The holiday season marks an influx of late releases in the movie industry; not just films with seasonal themes – Christmas, Thanksgiving, etc. – but also last-minute hopefuls for the upcoming yearly awards marked by the announcement at the beginning of each year of Academy Award winners. Besides critical regard and artistic value, the information most people really pay attention to are box-office numbers. Late year releases are also an opportunity for movie studios as well as the companies on the distribution end of the industry to bring in major revenues, increase their bottom line and set the stage for the next year’s wave of new releases.

Movie studio revenues and profits can be a highly variable, volatile place to invest; very production is a gamble that consumers will be attracted to the plot, characters, and story. The demand for compelling content is constant, and the consumer trend away from traditional viewing choices, including theaters and broadcast services made up by network, cable and satellite television to online, streaming services creates a big challenge not only for production studios, but also on the companies that distribute and exhibit moves for the masses. That reality could be one of the biggest reasons no only that a recent report showed that box office revenues decreased in 2019 versus the prior year, but are also expected to the same in 2020.

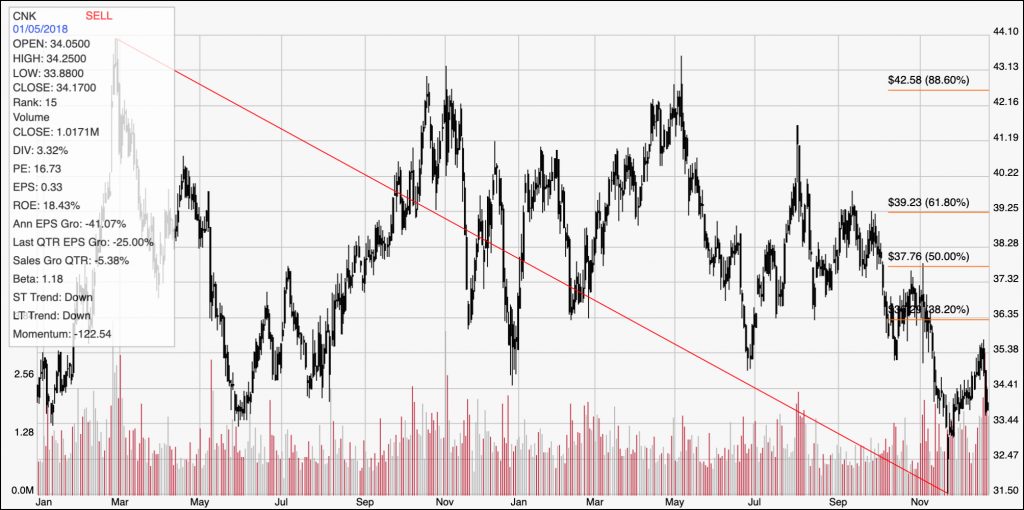

That bearish report could put pressure on the entire film industry. Cnemark Holdings, Inc. (CNK) is perhaps the biggest player in the exhibition sub-industry. Since February 2018, the stock’s price performance and long-term trend has reflected the declining revenue pattern I just mentioned; from a peak at a bit above $44 to its current price around $34, the stock is down almost -25%. Does that mean this is a stock you should stay away from? The truth is that based on my favorite valuation metric, the stock looks pretty attractive; but the real question for a value-oriented investor is really whether the stock’s fundamentals match the value? Let find out.

Fundamental and Value Profile

Cinemark Holdings, Inc. is engaged in the motion picture exhibition business with theatres in the United States (U.S.), Brazil, Argentina, Chile, Colombia, Peru, Ecuador, Honduras, El Salvador, Nicaragua, Costa Rica, Panama, Guatemala, Paraguay, Curacao and Bolivia. The Company manages its business in two segments: U.S. markets and international markets. The international segment consists of operations in Brazil, Argentina, Chile, Colombia, Peru, Ecuador, Honduras, El Salvador, Nicaragua, Costa Rica, Panama, Guatemala, Bolivia, Curacao and Paraguay. As of December 31, 2016, the Company operated 526 theatres and 5,903 screens in the United States and Latin America. As of December 31, 2016, its the United States circuit had 339 theatres and 4,559 screens in 41 states and its international circuit had 187 theatres and 1,344 screens in 15 countries. It develops new platforms for its theatre circuit, such as XD, Cinemark Reserve, Luxury Lounger reclining seats, CineArts and other concepts. CNK has a current market cap of about $4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by more than 16.25%, while revenues improved by almost 9%. In the last quarter, earnings dropped by almost -42% while sales decreased by about -14%. The company’s margin profile is a red flag; Net Income as a percentage of Revenues in the last quarter is 3.98% versus 5.67% over the last twelve months.

Free Cash Flow: CNK’s free cash flow is $318.7 million. That represents a significant improvement from a year ago, when Free Cash Flow about $258 million. Its current Free Cash Flow translates to a useful Free Cash Flow of almost 8%.

Debt to Equity: CNK’s debt to equity is 2.09, which is a high number, which isn’t unusual for the industry. Their balance sheet show about $483 million versus $3 billion in long-term debt. The company’s declining Net Income suggests that while for now, operating profits are sufficient to repay their debt, a continuation of the current pattern could translate to liquidity problems if it isn’t reversed in coming quarters.

Dividend: CNK’s annual divided is $1.36 per share, which translates to a yield of about 4% at the stock’s current price. Their dividend payout ratio is also about 80% of its earnings over the last twelve months. I think that puts the dividend at risk, if Net Income continues to decline, of being cut to save cash.

Price/Book Ratio: CNK’s Book Value is $12.77, which translations to a Price/Book ratio is 2.66 versus their historical Price/Book ratio of 3.36, which suggests that the stock is undervalued by about about 26% right now. By comparison, the stock is only about 3% below its historical Price/Cash Flow ratio, suggesting that the stock is fairly valued.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward trend from February 2018 to a low point in November of this year, and provides the reference for calculating the Fibonacci retracement levels indicated by the horizontal red lines on the right side of the chart. The stock is current sitting about $1.50 above current support at around $32.50. Current resistance is sitting at the stock’s latest peak around $34.50 per share. A break above that point will see the stock find its next resistance at the 38.2% Fibonacci retracement level near $36.50; a break above that level should give the stock room to run to the 61.8% retracement line, which is a little above $39 per share. A drop below the stock’s current support will extend the current downward trend, with room to drop as low as about $29 per share; that is a price level that was last seen in early 2016.

Near-term Keys: CNK’s fundamentals are mostly strong; but the company’s pattern of declining Net Income, in the face of broadly declining industry revenues stands as a major headwind in the year to come. I think the downside risk on the stock right now outweighs any useful valuation metric, including any hope for a short-term bullish bounce. The best probability lies on the bearish side, with a drop below current support at $32.50 would be a good signal to short the stock or work with put options, with an eye on $29 as a quick price target, or even lower – into the mid-$20’s – if bearish momentum continues.