And how he says investors can profit on the move higher.

Tech stocks have had a good year. And according to one expert, the sector could be on its way to new all-time highs by the end of this year.

Technical analyst Todd Gordon, founder of TradingAnalysis.com, says the charts of some of the biggest names in tech indicate a breakout is on the way.

“You’re seeing the semis, measured by the [Semiconductor VanEck ETF] SMH, make new highs. You’re seeing large-cap tech like Microsoft (NASDAQ: MSFT) just below highs. You’re seeing Facebook (NASDAQ: FB) act better. You’re seeing Apple (NASDAQ: AAPL) at new highs,” Gordon said to CNBC. “So, I’m seeing a lot of good things in technology.”

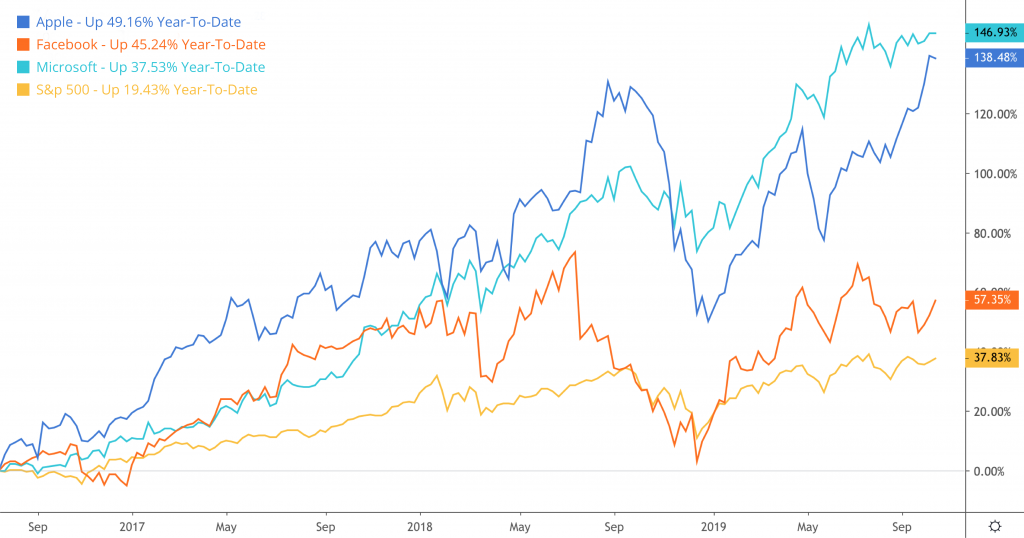

Apple shares are up 49% so far this year, and reached a new all-time high last week. Facebook, after a difficult 2018 following the Cambridge Analytica scandal, is up 45% year-to-date. And Microsoft is up nearly 38% so far this year, and is just 2% below its all-time high.

The tech sector as a whole has already been outperforming the rest of the market so far this year, with the XLK—the S&P 500 Info Tech Sector SPDR—up by nearly 32% year-to-date, compared to the S&P 500’s 19% gain.

But while what happened to tech stocks this time last year is still fresh in the memories of many investors, Gordon says stocks are about to head higher.

“All we’ve seen is a market that’s gone sideways and weather a lot of bad news” both on the fundamental side for stocks as well as on the political and trade front, Gordon said. “I think the market’s held in extremely well and I think it’s time to finally push higher.”

According to Gordon, the XLK—which tracks 68 of the market’s biggest tech stocks by market cap—is making higher lows and lower highs, indicating “indecision” in the market on the group. But Gordon says that, despite this indecision, the sector is headed for a meaningful breakout.

“It seems to be that if earnings are strong, we should be able to continue higher,” Gordon said, pointing out that the XLK has a floor of support between $77 and $78, which is just above its 200-day average.

“If the momentum is going to carry us higher, then we should have no problem reaching the higher $80s,” Gordon said. “There’s a reasonable shot we should be able to get up to the $88 mark, and if we break down, if earnings season does not go well and we get some bad news on the political front, we might even see as low as $76. So, I think we’re going to push higher, up towards that $88 mark.”

The $88 level is 7% above where the XLK is now, and would be a new all-time high for the ETF.

Gordon said one way to profit on the possible move would be to set up a call spread by buying the $83 monthly call options expiring in December, and selling the $88 December monthly call options, a $5 spread that costs $2.

“That means we’re risking $2 to make $3,” Gordon explained. “We shouldn’t have to risk the entire $2; if the trade is not working and we’re starting to see the market roll over, we should be able to recover this call spread at about $1. So, I’m risking about a dollar, or $100 per call spread.”