The start of the fourth quarter has been rocky so far, with investors hoping for good news coming from renewed trade discussions and the expectation of another rate cut from the Federal Reserve this month, balanced against signs that tariffs are eroding not only corporate profits on a global scale but also starting to wear down consumer confidence. Last year around this time, a fresh wave of negative news – not surprisingly, primarily around trade – propelled the stock market to its most extended correction in the last several years as all three major indices tested bear market levels before rebounding.

I’m starting to see a rising tide of opinions and reports that, as we move into the fourth quarter of 2019, we could be in for a repeat of last year’s performance. I’m not entirely sure that’s true, but it is something that a smart investor should be aware of and pay attention to. It does suggest that at the least, the markets are likely to remain volatile through the end of the year as investors look for some kind of foothold to drive their investment decisions.

Uncertainty and volatility amid signs that a globally slowing economy is finally starting to be felt in North America means that while you can find stocks in a lot of cyclical industries, like Transportation trading at pretty significant discounts to their not-so-distant highs, they could still actually be more risky than useful at this stage. I still like to look at these stocks, because their fundamental profile can give me some useful clues about their ability to weather an economic downturn. If we are on the cusp of a legitimate bear market and recession as some seem to think, it might not be a good time to jump into these stocks right now; but that also means that down the road, when signs begin to turn more positive (sooner or later), these same stocks will present many of the best value-oriented opportunities.

CSX Corporation (CSX) is a good example of the kind of stock I’m referring to. As one of the largest transportation companies in the Road & Rail industry, this is a stock that is very sensitive to a variety of economic dynamics, from commodity and fuel prices to interest rate fluctuations and – not surprisingly – tariffs and trade. This is a company with a strong fundamental profile that hasn’t kept the stock from a decline over the past five months of a little over -17%, with about half of the decline coming in just the last few weeks. At first glance, that makes the stock sound like a tempting opportunity; but balanced against a long-term trend that has seen the stock increase more than five times since the bottom of the last bear market in 2009, still appears to remain overvalued. Where would the stock have to go to provide a good value? Let’s find out.

Fundamental and Value Profile

CSX Corporation is a transportation company. The Company provides rail-based freight transportation services, including traditional rail service and transport of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. The Company categorizes its products into three primary lines of business: merchandise, intermodal and coal. The Company’s intermodal business links customers to railroads through trucks and terminals. The Company’s merchandise business consists of shipments in markets, such as agricultural and food products, fertilizers, chemicals, automotive, metals and equipment, minerals and forest products. The Company’s coal business transports domestic coal, coke and iron ore to electricity-generating power plants, steel manufacturers and industrial plants, as well as export coal to deep-water port facilities. CSX has a current market cap of $52.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew modestly, at about 7%, while sales were flat but slightly negative at -1.32%. In the last quarter, earnings increased by almost 6% while sales grew a little over 1.5%. CSX operates with a healthy, stable margin profile; in the last twelve months, Net Income was 27.8% of Revenues and increased to 28.4% in the last quarter.

Free Cash Flow: CSX’ Free Cash Flow is healthy, at almost $3.5 billion. That number has increased over the past year from about $3.2 billion and translates to a Free Cash Flow Yield of 6.67%.

Debt to Equity: CSX has a debt/equity ratio of 1.26. This indicates the company is highly leveraged; but this is also typical of stocks in the Transportation industry. Their balance sheet indicates they have $1.7 billion in cash and liquid assets against $15.5 billion in long-term debt as of the most recent quarter. CSX’ operating profile suggests they should have no problem servicing the debt they have.

Dividend: CSX pays an annual dividend of $.96 per share, which at its current price translates to a dividend yield of about 1.43%. Their dividend payout ratio is also conservative, at less than 25% of their earnings over the last year.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for CSX is $15.40 per share. At the stock’s current price, that translates to a Price/Book Ratio of 4.34. CSX’s historical average Price/Book ratio is 3.28, implying the stock is overvalued by a little over -24% and puts their “fair value” at around $50 per share.

Technical Profile

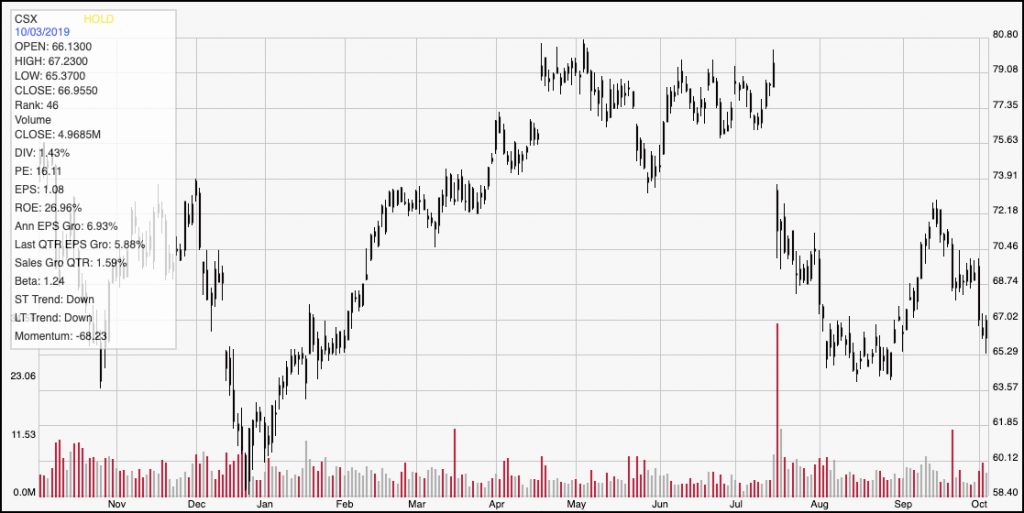

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the past year of price activity for CSX. The stock’s peak at a little below $81 came in early May, with a big overnight gap down in mid-July that coincided with their last earnings report. The stock recovered a bit in August, pushing off of support at around $64 to reclaim a peak at around $73 before dropping back to its current price just a couple of dollar above that August low. A drop below $64 could see the stock drop to its December 2018 low around $58. If the stock can find support anywhere between its current price and $64, it could see a short-term push to about $69 before finding new resistance, but would realistically need to push above $72 to be able to sustain any kind of significant bullish momentum.

Near-term Keys: From a long-term perspective, it’s hard to see a lot of long-term upside in CSX, despite its generally strong fundamental profile. Based on the Price/Book analysis I described earlier, the stock wouldn’t offer a compelling value-based price unless it drops to about $40 per share – which is more than -40% below the stock’s current price. That means the best opportunities to work with the stock are with short-term, momentum-oriented trades. If you want to be aggressive, look for a bounce off of support around $64 as a signal to buy the stock or work with call options with a target price at around $69 per share. The stock’s current bearish momentum suggests a break below support is more likely; a drop below $64 would be a good signal to consider shorting the stock or working with put options with an eye on $58 as an exit target for a bearish trade.