The euphoric rally seen in the last couple of months could mark the end of this bull market. Here’s why.

December has gotten off to a rocky start.

Between mid-August and the end of November, a 74-trading-day stretch, the Dow Jones Industrial Average gained 10.1%, the S&P 500 is up 10.6%, and the Nasdaq has jumped 11.5%.

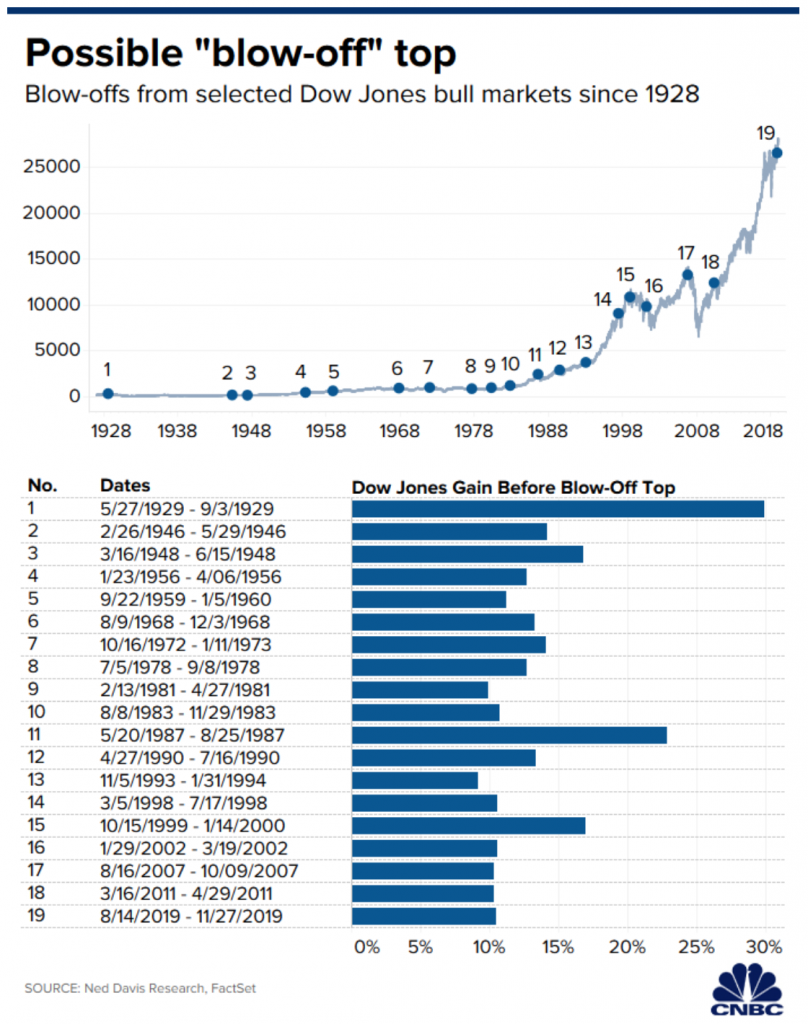

But this euphoric rally seen in the last few months is reminiscent of the kind of rally that has market the end of other bull markets, or what’s called a “blow-off top.”

The Dow in particular has gained an average 13.4% during blow-off tops dating back to 1901, according to Ned Davis Research. And the average length of such rallies was 61 days.

“Given the high valuations I see, plus these divergences between many different indices, I am aware that many bull markets have ended with a rally similar to what we have seen since August,” Ned Davis wrote in a note.

Looking back, a rally similar to the one we’ve seen in the last few months happened between October 15, 1999 and January 14, 2000, or just before the dot-com bubble burst, when the Dow gained 17% in just 64 trading days.. And another happened between August 16, 2007 and October 9, 2007, or just before the financial crisis that sparked the Great Recession. with that rally, the Dow added 10.3% in 38 trading days.

In the last few months, the market has surged higher as the Federal Reserve has cut rates twice since August, and the U.S. and China have moved closer to striking a phase one trade deal.

But rhetoric on both fronts has changed. The Fed has said it’s done cutting rates for now, and while both the U.S. and China have said that trade talks are moving forward, there has recently been contentiousness on both sides. China retaliated after the U.S. signed a bill into law supporting protesters in Hong Kong, while President Donald Trump said this week that he’s in no rush to sign a trade agreement with China and would be content waiting until after the U.S. elections next year to make a deal.

However, despite all this, the market just kept climbing last month, in a “melt-up fashion,” according to Yardeni Research president Ed Yardeni.

And Wells Fargo Securities head of equity research, Christopher Harvey, said that the key catalysts that have driven the market higher in recent months have been “played out.”

“What we’re left with is near-term sentiment and near-term sentiment being he driver of prices,” Harvey said. “That could be based on a tweet. It could be based on positioning.”

So far in December, the Dow is down nearly 432 points spurred on by pessimism regarding the U.S.-China trade deal.

And if the two countries don’t have a deal by December 15, when the U.S. has plans to unleash tariffs on another $156 billion worth of Chinese goods, “then there’s another sell-off,” said UBS’ Art Cashin.

“If they put on additional tariffs and [Trump] bumps them by 10% to 15%, a sell-off but nothing severe. 50% or something like that? Better put on your helmet,” Cashin said.

While the Dow is down so far this month, and could be headed lower in the near-term if new tariffs go into effect, Baird’s Willie Delwiche says investors shouldn’t be too concerned.

“A pause after a two-month rally shouldn’t be surprising,” Delwiche said. “And it shouldn’t preclude from strength over the latter half of December, which is when we tend to see seasonal strength for the month.”