics, is the price of the S&P 500. That does not mean it is the most likely risk – what it means is that the ripple effect of a sizable selloff in stocks right now is monstrous. What’s disconcerting is that it’s remarkably easy to imagine a series of events that by nature should not necessarily pose great risk, but taken together could cause some major shocks to the S&P 500 due to current investor positioning,” Renick wrote.

So what could cause such a ripple?

Renick painted a rather bearish picture where the economy improves enough that the Fed doesn’t cut rates, investors then get spooked, assets pull back in a highly-correlated fashion, cash from the sidelines doesn’t pour in, and the bottom falls out.

“If no one’s there to buy because they’ve already bought, hedges don’t work because they’re all tied to the same events, liquidity exacerbates swings and the president realizes his cow-prod is on the verge of breaking, watch out below,” Renick wrote.