The Consumer Discretionary sector cuts a wide swath across the economic landscape of the United States. It’s easy to think about the sector as the place you’ll find retail stocks, but the truth is that there are a lot of other businesses within the sector that are much more than just the department stores and restaurant chains that you might normally think about.

Within the sector, there is an industry called Specialty Retail, and this industry is the category where you’ll often find retail businesses and stores that each have a unique, specific focus; the interesting thing about the industry is the wide range of business types you’ll find. Think Best Buy (BBY), Home Depot (HD), and Tailored Brands (TLRD), to name just a few, and you start to get an idea about the diversity of business types the industry covers.

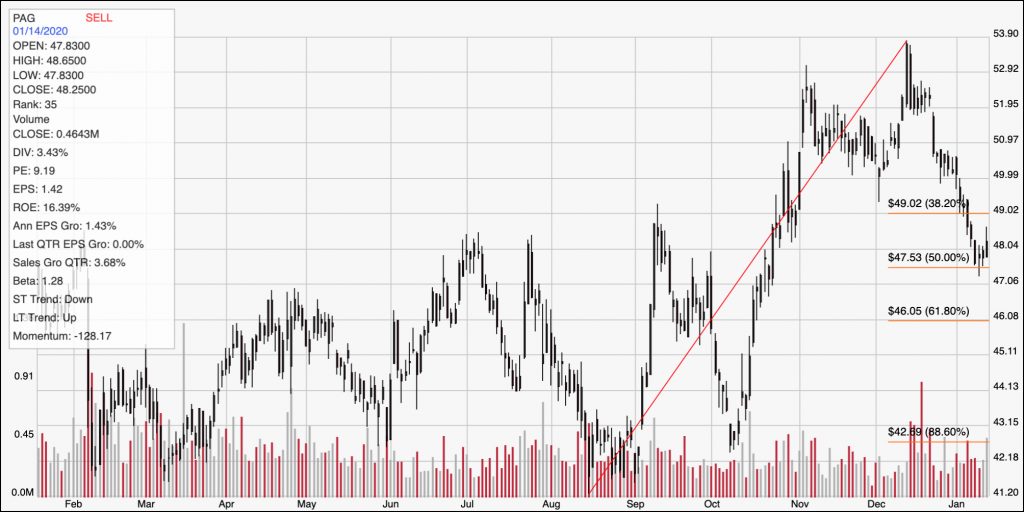

Penske Automotive Group Inc (PAG) is a company in the Specialty Retail industry that you’ve probably heard of, but wouldn’t naturally think of as a retail stock. It isn’t all that unusual to see a Penske moving truck moving along any of America’s highways, so this is a stock with immediate name-brand recognition and a large international footprint in their specific niche. After a pretty volatile 2018 that extended into most of 2019, the stock saw a big move in the latter part of last year, rallying from a low around $41 in late August to a peak in early December at nearly $54 per share.

From that point, PAG has dropped back sharply, falling a little over -10% into the end of last week to a low around $47.50 per share. Against the backdrop of the larger, intermediate upward trend, that could offer an interesting technical set up for a bullish opportunity. It also carries a value proposition that, taken alone, might tempt you to think about taking a position in a stock that includes a high dividend yield to boot. Be careful, though; there may be some fundamental issues that could point to a higher than normal level of downside risk that even the stock’s currently discounted price doesn’t justify, along with the potential of a bearish trend reversal with a fair amount of room to keep dropping.

Fundamental and Value Profile

Penske Automotive Group, Inc. is an international transportation services company. The Company operates automotive and commercial truck dealerships principally in the United States, Canada and Western Europe, and distributes commercial vehicles, diesel engines, gas engines, power systems, and related parts and services principally in Australia and New Zealand. The Company’s segments include Retail Automotive, consisting of its retail automotive dealership operations; Retail Commercial Truck, consisting of its retail commercial truck dealership operations in the United States and Canada; Other, consisting of its commercial vehicle and power systems distribution operations and other non-automotive consolidated operations, and Non-Automotive Investments, consisting of its equity method investments in non-automotive operations. The Company holds interests in Penske Truck Leasing Co., L.P. (PTL), a provider of transportation services and supply chain management. PAG’s current market cap is $3.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased just 1.43%, and were outpaced by revenue growth, at 5.46%. The pattern is pretty similar in the last quarter; earnings were precisely flat (0% growth) and sales growing almost 4%. The company operates with a very narrow margin profile; Net Income was 1.9% of Revenues over the last twelve months, and 1.94% in the most recent quarter. With a margin profile so thin, there isn’t a lot of room to lose and still maintain a healthy balance sheet, so this could mark a pretty big red flag if there is any kind of decline in Net Income.

Free Cash Flow: PAG’s free cash flow appears strong, at more than $440 million. That translates to a Free Cash Flow Yield of 11.6%, which is normally very attractive; however as you’ll see next, this positive data point appears to be the exception to a generally negative financial picture.

Debt to Equity: PAG has a debt/equity ratio of .86. This is a generally conservative number that typically suggests debt management shouldn’t be a problem; however the balance sheet shows that PAG’s cash and liquid assets were only $77.5 million in the last quarter versus $2.28 billion of long-term debt. It is worth noting that cash in the last quarter marked an improvement of almost 100% from the first quarter of 2019, when this number was just $37.5 million.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for PAG is $32.39 per share, and which translates to a Price/Book ratio of 1.48. Their average Price/Book Value ratio is 2.98, which means the stock is quite undervalued, with about 93% upside potential at its current price. That notion is countered, however by the fact the stock is also trading about -11.6% above its historical Price/Cash Flow average.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the past year; the red diagonal line also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The red line follows the stock upward trend through the fourth quarter of 2019, and the pullback from mid-December to its current pivot low saw the stock drop all the way to support at the 50% retracement line. Immediate resistance is at $49, where the 38.2% retracement line rests. A break above that point should give the stock momentum to rally to a new short-term peak at around $52.50, while a drop below support at $47.50 could see the stock fall to about $46, in-line with the 61.8% retracement line.

Near-term Keys: No matter what the stock’s Book Value metrics suggest, this is a stock that doesn’t really have the fundamentals to support a long-term investment right now. There could be a short-term trading opportunity, however depending on whether the stock can rally higher off of its recent pivot low. A break above $49 would be an interesting signal to buy the stock or to consider using call options with a near-term target at around $52.50. A drop below $47.50, on the other hand would be a signal to think about shorting the stock or buying put options with an eye on a very near-term price target at around $46.