The market could be in for some pain ahead. Here’s why.

The three major indexes may have just notched fresh record highs, but according to one expert technical analyst, we could be in for some pain ahead.

JC O’Hara, chief market technician at MKM Partners, told CNBC that the stocks market is “a little overbought in the short term,” and now the question is whether it’s “a good overbought or a bad overbought.”

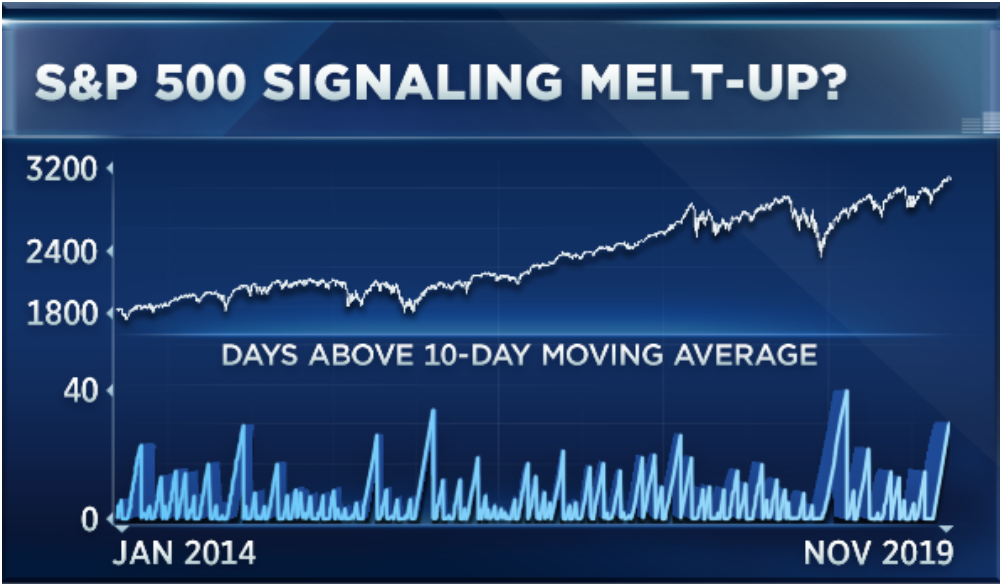

To answer this, O’Hara examined how much time the S&P 500 has spent above its short-term, 10-day moving average.

“We found the streak to be 30 days,” O’Hara said, adding that while that streak ended late last week, it’s still “one of the longest streaks on record.”

Over the last decade, the S&P has seen five similar streaks.

“What we found was the market had a very minor pullback, consolidated for a few weeks before ultimately, in most cases, resuming its uptrend,” the technical analyst said. “So, I don’t want to get too negative here. Yes, we’re up a bunch, but I think if we repeat history here, we’re due for a short-term consolidation before resumption of the uptrend.”

O’Hara isn’t alone in anticipating pain in the near-term.

RBC chief U.S. equity strategist Lori Calvasina warns that a pullback is on the horizon on the basis that many of the biggest money managers are more positive on stocks than they have been in months.

“This keeps us on guard for a period of significant consolidation near-term, and will be an overhang on 2020 performance if not resolved before year end,” Calvasina wrote in a note.

“We expect 2020 to be a year of moderation, turbulence, and transition in the U.S. equity market,” Calvasina continued. “Risk of a pullback near-term is quite high in our opinion. If a pullback doesn’t occur by the end of 2019, as we’ve anticipated, then we suspect it will come in 1Q20.”