Last week, the U.S. and China finally signed the first phase of what everybody hopes ultimately becomes a long-term trade agreement. That, along with expectations that central banks all over the globe will continue to follow the Federal Reserve’s accommodative lead have a lot of investors looking hopefully into the rest of the year, looking for reasons to keep pushing the market higher. It doesn’t mean risk hasn’t completely abated; I was intrigued yesterday by a report from the International Monetary Fund (IMF) that forecasts revised global growth that is lower than previously indicated.

While the market may be able to use the news in a mostly bullish fashion going in the near term, the truth remains that the biggest, most important components of a long-term trade peace aren’t done; what most are calling “Phase Two” of talks between the largest economies in the world is likely to continue to take some time to finalize. Still, Phase One is a positive, so progress of any kind is very likely to be used by the broad market as a reason to be more optimistic. In the near-term, that should bode well for stocks in any sector with exposure to trade and tariff risk, including Materials. If the news is less optimistic, and the IMF’s recent report suggests, then I think stocks with a combination of fundamental strength and good value are going to be the smartest plays to put your money.

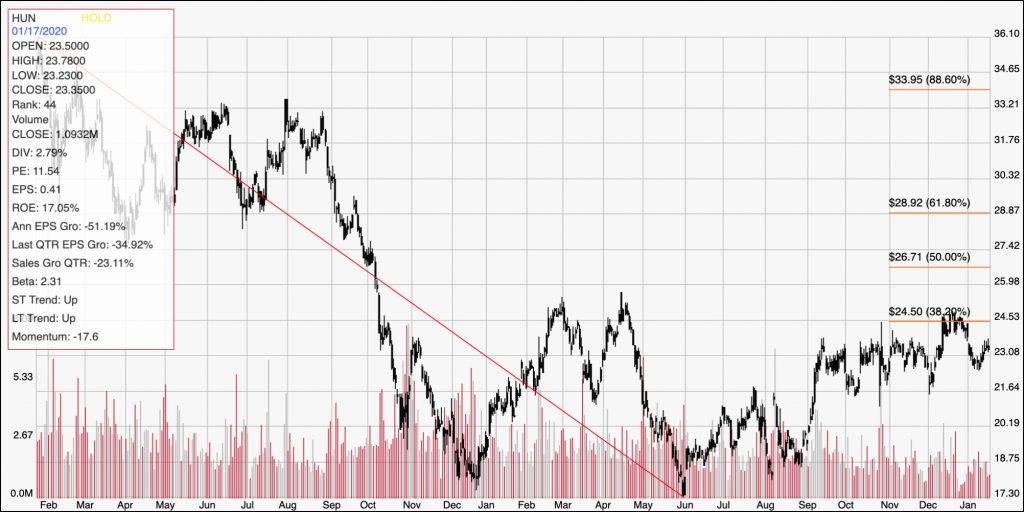

One of the most interesting stocks in the Materials sector is Huntsman Corp. (HUN), a mid-cap Chemicals company that has followed the sector’s trend this year, but to much more volatile extent. The stock hit a multi-year low in December 2018 before rallying almost 44% around the end of April. It then dropped back to that multi-year low and has since managed to rebound about 35% from that point. Despite those positive moves, the stock remains at the extreme low end of its historical ranges. HUN’s fundamentals are generally solid, but are also showing some signs of weakness that seem to reflect some of the economic pressures that have come from increasing commodity costs and from trade difficulties, as U.S. companies in this sector derive a significant portion of their revenues from exports to China. Does that mean HUN is a stock to say away from, or does progress in trade create a useful value-oriented opportunity for the smart long-term investor?

Fundamental and Value Profile

Huntsman Corporation is a manufacturer of differentiated organic chemical products and of inorganic chemical products. The Company operates all of its businesses through its subsidiary, Huntsman International LLC (Huntsman International). The Company operates through five segments: Polyurethanes, Performance Products, Advanced Materials, Textile Effects, and Pigments and Additives. Its Polyurethanes, Performance Products, Advanced Materials and Textile Effects segments produce differentiated organic chemical products and its Pigments and Additives segment produces inorganic chemical products. The Company’s products are used in a range of applications, including those in the adhesives, aerospace, automotive, construction products, personal care and hygiene, durable and non-durable consumer products, digital inks, electronics, medical, packaging, paints and coatings, power generation, refining, synthetic fiber, textile chemicals and dye industries. HUN’s current market cap is $5.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined a little over -51%, while revenues dropped almost -32%. In the last quarter, earnings dropped almost -35% while revenues shrunk by -23%. The company’s margin profile has been negative over the past year, but appears to be improving; Net Income as a percentage of Revenues was 1.77% in the last quarter versus —.9% in the last twelve months.

Free Cash Flow: HUN’s free cash flow is healthy at $614 million. That translates to a Free Cash Flow Yield of 9.3%. It is noteworthy that Free Cash Flow has increased from $500 million in June of 2019, but still below its peak at $1.2 billion in June 2018.

Debt to Equity: HUN has a debt/equity ratio of .97. This is a conservative number, but it increased from .57 in the third quarter of 2018. The improvement in the company’s Net Income is also reflected by an increase in liquidity, which is a positive development. Total cash in the last quarter was $418 million, while long-term debt is $1.2 billion.

Dividend: HUN pays an annual dividend of $.65 per share, which translates to an annual yield that of about 2.78%.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but one of the simplest methods that I like uses the stock’s Book Value, which for HUN is $11.50, and which translates to a Price/Book ratio of 2.03 at the stock’s current price. HUN’s historical average Price/Book ratio is 2.4, which means the stock is current sitting about 18% below a long-term target price at around $27.50 per share. It is also about 21.5% below its historical Price/Cash Flow ratio, offering a higher range at around $28.40 per share.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line on the chart above traces the stock’s downward trend from February of 2018 to its low point in early June. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has increased from that recent low at around $17.30 per share, with a strongly bullish push to a high around $23 in early September, with the stock hovering at about that same level since then. Current support is around $21.50, with a recent pivot low a little higher at around $22 per share. A break above the 38.2% Fibonacci retracement line at around $24.50 could give the stock room to run to about the 61.8% retracement line, which sits at around $29 per share. A drop below support at $21.50, on the other hand should see the stock drop near to its multiyear low between $17.50 and $18.50 per share.

Near-term Keys: The stock’s rebound from its trend low, and current consolidation pattern since the fourth quarter of 2019 makes a short-term bearish set up look like a very low probability trade; in the short-term, the best likelihood of success is on the bullish side, with a break above $24.50 offering a good signal to buy the stock or to consider working with call options with an eye on the stock’s high at around $29. From a value perspective, the company is showing some useful signs of improving fundamental strength, with a bargain proposition that remains attractive at current price levels. Progress on the trade front is likely to boost the sector as well, which means this could be a good time to think about HUN as a solid long-term opportunity.